What is an S corporation (S corp)?

The IRS defines an S corp as a corporation that elects small business status. If you choose to form a business as a S corp, the shareholders (owners) have limited liability, and the profits are taxed on each shareholder’s personal tax return.

S corps are classified as pass-through entities, which means that the profits and losses are passed through to the personal tax returns of the shareholders. The S corp files a tax return using Form 1120S, but the tax liability is paid directly by shareholders.

S corporation requirements

To elect S corp status, a business must meet these requirements:

- Must be a domestic corporation

- 100 or fewer shareholders

- Only one class of stock

- Use a December 31st year-end date

- No partnership, corporation, or non-resident alien as a shareholder

Distribution of profits

Shareholders receive dividends, which represent a share of the S corp earnings. The company board of directors can vote to declare and pay a dividend to shareholders. S corps report each shareholder’s dividends on Schedule K-1.

Assume, for example, that Julie is a shareholder in an S corp. She receives a Schedule K-1 reporting $5,000 in dividends, and the amount is added to other income (wages, interest income, dividend income) on Julie’s personal tax return.

Companies must elect S corp status, using an IRS form.

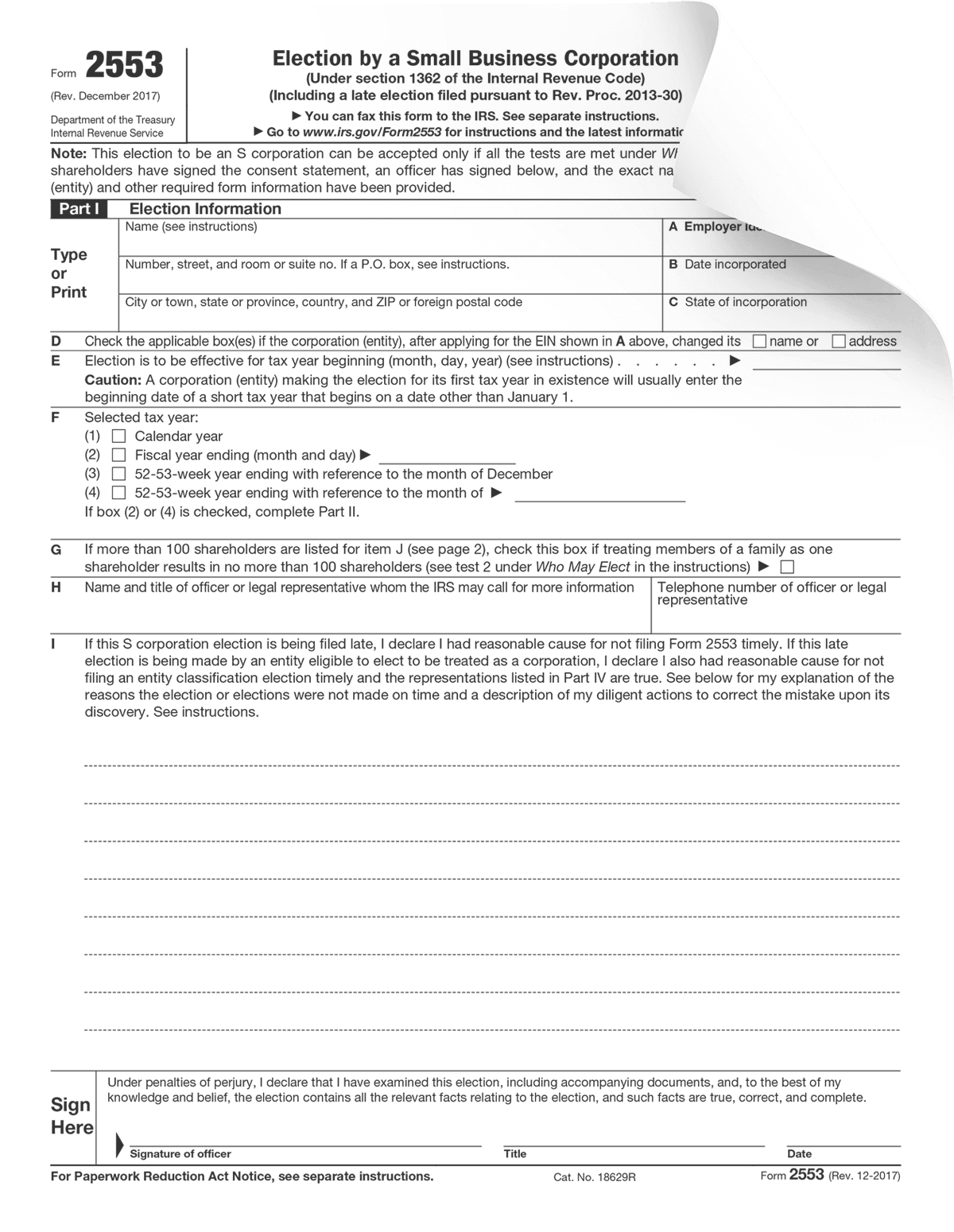

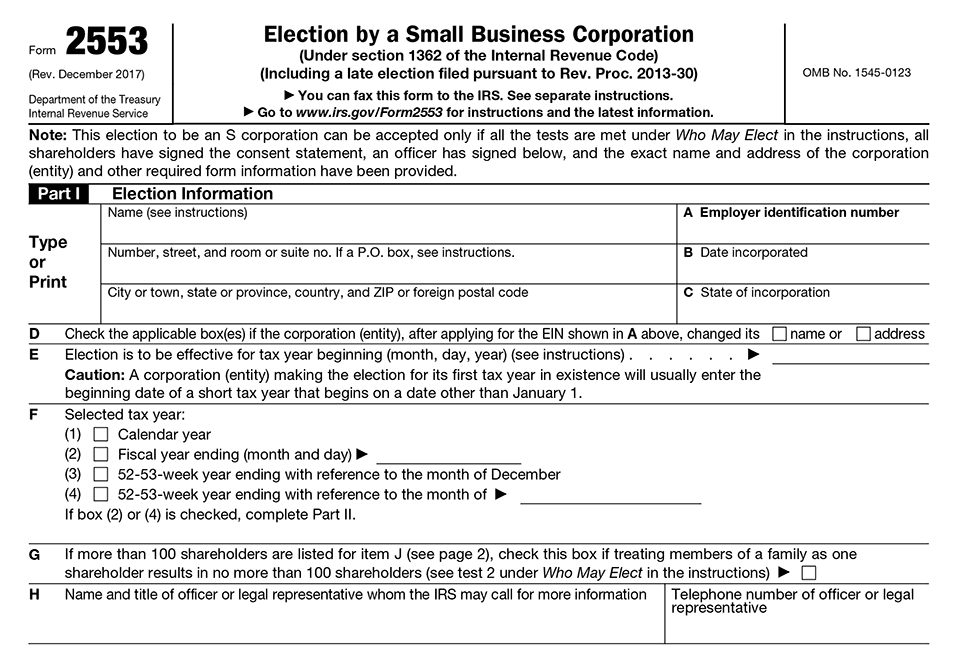

How to elect S corporation status using Form 2553

An S corporation dictates how a corporation is taxed, and firms can elect S corp status by completing Form 2553, Election by a Small Business Corporation.

Election information

Part 1 of the form collects basic information about the S corp, including the date of incorporation, and the state of incorporation. You also indicate when the election is effective, and the tax year. Finally, you list the name and phone number of a company officer or legal representative.

