Paystub Calculator to Estimate Take Home Pay and Deductions

Payday is great—until the number in your bank account doesn’t match what you imagined. Your take-home pay (net pay) is your gross earnings minus taxes and other deductions, and a clear paystub shows where the money goes. While paystubs track each pay period, your W2 summarizes the entire year; knowing the differences between a paystub and Form W2 helps you stay on top of your finances.

Table of Contents

Paystub vs. Take-Home Pay

Before diving into deductions, let’s align on definitions….

| Term | What It Means | Why It Matters |

|---|---|---|

| Paystub | Itemized record each pay period: current & YTD earnings, taxes withheld, benefits/other deductions, employer contributions, and net pay. | Transparency: lets you verify how gross turns into net. |

| Gross Pay | Total pay before any deductions (salary for the period or hourly rate × hours worked; includes overtime/bonuses if applicable). | It’s the starting point—not what you can spend. |

| Take-Home (Net) Pay | What’s left after all taxes and deductions. It’s what actually lands in your account. | Budgeting and saving should be based on net, not gross. |

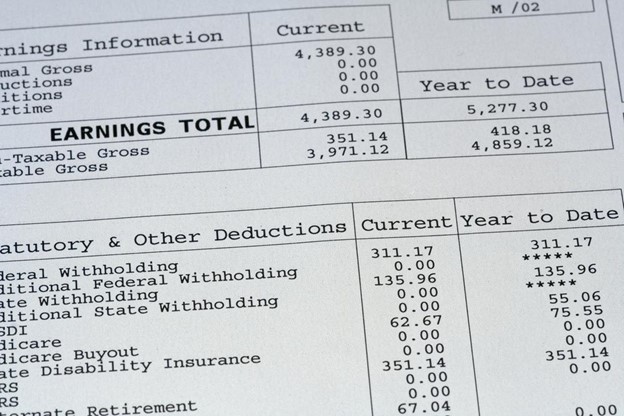

What You’ll See on a Paystub

You’ll usually see a current line and year‑to‑date (YTD) totals. The top portion summarizes earnings—salary or hours, overtime, and any bonuses.

Mid‑page, you’ll find taxes (federal, state/local where applicable, and FICA for Social Security and Medicare), followed by benefits and other deductions like health insurance, retirement contributions, FSA/HSA, union dues, and charitable giving.

Finally, the stub displays employer contributions (e.g., the employer‑paid share of FICA/benefits) and the net pay figure that hits your bank.

If anything looks off—like a deduction you don’t recognize—flag it with HR/payroll and compare to previous stubs.

What Reduces Your Take-Home Pay

- Pre‑tax deductions that shrink taxable wages first (medical/vision/dental premiums, traditional 401(k)/403(b), FSA/HSA, commuter benefits).

- Taxes withheld on the remaining taxable wages:

- Federal income tax (based on your Form W‑4)

- State and local income taxes (where applicable)

- FICA: Social Security and Medicare

- Post‑tax deductions (life/disability insurance, Roth retirement, certain charitable or other voluntary deductions)

- Garnishments (if any): child support, tax levies, court‑ordered repayments.

How to Calculate Net Pay

Start with gross pay for the period. Subtract any pre‑tax deductions to get taxable wages. Apply withholding taxes—federal, state/local (if any), and FICA. Then take out post‑tax deductions (like Roth contributions or after‑tax insurance). If a wage garnishment applies, subtract it near the end. What remains is your net pay.

If that seems like a lot to digest, lets simplify it with some examples.

How to Calculate Your Paystub

To better understand the process of calculating your paystub, let’s walk through a simple example.

Alex earns an annual salary of $75,000, and his company processes payroll bi-weekly (26 pay periods per year). To determine his gross pay per period, we divide:

$75,000 ÷ 26 = $2,884 (gross pay per pay period)

Deductions:

- Federal Taxes: Based on the allowances from his W-4, 20% of his gross pay is withheld for federal taxes:

$2,884 (gross pay per pay period) × 20% = $577

- State Taxes: Alex lives in a state with no income tax, so no state taxes are deducted.

- Health Insurance: Alex contributes $50 per pay period toward his company’s health insurance plan.

Net Pay Calculation:

Alex’s net pay (take-home pay) is calculated as follows:

$2,884 (gross pay) – $577 (federal tax) – $50 (health insurance) = $2,257 (net pay)

*This example applies to salaried employees, whose pay remains consistent each period. Hourly employees will also see details on total hours worked, overtime wages, and applicable deductions on their paystub.*

His pay stub will include all of these details for both the current payroll period and the year-to-date (YTD) totals. For a quick and easy way to verify your earnings, try using a check stub calculator to ensure all numbers align correctly.

Another Step-by-Step Example

To make things more concrete, let’s walk through a simplified example of how to calculate your take-home pay from your gross salary.

