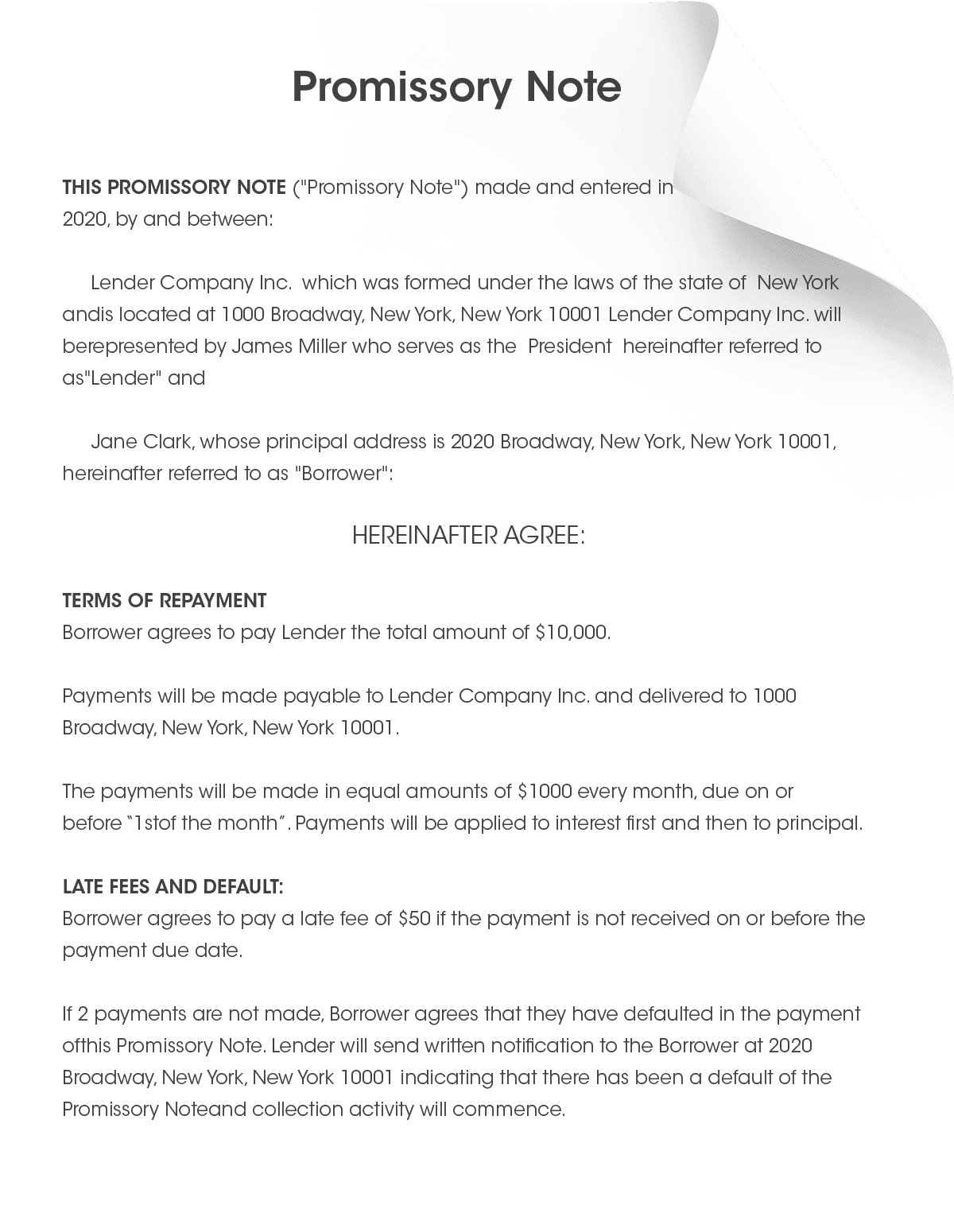

What Is a Promissory Note?

A promissory note—also known as a loan agreement or an IOU—is a legal document that defines the details of a loan made between two people.

This document clearly outlines the borrower’s promise to repay the lender in full, within a specific amount of time. It serves as a written record of the transaction and the borrower’s intentions.