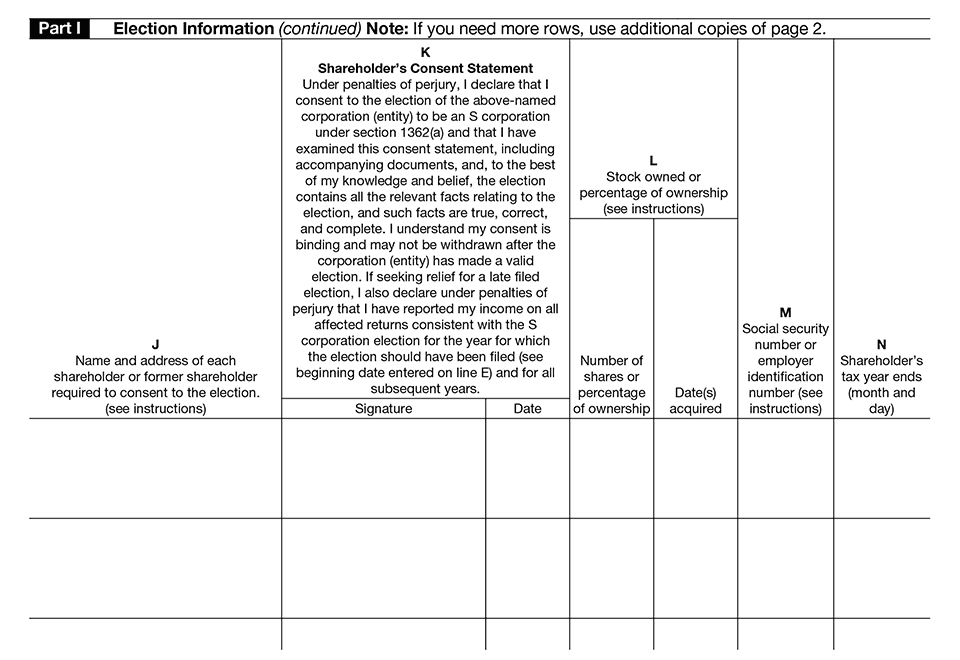

Part 1 also requires additional information regarding the shareholders:

The form requires the name, address, percentage of ownership, and social security number of each shareholder. Each shareholder consents to the S corp election by signing and dating the form (section K).

Shareholders must meet a deadline to file as an S corp.

Deadline to elect S Corporation status

The deadline for filing Form 2553 and electing S corp status is:

- No more than 2 months and 15 days after the beginning of the tax year the election is to take effect, OR

- At any time during the tax year preceding the tax year it is to take effect.

If you miss the deadline to file, check the Form 2553 instructions regarding a late filing.

Benefits of S corporation status

Here are the benefits of operating as an S corp:

Limited liability protection

Shareholders in an S corp have limited liability protection. If the S corp is sued, the most that a shareholder can lose is the value of the S corp investment. Limited liability means that a business lawsuit (or company debt) does not put a shareholder’s personal assets at risk.

Self-employment taxes

S corp shareholders are not considered self-employed workers, and do not have to pay self-employment taxes on S corp earnings. Check with a tax accountant to understand how this tax policy impacts your personal tax return.

No double taxation on earnings

S corp earnings are taxed once, when dividends are posted to a shareholder’s personal tax return. In a C corporation, the earnings are taxed twice. The corporation pays taxes on profits, and shareholders pay taxes when dividends are received. The double taxation of a C corp lowers the after-tax earnings of shareholders.

Tax benefits on losses

If the S corp has a loss, the losses reduce other income on the shareholder’s personal tax return. Posting losses can reduce the shareholder’s tax liability. If personal tax rates on S corp dividends are lower than the corporate tax rate, the S corp shareholder will pay less in tax than a C corporation on the same amount of earnings.

Completing tax form can be time consuming, and you need the help of an expert

Take Charge of the Process

Owners need to submit an accurate Form 2553 to the IRS, and using technology can help.

FormPros provides a Form 2553 generator that is user friendly, and helps you produce accurate tax forms in less time. Use FormPros to take charge of the Form 2553 process.

Form 2553 FAQs

-

What is Form 2553?

The form is used by Shareholders of a Corporation to elect S status with the IRS. The status provides limited liability protection for shareholders, and S-Corp. profits are passed directly to the personal tax returns of each shareholder.

-

What is the deadline for filing Form 2553?

The deadline for filing Form 2553 and electing S-Corp status is:

- No more than 2 months and 15 days after the beginning of the tax year the election is to take effect

- OR at any time during the tax year preceding the tax year it is to take effect.

-

What are the main things that go on Form 2553?

The firm lists the name, address, social security number and percentage of ownership for each shareholder. Form 2553 requires each shareholder to consent to the S-Corp election by signing and dating the form.

-

What are the common mistakes to avoid?

Owners must understand the pros and cons of electing S-Corp status, and ask each shareholder to sign and date the form. If shareholders don’t understand how S-Corp status impacts their ownership, they may be hesitant to sign the form. Avoid the mistake of filing Form 2553 after the deadline.

-

Do I need to use a lawyer, accountant, or notary to help me?

You may think you need one, but it is not necessary to hire a lawyer, accountant or notary to help you create the Form 2553. You can easily and accurately do it online. Doing it this way you can save considerable money, particularly if you have to create many copies of the form.

-

Why use our Form 2553 generator?

The easiest way to correctly complete and verify the Form 2553 is to use special services like Form Pros. It does not require the installation of additional software, and it saves you time and money.