Scenario:

- Employee: Full-time worker paid biweekly

- Gross Pay: $2,000 per paycheck

- Filing Status: Single

- Location: State with income tax (e.g., New York)

- Benefits: Enrolled in health insurance and 401(k)

Deductions Breakdown:

| Deduction Type | Amount |

|---|---|

| Federal Income Tax | $200 |

| Social Security (6.2%) | $124 |

| Medicare (1.45%) | $29 |

| State Income Tax | $80 |

| Health Insurance Premium | $100 |

| 401(k) Contribution (5%) | $100 |

Calculation:

Takeaway:

Out of a $2,000 paycheck, this employee takes home $1,367 after taxes and deductions. That’s a difference of over $600—which is why understanding your deductions is so important.

Maximize Your Net Pay

Maximizing what lands in your account starts with the paperwork that drives withholding. Begin by revisiting your Form W‑4—if you routinely receive a large refund, you’re likely over‑withholding, so adjust your entries to bring each paycheck closer to your true tax liability.

Next, lean into pre‑tax benefits: employer health coverage, HSA/FSA, and traditional 401(k) contributions all reduce taxable wages and can improve your net over time. If you earn money outside your W2—freelance or contract work reported on Form 1099‑NEC—remember that taxes usually aren’t withheld; set aside funds for income and self‑employment taxes so you’re not caught short.

Finally, audit your paystub regularly. Scan each line for errors or outdated deductions, and compare against prior stubs after major life changes (marriage, dependents, job moves) to ensure withholdings still fit your situation.

FormPros Has You Covered!

Knowing how to read and calculate your pay stub ensures you have full transparency over your earnings, deductions, and take-home pay. By staying informed, you can catch potential errors, plan your finances more effectively, and adjust tax withholdings if necessary.

Simplify your paperwork with FormPros! From creating employment verification letters, W-2s, and 1099-NEC forms to generating LLC Operating Agreements and even voided checks, our easy-to-use platform has you covered. Save time, reduce errors, and handle your business documents with confidence. Start now and see how FormPros makes professional form generation fast, affordable, and hassle-free!

FAQs

-

How are bonuses, commissions, or PTO cash-outs taxed on my paycheck?

These are “supplemental wages.” Employers usually withhold using one of two IRS-approved methods: the percentage method (a flat supplemental rate) or the aggregate method (add the bonus to your regular wages for that period and withhold as if it were one big paycheck). The method affects how much tax you see withheld up front, but your final annual tax is reconciled on your return.

-

Why did my net pay change when my pay frequency changed (biweekly → semimonthly, etc.)?

Your annual salary didn’t change—but the timing of withholdings and benefit deductions did. Some deductions (like health insurance) are per-paycheck amounts, so switching frequencies can make certain checks feel lighter or heavier. Also, tax tables and rounding occur each run, which can slightly shift per-check net pay even if the annual total is the same.

-

I work in one state and live in another. Which state gets my income tax withholding?

Generally, tax is withheld where you work, but reciprocity agreements or remote-work policies can change this. Some states let you withhold for your residence state instead, while certain cities impose local taxes as well. If you split time across states, you may need part-year or nonresident returns; ask payroll about your work location on file and any reciprocity form you might need.

-

Do Roth 401(k) contributions change my take-home pay the same way as traditional 401(k)?

No. Traditional 401(k) contributions are pre-tax—they lower your taxable wages now, usually increasing your current take-home. Roth 401(k) contributions are after-tax—they don’t reduce current taxable wages but can yield tax-free withdrawals later (if rules are met). Your choice affects today’s net pay vs. tomorrow’s tax bill.

-

HSA vs FSA: which one affects my paycheck more?

Both are typically pre-tax, reducing taxable wages. An HSA (with a qualifying high-deductible plan) has higher annual limits and unused funds roll over; an FSA usually has lower limits and “use-it-or-lose-it” rules (with limited carryover). Because they’re pre-tax, contributions to either can nudge your net pay up compared to paying those medical costs after tax.

-

My paycheck looks wrong. What’s the fastest way to get it fixed?

Compare the stub to your last one and your W-4/benefit elections. Note the exact line items that changed (amount and date), then contact payroll/HR promptly—most employers can issue an off-cycle correction or adjust on the next run. Keep copies of emails and stubs.

-

How do overtime, shift differentials, or tips show up—and how do they change taxes?

Overtime (often time-and-a-half) and differentials are added to gross pay for that period; tips can be reported and taxed as wages. Because they increase taxable wages, they raise withholding for that check. If your hours vary a lot, expect net pay to swing—using a paycheck calculator with variable hours/overtime inputs can help you forecast more accurately.

We Can Help You!

- Create Paystub Instantly

- Saves Time and Headaches

- Preview and Share Easily

- Easy to Follow Steps