What is an LLC Operating Agreement?

A Limited Liability Company (LLC) Operating Agreement, sometimes referred to as an LLC Company Agreement, is a legally binding document that details the rights and obligations of each member of your LLC.

The agreement is between all the members of the limited liability company. It establishes the rules according to which the affairs and conduct of the business will be run.

An operating agreement for LLC should display how a company is organized, who the members are, and which portion of the company they own.

From daily operations like invoicing and payroll to what would happen in certain scenarios, such as a member wanting to leave an LLC, an operating agreement is crucial to your company, and you should create this document as soon as you form your LLC.

When Do I Need an LLC Operating Agreement?

- If you need to define the LLC as a separate entity from oneself.

- If you want to outline how the business will operate.

- If you intend to seek funding while forming an LLC.

- If you form an LLC in a state where the laws require an operating agreement

Crafting an operating agreement should be a priority as soon as your LLC is formed. This document serves as a safeguard for your company, protecting the interests of its members and ensuring smooth operations.

What makes LLCs popular business entities is that they offer substantial flexibility combined with the benefit of liability protection of a corporation and the tax treatment of a partnership.

How Are LLCs Formed?

LLCs are mostly formed when members enter into LLC agreements (also referred to as operating agreenents) and file a simple certificate with the relevant authority in the state of formation whose state LLC laws govern such entity.

When Should the LLC Agreement Be Executed?

Optimally, it’s advisable to finalize the LLC agreement at the time of the LLC’s formation, especially from the standpoint of a minority party. For instance, a majority investor eager to launch a new venture might be more open to compromise with a minority party during the initial formation stages. Once the business is established and operational, the dynamics of negotiation can frequently change, often tipping the balance of power.

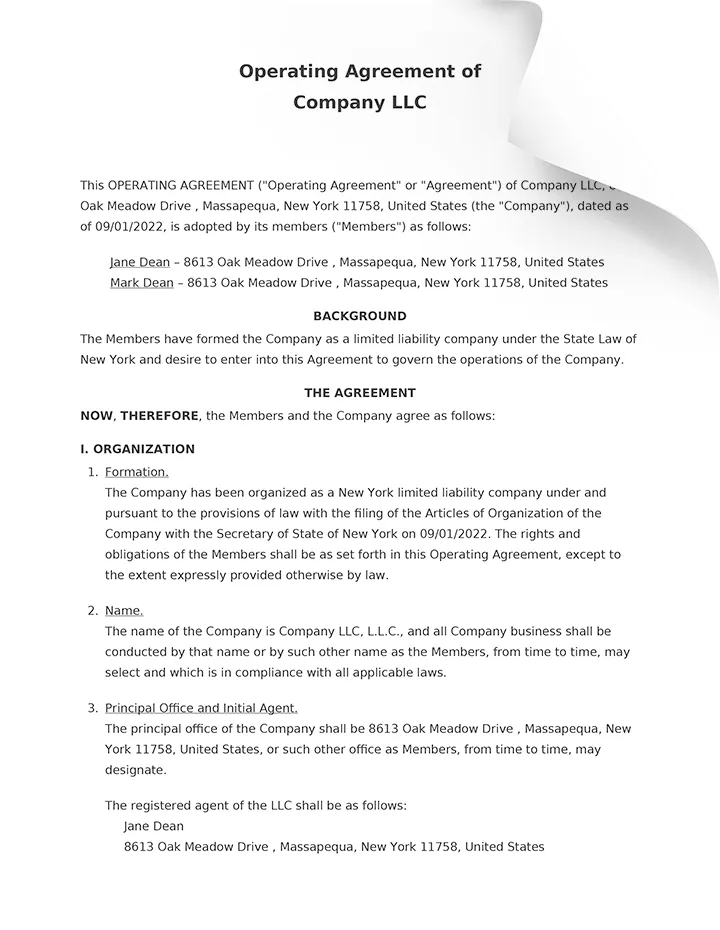

Sample LLC Operating Agreement

Creating an LLC Operating Agreement can be a complex and time-consuming task, but thanks to the availability of well-designed LLC Operating Agreement templates. LLC owners can simply fill in the details and receive a comprehensive and legally binding document.

Why Is an LLC Operating Agreement Important?

