How to Fill Out Your W4 (and What Replaced Withholding Allowances)

If you’ve ever wondered how much tax your employer should take out of your paycheck, the answer starts with your W4 form. The IRS redesigned this form to replace the old “withholding allowances” system. In 2025, the W4 helps you match your paycheck withholding to your actual tax bill; accurately and simply.

Table of Contents

What Were Withholding Allowances?

Before 2020, the IRS used a system of “withholding allowances” to decide how much federal income tax to withhold from your paycheck. Each allowance roughly represented one exemption; like yourself, a spouse, or a dependent. The more allowances you claimed, the less tax was withheld.

That system is now retired. The 2020 IRS W-4 redesign removed allowances to make tax withholding clearer and more accurate. Instead of counting allowances, you now enter real financial details (like dependents and deductions) directly on the form.

If you’re still seeing the term “withholding allowances” online or on older HR materials, it simply means the pre-2020 method. In 2025, you’ll use the new W4 inputs to get the same results, with less guesswork.

How the New W4 Form Works in 2025

The 2025 W4 Form, officially called the Employee’s Withholding Certificate, has five steps. You’ll usually only fill out Steps 1 and 5, unless you have other income or deductions. Here’s how it works:

Step 1: Enter Personal Information

— First, write your name, Social Security number, and address, and then choose your filing status: single, married filing jointly, or head of household. Because your filing status determines your tax bracket, it also affects how much tax your employer withholds from each paycheck.

Step 2: Multiple Jobs or Spouse Works

— If you have more than one job, or your spouse also works; use the IRS online Tax Withholding Estimator or check the box in Step 2(c). This helps your employer withhold the right amount for combined income.

Step 3: Claim Dependents

— Previously, this step involved claiming “allowances.” Now, it works differently. You’ll first multiply the number of qualifying children under 17 by $2,000, and then multiply any other dependents by $500. Finally, add those amounts together to reduce your overall withholding.

Step 4: Other Adjustments

— Use this optional section for other income (like freelance earnings), deductions (like mortgage interest), or any extra amount you’d like withheld each pay period.

Step 5: Sign and Date

— The form isn’t valid until you sign. Your employer then uses the information to calculate how much federal income tax to withhold each paycheck.

*This form applies to federal taxes only (state forms may differ).*

How to Calculate Your Withholding

Let’s look at a simple example.

Scenario:

You’re single, earn $60,000 per year, and have one qualifying child under age 17.

Step 1: Mark “Single.”

Step 2: Skip this step since you only have one job and no working spouse. If you had multiple jobs, you’d use the IRS Tax Withholding Estimator or check the box in Step 2(c) to combine income.

Step 3: Enter $2,000 for your dependent.

Step 4: Leave blank if you don’t have other income or deductions.

Your employer will now use IRS tables to calculate how much federal tax to withhold from each paycheck. In this case, roughly $190 to $210 in federal income tax might be withheld per biweekly paycheck, depending on your pay frequency and benefits deductions.

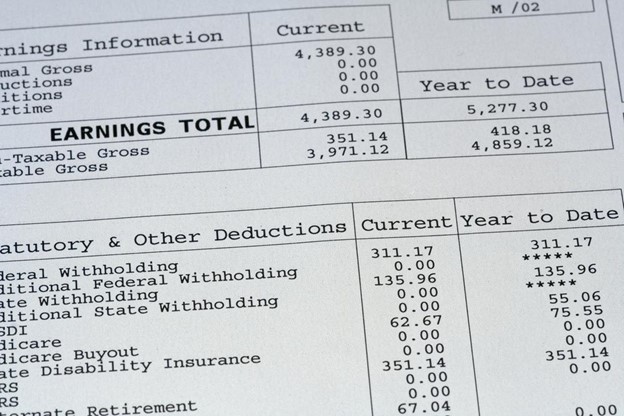

Review Your Withholding Using Your Paystub

After you submit your W4, the best way to confirm everything looks right is by checking your next paystub. It’s a quick reality check to see how your W4 choices translate into real-world tax withholding.

Here’s what you’ll usually see on your paystub:

- FED TAX or FIT — Federal income tax withheld, based on the information you entered on your W4.

- FICA — Social Security tax, fixed at 6.2% of wages up to the annual limit ($168,600 in 2025).

- MEDICARE — Medicare tax, fixed at 1.45% of all wages (plus 0.9% for income over $200,000).

- STATE TAX — Varies by state; some states have their own W4-type forms.

- NET PAY — The amount you actually take home after all withholdings.

These line items show how your W4 selections: like filing status, dependents, and extra withholding affect your paycheck. If the federal tax amount looks higher or lower than expected, it’s a signal to revisit your W4.

When to Update Your W4

Your W4 isn’t “set and forget.” Life changes, and your withholding should too. Review your form at least once a year, or sooner if:

- You start or leave a second job.

- Your spouse starts or stops working.

- You get married or divorced.

- You have a new child or dependent.

- You earn side income, like freelancing or gig work.

Updating your W4 after these changes keeps your withholding accurate and helps you avoid a large tax bill or refund next spring. The ideal goal is balance: to have just enough withheld so you neither owe a big payment nor overpay throughout the year.

Simplify Your Withholding

Getting your tax withholding right doesn’t have to be complicated. The redesigned W4 form makes it easier to align what you pay throughout the year with what you actually owe but only if your information is up to date.

If you’re starting a new job, changing your income, or just want to double-check your withholding, FormPros can help.

You can create a ready-to-use W4 and generate real paystubs that clearly show how much tax is withheld each pay period. These tools make it simple to try out different withholding amounts, see how they affect your take-home pay, and then adjust your form before you submit it.

Staying proactive now can save you from surprises at tax time.

FAQs

-

Do I still need to claim allowances?

No. The IRS removed allowances to simplify the process. Instead, you report dependents and deductions directly on the W4.

-

What happens if I don’t update my W4?

Your employer will keep using your most recent form. If it’s based on old data, you might owe tax or get a large refund at filing time.

-

How can I check if my withholding is correct?

Use the IRS Tax Withholding Estimator or FormPros’ W4 generator. Compare your projected refund or balance due—then update your W4 if needed.

-

Is this the same for state taxes?

Not always. Some states use their own withholding forms. Check your state’s revenue department website for local rules.

-

Can FormPros help me fill out a W4 correctly?

Yes. FormPros’ guided W4 generator walks you through each step of the 2025 form, ensuring your withholding reflects your real income, dependents, and deductions. You can also create paystubs to see how those choices affect your take-home pay.

FormPros Can Help!

- Create W4 Instantly

- Saves Time and Headaches

- Preview and Share Easily

- Easy to Follow Steps