Although it may seem like an informal document – particularly if you sign one when borrowing money from a friend or family member – these notes are legally enforceable.

What Is a Demand Promissory Note?

This is a variation of a regular promissory note where the borrower is obligated to repay the loan when the lender demands payment. Once the lender gives the borrower notice that they want their money, they will also set a number of days in which they want to be repaid.

What Types of Promissory Notes Are There?

- Informal or personal loans: This type of promissory note could be from one friend or family member to another to repay vehicle down payments or a student loan, for example.

- Commercial: These notes are more formal and spell out specific loan conditions. They could be in the form of business loans.

- Real estate: This promissory note and deed of trust are included with a mortgage loan or other real estate purchase.

- Investment: A company can issue a promissory note to raise capital, which can also be sold to other investors. Only savvy investors with the required resources should assume the risks of these notes.

Can a Promissory Note Be Handwritten?

Although a promissory note can be handwritten, it’s not recommended. This is because it’s often easier to add information to a handwritten document afterward, even though both parties might not have agreed on it.

Using legally binding online tools like Form Pros can help you to avoid costly mistakes and potential legal implications that come with handwritten documents.

Why Do You Need a Promissory Note?

A promissory note is typically a way of formalizing a basic repayment agreement between two parties. This document establishes the terms, dates, and amount of each payment due. Without one you may not be paid on time, or you may run into other issues.

A promissory document can be either secured or unsecured.

- An unsecured promissory note pertains to a loan that’s made based solely on the maker’s ability to repay.

- A secured promissory note means the loan is secured by an item of value, such as a house.

When Do You Need a Promissory Note?

A promissory note should be created if you want to create a legally enforceable agreement that spells out the terms of the repayment.

It also serves as an official record of the promise of repayment. A promissory note should be used in the following situations:

- You plan to borrow money and want to secure the loan by putting up collateral.

- You plan to loan money and need a schedule of payments or intend to charge interest.

- If you plan to borrow money between friends or family and want to show your intent to repay.

If you’re lending money to a party and want a written agreement.

Why Is a Promissory Note Important?

Promissory notes provide flexible options to easily obtain funds. Putting the financial terms in writing protects both the lender and the borrower.

This document will be a legal record of the agreement and will help ensure that the money is paid back.

What Are the Main Things That Should Be Included in This Form?

Even if you’re just creating a simple promissory note, it’s important to ensure that it contains all of the correct information.

Below is a list of essential things that must be included in your promissory note form:

- Information about the borrower and lender: Clearly identify both of the parties involved in the loan by listing the lender and the borrower. The borrower can be an individual or a corporation.

- Payment dates: Specify when the first payment is due, and how long a borrower has to make it.

- End of promissory date: Specify when the promissory note’s time period ends.

- Payment plan: Establish a schedule to include how the borrowed amount should be repaid and how frequently (weekly, monthly, annually). Here are a few different payment options:

- Lump-sum payment: The entire loan amount is to be repaid in one payment.

- Due on demand: The borrower must repay the loan when the lender asks for repayment.

- Installment: A specified schedule of payments determines how the loan is to be paid back.

- Interest rate: The agreement should spell out the interest rate, if any. The interest rate is usually expressed as a percentage of the amount borrowed and is calculated at a specified interval over the course of the term of the promissory note.

- The amount of the loan, including interest and how it is to be compounded.

- Collateral: Collateral secures repayment on a note. Collateral is when something is pledged to the lender to guarantee repayment. For example, real estate (such as a house) is collateral on a mortgage.

- Consequences of late payment(s): Specify what will happen if the borrower fails to pay on time, if they will be charged for late fees and if so, the penalty/amount.

- Transfer or selling permissions: Specify if the lender has permission to sell/transfer the loan and under which conditions this can happen.

- Amendments: Just like with many contracts or agreements, amendments can only be enforceable if both parties agree to alter the terms of the note.

- Signatures: Once the note has been constructed both parties need to sign the agreement, officially binding the terms of the contract. Depending on how much the parties trust each other, you may also wish to have the signatures notarized.