Safeguard Your Personal Assets

An operating agreement helps to preserve the legal distinction between the LLC and its owners, safeguarding personal assets from business liabilities. This is important to retain the limited liability and, if applicable, the LLC’s pass-through tax benefits.Mitigate Misunderstandings

An LLC Operating Agreement is key in delineating roles, responsibilities, and profit shares, providing a clear foundation to mitigate misunderstandings and disputes among members.Transparency and Accountability

The Operating Agreement acts as a blueprint for the company’s internal processes, offering clarity for decision-making and profit distribution. It enhances transparency and accountability, crucial for smooth and conflict-free business operations.Clarify Succession or Expansion

If the single member is an individual, the operating agreement can include a plan for succession or expansion of the LLC in case the single member unexpectedly dies or becomes incapacitated.Avoid the Default Rules

The LLC may want to avoid the state’s default rules, which may be undesirable in some circumstances, by setting out different provisions in its operating agreement.Outline Operations

The operating agreement can include important operational or logistical information to assist in LLC operations and ensure proper documentation is kept.Dispute Resolutions

The agreement delineates each member’s rights and duties, clarifying obligations and minimizing conflicts. It also provides mechanisms for resolving disagreements, and maintaining harmony within the LLC.Anticipate Future Scenarios

By creating an Operating Agreement, LLC members can customize their business operations and anticipate future scenarios, such as the company’s lifespan or changes in membership, ensuring tailored governance.Fosters Trust

An LLC Operating Agreement aids in aligning business practices with generally accepted accounting principles (GAAP). It establishes clear financial reporting and record-keeping procedures, enhancing transparency and fostering trust among stakeholders.

How to Make an LLC Operating Agreement?

Forming an LLC requires a crucial step: creating an Operating Agreement. This document is foundational for any new LLC, as it includes critical details like member contributions, ownership stakes, and the core operating principles of the business.

In this section, we enumerate the essential components or elements of an LLC Operating Agreement, providing insights and explanations for each vital clause to guide you in establishing a strong and clear framework for your LLC’s governance and operations.

Members of LLCs may enter into one comprehensive, long-form operating agreement or a series of one or more stand-alone agreements covering different matters. But a single agreement minimizes the risks of conflicting provisions.

Provisions under an LLC operating agreement:

Preliminary Provisions

Preamble: In this section, you specify the agreement’s effective dates, delineate its terms, and introduce the members involved. Typically, this part outlines the entity type and place of formation for any member who isn’t an individual. If there are multiple members, they’re usually itemized in an appended schedule rather than in the preamble. Additionally, if the LLC agreement places duties on the LLC alongside its members, the LLC is generally included as a party to the agreement.

Recitals: The recitals section offers foundational information regarding the formation of the LLC. They are a good place to explain any related transactions or other relevant information. For example, the recitals often state when and why the LLC was formed (if already formed), if it is being formed as part of a larger transaction (such as a joint venture), or if the LLC agreement is being amended and restated. In some instances, recitals sections are used interchangeably with the preamble.

Definition of Terms: Important terms in an LLC agreement are often clustered under the definition of terms section for ease of reference and to enhance the document’s clarity. This part streamlines the drafting and reviewing process by eliminating the need for repetitive explanations. For example, the definition of “Consent of the Members” is vital since it typically determines the necessary member approval level for significant decisions, like the sale of the LLC’s assets, by the LLC’s manager.

The Composition of the Company

This may often be referred to as the preamble or recitals.

The Company’s Name: Clearly state the legal name of your LLC as registered with the state. This should match the name on your formation documents to avoid any legal discrepancies.

Head Office Address: Include the official address of the LLC’s principal place of business. This address is used for official correspondence and may be required for legal and tax purposes.

The Company’s Purpose and Goals: Outline the overarching purpose and the long-term goals of your LLC. This can include the mission statement and the strategic objectives the company aims to achieve.

Products or Service Description: Detail the specific services or products your LLC offers. This section helps define the scope of the business’s operations and its offerings to clients or customers.

Term: Specifies the length of time until the Agreement is terminated. It could be perpetual or shall be for a certain number of years.

Effective Date of Agreement: the specific date when the terms and conditions outlined in the agreement become legally binding on the members of the LLC.

How Company Affairs Will Be Managed: This crucial part describes the governance structure of the LLC. It includes the percentage required to for major company decisions. It outlines the roles and responsibilities of members and managers, voting rights and procedures, and how meetings will be conducted.

Information of the LLC Members:

The information of LLC members, sometimes called as Schedule,

Names and Postal Addresses: This section should include the complete names and postal addresses of all members, establishing a clear record of who is involved in the LLC.

Ownership and Member Duties: Outline the specific roles, responsibilities, and obligations of each member, clarifying how they contribute to the functioning of the LLC.

Value of Capital Contributions: Specify the exact monetary or asset value that each member has contributed to the company, providing a transparent record of each member’s investment.

Ownership Interest and Percentage: Detail the percentage of ownership interest each member holds in the LLC, reflecting their share of profits, losses, and voting power in company decisions.

Membership Guidelines

Rights and Responsibilities for New Members: This segment defines the obligations and privileges afforded to new members upon joining the LLC, including their role in decision-making and operations.

Initial Contribution of Each Member: Outline the initial investment, whether monetary or in-kind, that each member makes when joining the LLC, establishing their financial stake in the company.

Rights and Responsibilities of Voting Members: Detail the specific voting rights of members in company decisions and their corresponding responsibilities in the governance of the LLC.

Member’s Contributions: Specify the nature and extent of contributions (financial, physical, or intellectual) that members are expected to make to the LLC.

The Scope of a Member’s Interest: Clarify the extent of each member’s interest in the LLC, including their share of profits, losses, and rights to company assets.

Distribution of Company Assets: Describe the process for distributing the company’s assets among members in the event of the LLC’s dissolution. Usually this is couched in the general term “reasonable fashion.”

Rights and Responsibilities of Continuing Members: This part outlines the obligations and entitlements of members who remain or continue with the LLC following the departure of a fellow member.

Non-competition Provisions: If the operating agreement includes non-competition provisions, consider whether they apply to all members and managers. Restricting competitive activities of members and managers who are also key employees of the LLC is usually more important than restricting minority investors with no involvement in the LLC’s operations.

Provisions Related to Withdrawal: Define the parameters for members who contemplate or decide to withdraw from the LLC. Provisions may include financial settlements and asset distributions.

Guidelines on Admitting New LLC Members: Establish the criteria and process for bringing new members into the LLC, including any necessary approvals and adjustments to existing members’ shares.

Voting Procedures for Operating Agreement Changes: Set forth the procedures for voting on amendments to the operating agreement, detailing how proposals are brought forth and the majority required for changes to be approved.

Designate a Registered Agent

The registered agent, also known as a statutory agent or agent for service of process, is an individual or entity designated by the LLC to receive legal documents, official correspondence, and important notices on behalf of the company.

Company Claim Provisions

A company claim refers to any legal action, dispute, or liability that the LLC may encounter. It could involve contractual disputes, litigation, or any other legal matter that may arise during the course of the company’s activities. The provision in the LLC Operating Agreement related to company claims outlines how such claims will be handled and resolved.

Decision-making Processes and Administration

In the operating agreement, make sure that you specify whether members will run the company or if a manager will be appointed.

It’s also important to outline how the voting process works. This includes the weight of each member’s vote, which members have voting rights, and how often meetings should be held.

How Disputes Should Be Handled

The operating agreement should specify how disputes will be handled, actions that would require unanimous approval, and which members can sign contracts on behalf of the company.

You should also outline how administrative processes will be managed. Typically, this will include:

- The company’s tax classification (business entity, partnership, corporation).

- When the business’s fiscal year-end is.

- How the company’s profits and losses will be divided.

- Which documents and statements should be included in the annual report.

Decisions That Require Unanimous Consent From All LLC Members

Certain decisions of the LLC require unanimous consent from all LLC members.

These decisions typically involve significant changes or events that could affect the LLC’s operations, such as amending the operating agreement, admitting new members, or selling major company assets.

The process of creating an LLC Operating Agreement from scratch can be daunting. One way to avoid this tedious task is to use an LLC Operating Agreement template or generator.

Other Things to Consider

Consult With an Independent Accounting Firm

An LLC Operating Agreement may require the engagement of an independent accounting firm to ensure the accuracy and integrity of financial statements and reports.

Doing so will help you you can obtain an objective and unbiased assessment of your company’s financial activities, transactions, and records.

Its involvement adds an extra layer of credibility and reliability to your financial statements, as their expertise and professional standards contribute to accurate and transparent financial reporting.

Include Provisions on Fair Market Value

In an LLC Operating Agreement, it is common to include provisions related to fair market value. It refers to the price at which an asset would be exchanged between a willing buyer and a willing seller, both parties having reasonable knowledge of the relevant facts and neither being under any compulsion to buy or sell.