Are Promissory Notes Legal Contracts?

Like common law contracts, a promissory document or letter is a legal instrument. However, for the document to be legally enforceable certain conditions must be met – for example, an offer and an acceptance of the offer. A legal promissory document will be tailored around the loan amount and the repayment terms.

Additionally, the promissory note contains the terms and conditions that were agreed upon by the two parties.

Once the above conditions for the loan are agreed upon and signed by both parties, the promissory document will meet all the requirements for a legally binding contract.

Do I Need Witnesses to Sign the Promissory Document?

Generally speaking, there is no requirement for a witness or notary public to witness the signing of the promissory note. However, a witness or notary public might need to be present while you sign the promissory note if state-specific laws require it.

Even if it is not required, having an objective third party witness the signing of the note will be better evidence if you need to enforce the agreed-upon repayment of the note.

Signing the note in the presence of a notary public is the best evidence that the borrower signed the document.

Reasons to Consider Not Using a Promissory Note

A promissory note may not always be your best option. Consider the following possible drawbacks:

- Unsecured loans typically carry higher interest rates.

- Lenders may require a more formal agreement before lending larger sums of money.

- Your business doesn’t have the cash flow to support debt financing.

- Promissory notes may still be considered a public securities offering.

- If you don’t pay the promissory note, the lender could buy your assets in bankruptcy for the amount of outstanding debt.

What Are the Tax Implications of Promissory Notes?

Whenever interest is earned or paid, there will be income tax implications for both lenders and borrowers.

Principal, Interest, and Basis

Before we discuss the tax implications for lenders and borrowers it’s important that you understand the note’s principal, interest, and tax basis. The note’s principal simply refers to the amount of money loaned to the borrower. The interest is the amount of money the lender makes for loaning the money.

Additionally, all loans have a basis that refers to the purchase price and costs associated with acquiring the investment.

Tax Implications for the Lender

Income generated from a promissory note is taxable income and must be reported as such. The interest that the lender earned on the note would be considered as income.

However, if you lent the money in a personal capacity instead of through a business it must be reported on your income tax return.

It’s also important to note that if the income you generated was more than $1,500, it must be reported on Schedule B of Form 1040 or 1040A.

Tax Implications for the Borrower

Depending on whether the loan is used for personal or business purposes, it has different tax implications for the borrower. Unless the loan is used for a home loan under IRS regulations, the interest payments are not tax-deductible if used for personal purposes.

If the loan is used for a valid business purpose, it is possible to deduct interest repayments as business expenses under IRS regulations.

Below-Market Loans, Loan Forgiveness and Forgone Interest

If a loan is forgiven, the amount must be treated as income and reported by the borrower on their tax return.

If the loan is set at an interest rate below that set by the IRS, it is possible to treat the foregone interest as income.

Steps to Follow When Making Use of a Promissory Note

Since a promissory note is a legally binding financial document, there are certain things you’ll need to do to comply with the law. Take the following steps when using a promissory note:

- Carry out financial due diligence to ensure you can repay the loan.

- Compare other funding options for lower-cost alternatives.

- Do not solicit a loan from outside sources without speaking to an attorney. This could be considered a public offering unless you meet the requirements of Regulation D, the JOBS Act, or another exemption.

- Carefully review the terms of the promissory note. Standard forms may not include important provisions, or may contradict your intent.

- Execute the agreement, and keep copies securely stored for your records.

What’s the Difference between a Promissory Note, an IOU, and a Loan Agreement?

The main difference is in the names, not the function. IOUs are generally less formal and may not have exact repayment terms.

Loan agreements – or loan contracts – are more formal and are often used by banks. Mortgages secure a loan with the title to real estate property. Let’s take a closer look at what each of these means.

What Is a Loan Contract?

The principles and main aim of a loan agreement and promissory document are similar because they both provide an agreement about the conditions of a loan repayment. However, the difference is that the loan agreement is more detailed than the promissory document.

Loan agreements are better to use when the principal amount of the loan is a large sum and the lender is unfamiliar with the borrower.

A promissory document is a better option for smaller loans between trusted parties (such as family or friends).

What Is an IOU?