Use an LLC Operating Agreement Generator

Online platforms like Form Pros allow you to create your own LLC operating agreement in just a few clicks. This will help you eliminate common mistakes and avoid legal fees.

An LLC operating agreement generator offers a user-friendly interface and an intuitive step-by-step process that guides you through the customization of your agreement.

With a generator, you can quickly and effortlessly generate a personalized, legally binding document that meets the specific needs of your LLC.

Why Use Our LLC Operating Agreement Generator?

Our form generator simplifies creating an LLC operating agreement by guiding you through customizable items, ensuring all critical details are included and minimizing errors.

With FormPro’s free LLC operating agreement template generator, you can easily create legally binding documents without needing a lawyer, accountant, or notary, while enjoying privacy, security, and cost savings, as no additional software installation is required.

Benefits of Using FormPro’s Free LLC Operating Agreement Template Generator

- Easy to use.

- Eliminates mistakes.

- 100% money-back guarantee.

- 100% private and secure.

- Legally binding documents.

- No need to hire a law firm, accountant, or notary.

- FormPros also doesn’t require the installation of additional software, which will save you even more time and money.

LLC Operating Agreement by State

Alabama |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by Code of Alabama Title 10A, Chapter 5A: Alabama Limited Liability Company Law of 2014 (AL Code § 10A-5A-1.08). |

Alaska |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by Alaska Statutes Title 10, Chapter 10.50: Alaska Revised Limited Liability Company Act (AK Stat § 10.50.095). |

Arizona |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. Most of the LLCA’s provisions are default provisions, meaning they apply only if a particular matter is not addressed by the operating agreement or in the absence thereof (A.R.S. § 29-3105(B)). Notable provisions:

|

Arkansas |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by Arkansas Code Title 4, Subtitle 3, Chapter 38 Uniform Limited Liability Company Act (AR Code § 4-32-405). |

California |

Formal written operating is required. (Cal. Corp. Code § 17701.01 et seq.).In the absence of an Operating Agreement, the LLC and related disputes are governed by California Corporations Code Title 2.6: California Revised Uniform Limited Liability Company Act (Cal Corp Code § 17701.01 through 17713.13) Important provisions:

|

Colorado |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an operating agreement, the LLC and related disputes will be governed by Colorado Revised Statutes Title 7 Article 80 (C.R.S. § 7-80. Notable provisions:

|

Connecticut |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by Chapter 613a, Uniform Limited Liability Company Act (CT Gen Stat § 34). |

Delaware |

Required. Legal basis: Delaware Code Title 6, Section 18-101(7). In the absence of an Operating Agreement, the LLC and related disputes are governed by Delaware Title 6, Chapter 18: Limited Liability Company Act (DE Code § 18). |

Florida |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an operating agreement, the LLC and related disputes shall be governed by the Florida Statutes, Chapter 605, Florida Revised Limited Liability Company Act. Notable provisions:

|

Georgia |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an operating agreement, the LLC and related disputes shall be governed by Georgia Code Title 14, Chapter 11 Uniform Limited Liability Company Act (OCGA § 14-11). Notable provisions:

|

Hawaii |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by Hawaii Revised Statutes Chapter 428: Uniform Limited Liability Company Act (Haw. Rev. Stat. § 428). |

Idaho |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by Idaho Statutes Title 30, Chapter 25: Limited Liability Companies (Idaho Code § 30-25). |

Illinois |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an LLC Operating Agreement, the Illinois Limited Liability Company Act will apply. (805 ILCS 180/15-5(a)) |

Indiana |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by Indiana Code Title 23, Article 18: Limited Liability Companies, also known as the “Indiana Business Flexibility Act” (IC 23-18). |

Iowa |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by Iowa Code Title XII, Chapter 489: Revised Uniform Limited Liability Company Act (IA Code § 489.110). |

Kansas |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by Kansas Statutes Chapter 17, Article 76: Limited Liability Companies (KS Stat § 17-7662 through 17-76,146). |

Kentucky |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by Kentucky Revised Statutes Chapter 275: Limited liability companies (KY Rev Stat § 275). |

Louisiana |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an operating agreement, the LLC and related disputes will be governed by the default provisions under Chapter 11 on Limited Liability Companies §12:982-§12:993 Notable provisions:

|

Maine |

Required (ME Rev Stat § 153). In the absence of an operating agreement, the LLC and related disputes will be governed by Maine Statutes Title 31, Chapter 21, Subchapter 2: Limited Liability Company Agreement (ME Rev Stat Tit. 31 § 21). |

Maryland |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by the Maryland Code, Corporations and Notable provisions:

|

Massachusetts |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an operating agreement, the LLC and related disputes will be governed by Massachusetts General Law Chatper 156C: Limited Liability Company Act. (M.G.L. ch. 156C) Notable provisions:

|

Michigan |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an operating agreement, the LLC and related disputes shall be governed by Michigan Compiled Laws, Act 23 of 1993 or Michigan Limited Liability Company Act, Chapter 450.4101-5200. Notable provisions:

|

Minnesota |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an operating agreement, the RULLCA provisions under Minn. Stat. Ann. § 322C.0110, subd. 3 may not be eliminated or modified. Notable provisions:

|

Mississippi |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by Mississippi Code Title 79, Chapter 29: Revised Mississippi Limited Liability Company Act (MS Code § 79-29). |

Missouri |

An LLC, including a single-member LLC, must have an operating agreement. – Revised Statutes of Missouri (RSMo) “The member or members of a limited liability company shall adopt an operating agreement containing such provisions as such member or members may deem appropriate, subject only to the provisions of sections 347.010 to 347.187 and other law. The operating agreement may contain any provision, not inconsistent with law, relating to the conduct of the business and affairs of the limited liability company, its rights and powers, and the rights, powers and duties of its members, managers, agents or employees…” (§ 347.081.1, RSMo). Notable provisions:

|

Montana |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by Montana Code Title 35, Chapter 8: Montana Limited Liability Company Act (MT CODE ANN § 35-8). |

Nebraska |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by Revised Statutes of Nebraska, Chapter 21, Article 1: The Nebraska Uniform Limited Liability Company Act (NE Code §§ 21-101 to 21-197 and §§ 21-501 to 21-542). |

Nevada |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions.Notable provisions:

|

New Hampshire |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by New Hampshire Revised Statutes Title XXVIII, Chapter 304-C: Limited Liability Companies (NH Rev Stat § 304-C). |

New Jersey |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an operating agreement, the LLC and arising disputes will be governed by New Jersey Statutes Annotated (N.J.S.A) 42:2C. Notable provisions:

|

New Mexico |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by New Mexico Statutes Chapter 53, Article 19: Limited Liability Company Act (NMSA § 53-19-1 to 53-19-74). |

New York |

The LLC’s members must adopt a written operating agreement. (NY LLCL § 417(a)). Notable provisions:

|

North Carolina |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by North Carolina General Statutes Chapter 57D: North Carolina Limited Liability Company Act (NC Gen Stat § 57D). Notable provisions:

|

North Dakota |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by North Dakota Century Code Chapter 10-32.1: North Dakota Uniform Limited Liability Company Act (ND CENT CODE §§ 10-01.1-01 through 10-36-09). |

Ohio |

Not required but a formal written agreement is highly advisable to minimize conflicts and avoid default provisions. In the absence of an Operating Agreement, disputes are governed by Ohio Revised Limited Liability Company Act (RLLCA): Revised Code 1706. Notable provisions:

|

Oklahoma |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by Oklahoma Statutes Title 18: Oklahoma Limited Liability Company Act (OK Stat § 18-2001). |

Oregon |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. Without an Operating Agreement, disputes are governed by Oregon Revised Statutes Chapter 63: Limited Liability Companies (Or. Rev. Stat. §§ 63) Notable provisions:

|

Pennsylvania |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an operating agreement, the LLC and related disputes shall be governed by Purdon’s Pennsylvania Statutes and Consolidated Statutes, Title 15 Pa.C.S.A., Part III: Partnerships and Limited Liability Companies (PA Cons Stat § 8101 to 8106). Notable provisions:Certain statutory provisions, however, may not be eliminated or modified (non-modifiable provisions) by the operating agreement such as:

|

Rhode Island |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by Rhode Island General Laws Title 7, Chapter 16: The Rhode Island Limited-Liability Company Act (R.I. Gen. Laws § 7-16). |

South Carolina |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by South Carolina Code of Laws Title 33, Chapter 44: Uniform Limited Liability Company Act of 1996 (SC Code § 33-44). |

Tennessee |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. Notable provisions:

|

Texas |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by Texas Business Organizations Code Title 3, Chapter 101: Limited Liability Companies (TX Bus Orgs Tit. 3 Sec. 101). |