An IOU is an acronym of the phrase, “I owe you” and consists of a document that acknowledges debt between two parties.

Whereas promissory notes are seen as legally binding, an IOU is an informal written agreement that states that one person owes another money.

Due to the informal nature of an IOU, a formal written agreement may follow because these documents can be difficult to enforce without stipulated conditions around the loan agreement.

What Is a Mortgage?

A mortgage is a financial agreement made between a homeowner and a lender, with the promise to pay back the loan used to purchase real estate.

Similar to a promissory document, a mortgage outlines the repayment terms, the size of the loan, the interest rate, and the penalty for late fees. The difference between a mortgage and a promissory document is that the note is not entered into an official record.

What Are the Most Common Mistakes to Avoid When Creating a Promissory Note?

A promissory note should be in a written format, not verbal. A note is only valid when it deals specifically with the exchange of money.

If you plan to include interest, it must be clearly stated in the document. You should also include the date on which the loan will “mature,” or be satisfied. Remember that the promissory note is not valid if it does not include both the signature of the borrower and the lender, so it is important to get it signed.

Here are some of the common mistakes:

- Not including all the necessary terms in the agreement.

- Not ensuring you have adequate cash flow to make timely payments.

- Violating covenants with other debt or equity holders that prohibit additional borrowing.

- Failing to protect your personal assets in case of default.Soliciting funds in a way that violates securities laws.

When Is a Promissory Note Void?

- Losing the Original: If you can’t prove the note ever existed, you have a problem. Suppose your debtor stops making payments, so you decide to sue for the money. When you gather your evidence, you can’t find the note, or even a copy of it. It’s still possible to collect—if you can prove that you own the note and that it’s been lost or destroyed. If the only evidence you have is your memory, you may be unable to prove your case. Different judges have taken different views of what constitutes proof of the debt. Even a copy of the original may not suffice because it’s easier to fake.

- Proof of Ownership: Even if you can prove the note exists, you must show that you’re the legal owner. There are multiple mortgage cases where the mortgage note was transferred from one owner to the next, but the second owner never received it. Even if they paid to get the note, they never possessed it. The debt was out of reach.

- Flaws in the Note: Even if you have the original note, it may be void if it was not written correctly. If the person you’re trying to collect from didn’t sign it then the note is void. It may also become void if it fails some other law, for example, if it charged an illegally high interest rate.

What Happens When a Promissory Note Is Not Paid?

Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions. You have a few options if someone who has borrowed money from you does not pay you back.

First, you should ask for the repayment in writing. A written reminder might be all you need to do to get your money paid back. Late fees reminders are commonly sent at 30, 60, and 90 days after the stated due date. If the borrower still does not pay you back, you might consider asking your borrower to make a partial payment. You can create a debt settlement agreement if you decide to accept partial repayment of a debt.

Another option to consider is creating an extended payment plan. This allows the borrower to pay you back in full over a revised period of time. You can also choose to use a debt collector to obtain repayment. A debt collector works with you to collect the note, generally taking a percentage of the payment.

Alternatively, you can sell the note to a debt collector. Selling a note to a debt collector gives the debt collector ownership of the loan and the ability to collect the full amount.

If nothing else works, you can also sue your borrower for the full amount owed to you.

Do I Need to Use a Law Firm, Accountant, or Notary to Help Me?

You can easily create a promissory note without hiring a lawyer, accountant, or notary.

Creating the form online with legally binding tools like Form Pros can save you time and money. It can also cut out the hefty expense of hiring a lawyer.

Why Use the Form Pros Promissory Note Generator?

Our easy-to-use free promissory note template generator was created by a staff of lawyers and business experts, and creates promissory notes for a fraction of the cost you would pay an attorney.

Our tool also has a subscription plan so you can create unlimited promissory notes at a low cost.

Here’s how to create your own promissory note in three simple steps with Form Pros:

- Step 1: Answer a few simple questions to create your document.

- Step 2: Preview our promissory note templates to see how your document will look and make any edits.

- Step 3: Download your document instantly to your computer and then print or share it with the lender or borrower.

Start creating error-free, affordable, and accessible documents with Form Pros today.