Utah |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by Utah Code Title 48, Chapter 3a: Utah Revised Uniform Limited Liability Company Act (UT Code § 48-3a). |

Vermont |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by Vermont Statutes Title 11, Chapter 25: Limited Liability Companies (VT ST Tit. 11 § 4001 to 4176). |

Virginia |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by Code of Virginia Title 13.1, Chapter 12: Virginia Limited Liability Company Act (VA Code § 13.1). Notable provisions:

|

Washington |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by Revised Code of Washington Title 25.15: Limited Liability Companies (WA Rev Code § 25.15). Notable provisions:

|

West Virginia |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by West Virginia Code Chapter 31b: Uniform Limited Liability Company Act (WV CODE § 31B). |

Wisconsin |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by Wisconsin Statutes Chapter 183: Limited Liability Company Law (Wis. Stats Chapter 183). |

Wyoming |

Not required but a formal written agreement can minimize conflicts and avoid undesired default provisions. In the absence of an Operating Agreement, the LLC and related disputes are governed by Wyoming Statutes Title 17, Chapter 29: Wyoming Limited Liability Company Act (WY ST § 17-29). |

State Specific LLC Operating Agreements

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

LLC Operating Agreement FAQs

-

What Are the Most Common LLC Company Agreement Mistakes to Avoid?

- Not having an operating agreement.

As a result of an operating agreement not always being required, many businesses will skip formulating this document. As a result, these organizations often end up with rules that don’t work for them. - Getting a ready-made template for an operating agreement.

There are many free LLC operating agreement templates that you can download from the internet. Unfortunately, some make a habit of just downloading templates and filling in their particulars. This means you are not considering each provision or glossing over the details could just as easily leave you with rules that don’t work for your company, which defeats the purpose of having an operating agreement. Using our LLC operating agreement template, you can ensure that your agreement is solid and professionally developed. - Delaying the creation of the operating agreement.

While in theory, members of an LLC who are in conflict are perfectly capable of executing an agreement; in practice, they will rarely do so because either side will want provisions that will put them in a better position.

- Not having an operating agreement.

-

What If an LLC Has No Operating Agreement?

Not having an operating agreement for LLC is dangerous as the LLC is essentially invalid, and its members are not protected from personal liability.

There are five states that require operating agreements—namely California, Delaware, Maine, Missouri, and New York—but even if your state does not require one, an LLC operating agreement is vital to your organization.

The agreement is evidence that a limited liability company has been formed and that the company is not a sole proprietorship or partnership in disguise. Without this agreement in place, disputes between members and officers are subject to default state laws which may not be in your favor.

-

Is an LLC Agreement the Same as an Operating Agreement?

An LLC agreement and an LLC operating agreement are the same, and these two terms are often used interchangeably. The document can also be called an LLC company agreement.

-

Do I Need to Use A Lawyer, Accountant, or Notary to Help Me?

Input from a legal professional can always help when it comes to formulating agreements. However, if you take time to understand what your company needs and you create an operating agreement according to those specific needs, you should be fine without a lawyer.

-

Single Member vs. Multi-Member LLC Operating Agreement

The content of an LLC operating agreement largely depends on how many people own a particular business. If you are the sole member and owner of a business, you’ll need to compile a single-member LLC agreement. However, if the business is owned by two or more people you will need to compile a multi-member LLC agreement.

One of the key differences between these two documents is that a multi-member operating agreement must specify whether the company is member-managed or manager-managed.

Let’s take a closer look at the differences between these two concepts:

Member-managed: All members have equal authority to run the day-to-day operations of the company’s business. The company also needs to have the majority of its members’ approval when securing a loan or making key decisions.

Manager-managed: This means that one person is appointed to oversee the company’s day-to-day operations. Members of a company that are not in this role will be responsible for strategic decisions.

There are also different tax considerations that should be specified on a single-member and multi-member LLC operating agreement. Single-member LLCs are taxed as sole proprietorships, whereas multi-member LLCs will be taxed as general partnerships—unless they change their tax treatment.

A multi-member operating agreement also serves as a binding contract between the company’s members. Both of these agreements separate the member(s) from the company and protect each person’s assets if the business runs into financial difficulties.

-

What are the different contexts of a company’s formation?

The context of a company’s formation could be one of the following: (a) an operating company; or (b) a holding company for investments. This distinction has particular implications for the drafting and negotiating of the LLC agreement particularly as to the expectations of the members regarding additional capital contributions.

-

Should an LLC operating agreement address potential bankruptcy and insolvency issues?

Yes. In forming an LLC, parties should consider the effects of potential bankruptcy and insolvency issues. The Bankcruptcy Code does not define an LLC nor adequately address critical issues that affect the rights, liabilities, and remedies of LLCs and their members, creditors, and third parties. The lack of clarity increases the risks for stakeholders, and if left unaddressed, often lead to expensive litigation.

For security, it is better to include whether a non-bankrupt LLC member has the right or obligation to operate or wind up and dissolve the LLC. Under some statutes, including Delaware (6 Del. C. § 18-801(b)) and New York (NY LLC § 701(b)), an LLC is not automatically dissolved as a result of the bankruptcy of a member. Other states provide that the LLC is automatically dissolved in the event of the bankruptcy of a member unless the operating agreement provides otherwise provides or a majority of the remaining members vote to continue the LLC within 180 days of the dissolving event (T. C. A. § 48-245-101(a)(5)).

-

How is LLC collateral used by secured partners?

Interests in LLCs are often used as collateral for a secured party. The ability to control LLC interests following an event of default is one of the trends in the recent years. Secured parties wanted to cause the LLC to execute actions that would preserve the value of their collateral.

During periods of economic strain on the business, secured parties often attempt to enforce the remedies provided to them under the agreement. The preferred mode was often the exercise of a proxy or power of attorney granted to the secured party in the security agreement. Secured parties, through the agreement, seek to direct the operations of the LLC without actually becoming the owner. Secured parties, through the proxy attorney, usually do the following:

- Put a new management in place;

- Run a sale process to sell the entity;

- Effect other changes at the LLC.

-

What are primary drafting concerns related to collateral?

- That the terms must be broad enough to allow the secured party to take actions to preserve the value of its collateral;

- To allow the secured party to exercise the proxy/power of attorney without consent by the pledgor or prior notice to the pledgor.

-

What is the difference between a proxy and a power of attorney?

At the outset, both are devices used to authorize another person to act on behalf of the person granting the proxy or power of attorney. Traditionally, a proxy is limited to granting authority with respect to acting for another under corporate law to vote the grantor's shares. A power of attorney, however, is not limited to corporate law and permits a grant of authority to act as an agent or attorney-in-fact for a grantor more generally.

-

Do All Members of an LLC Have to Sign the Operating Agreement?

Yes, all the members and officers of a limited liability company must sign the operating agreement, and in doing so, they are bound to it. If a member does not sign the company agreement for LLC, they are not legally obligated to follow the rules and regulations laid out in the document.

Our free LLC operating agreement template includes dedicated sections for each member’s signature.

-

How Do I File My LLC Operating Agreement?

Some states require you to create an operating agreement, but you will not need to file this internal document with the Secretary of State. Rather, certain states will require you to file your business’s Articles of Organization and any annual reports.

-

How Do I Change the Terms In an LLC Operating Agreement?

Any changes to a company agreement for LLC must be documented in writing and signed by all the parties involved in the LLC—this is the only way you can change the terms of the agreement.

-

Do I Need a Business Plan If I Have an LLC Operating Agreement?

Both LLC Operating Agreements and business plans are crucial documents for your business. You are not legally required to develop a business plan. However, it is advisable to have one in place. These two documents will overlap somewhat, but they have separate uses.

A business plan defines how a company will achieve its goals and objectives and is an important document when attempting to secure investment and funding.

An operating agreement outlines how the business will be run, including daily operations and the duties and responsibilities of each member of the LLC.

-

Can I Change My Operating Agreement?

An operating agreement can be updated at any time, as long as the changes are approved by all of the company’s members. The LLC Operating Agreement template that we provide makes it easy for you to create an operating agreement with a simple and user-friendly 100% private and secure tool.

There are a few reasons why you may need to change your LLC operating agreement. This includes:

- More capital is added to the company’s business.

- A new member joins the company or a current one leaves.

- The governance of the organization changes.

- These amendments also have to be in the interest of the majority of the company’s members and be approved through a vote.

If you make any changes to your LLC operating agreement, it’s important that you don’t leave out any key details from the original document. Although you don’t need to file the amendments with the state, you should keep the new operating agreement as an internal document.

-

What to include in the section on membership structure?

A membership structure section must be included in an LLC operating agreement. It defines the criteria for becoming a member, including qualifications, contributions, and any necessary approvals or consents. This section may also outline the process for admitting new members, transferring membership interests, or withdrawing from the LLC.

Member Duties and Rights:

This subsection outlines the specific rights and powers granted to each member. It covers areas such as voting rights, decision-making authority, participation in meetings, and access to company information.Additionally, it may detail any restrictions or limitations on the rights and powers of two or more members who collectively contribute to the operation and decision-making of the company, ensuring a balanced and equitable distribution of authority within the LLC. One important provision is the requirement for members to maintain insurance coverage to protect the company and its assets.

Capital Contributions and Ownership:

A section on capital contributions and ownership provides for the required initial contributions of the members to the LLC.This section details the initial contributions, subsequent contributions, and the ownership interests of each member in the company. It may also outline the process for valuing membership interests and allocating profits and losses among the members.

Member Meetings and Voting:

To facilitate effective communication and decision-making, the LLC Operating Agreement specifies the rules and procedures for member meetings and voting. This section covers topics such as the frequency of meetings, notice requirements, quorum, voting thresholds, and the recording of minutes. It ensures that members have a platform to discuss important matters and collectively make informed decisions in the best interest of the LLC.Member Withdrawal and Dissociation:

In the event that a member wishes to withdraw from the LLC or circumstances arise that lead to the dissociation of a member, this subsection provides the procedures and consequences associated with such actions. It may outline the process for voluntary withdrawal, including the transfer of membership interests, as well as the consequences of involuntary withdrawal due to bankruptcy, death, or other specified events. -

What are the different standard forms of LLC operating agreement?

- Multi-Member, Board-Managed: A multi-member LLC agreement with multiple classes of membership interests (denominated in units) and a board of managers controlled by a private equity sponsor.

- Common and Preferred Units, Board-Managed: A multi-member board-managed LLC agreement with common and preferred membership interests (denominated in units).

- Single Class, Manager-Managed: A multi-member LLC agreement with a single class of membership interests, managed by managers.

- Voting and Non-Voting Units, Managing Member-Managed: A multi-member managing member-managed LLC agreement with voting and non-voting membership interests (denominated in units).

For joint ventures, the following are the standard documents:

- LLC Agreement (Two Member, Managing Member-Managed).

- LLC Agreement (50/50 Joint Venture, Board-Managed).

-

What are notable limitations in an LLC?

Limitations to the personal liability of the members. This section typically states that no member is personally liable to the LLC for the LLC's debts and obligations (similar to the "corporate shield" principle of corporate law). Members are typically not at risk of losing more than the amounts they invest in the LLC.

Limitations on a manager's authority to take certain actions. LLC agreements often require that members representing a certain percentage of the LLC interests must approve some matters before the manager can take certain actions (for example, an LLC agreement may provide that a manager cannot agree to sell all of the assets of the company unless the sale is approved by a majority of the LLC interests).

Limitations to the issuance of pre-emptive rights. Issuances of LLC interests to employees, consultants, and acquisition targets usually do not give rise to pre-emptive rights or the right of the shareholders to purchase newly issued stock before it is offered to others. Pre-emptive rights are generally meant to provide dilution protection against rounds of equity financing, not every issuance of LLC interests.

-

How will the amendment section protect minority members?

For minority members to protect their interest, one way is to make sure that the amendment section provides crucial alternative solutions. This is particularly important when the minority members don’t have approval rights over major decisions and that the majority members restate the agreement immediately after the LLC Agreement is signed. This leaves the minority members with no recourse but to take refuge under the amendment section.

A common way to frame a solution is to state that any amendment to the LLC agreement requires not only majority approval, but the consent of any members who would be disproportionately impacted by the proposed amendment relative to another class holding LLC interests.

Another way is to provide that any amendment that requires a supermajority vote must also be approved by at least the same classification. This has the effect of ensuring that a simple-majority holder of the voting units cannot unilaterally change the negotiated deal.

-

How an LLC can address deadlocks?

The operations of a company can sometimes be halted if there is a disagreement among the parties on a matter requiring the consent of the members (for example, if there is a 50/50 vote on a matter requiring majority consent). LLC agreements can provide a solution by including the following common provisions:

- Requiring a decision to be made by a higher authority within the company or organization if the entity is a subsidiary of a parent entity.

- Mediation or arbitration.

- Bringing the matter to a third party with experience in the LLC's business.

- Buy-sell provisions.