Are Pay Stubs Better Than Excel Spreadsheets?

You need to work efficiently to grow your business. Successful companies expand by completing more work in less time. One of the most complex tasks you must complete is payroll, and that begs the question. Are pay stubs better than excel spreadsheets at completing that task?

This article defines pay stubs, and the information needed to make pay stubs. You’ll read about common mistakes, why using Excel spreadsheets is a bad idea, and how FormPros makes the pay stub process easy.

Let’s start with the definition…..

Table of Contents

What is a Pay Stub?

A pay stub lists all of the key information related to an employee’s pay. The pay stub provides information on wages, tax withholdings, and benefit withholdings.

The rules regarding pay stubs vary by state. Some states require employers to provide pay information to workers, while other states do not. Businesses should confirm the requirements in each state where they employ workers.

Employees should keep their most recent pay stubs as proof of income. If an individual applies for a loan, the pay stub confirms the borrower’s gross income.

Employers should keep a record of all generated paystubs. The pay stub information should match the data on each employee’s W-2 form, which individuals used to file their personal tax returns.

Information Needed to Create a Pay Stub

Determine this information for each employee:

- Payroll cycle: The number of pay periods determines how much salary the employer pays on each payroll date. It also determines the start and ending days for computing hourly payroll.

- Wages: Gross pay and net pay. Wages may be based on a salary, or calculated using an hourly rate of pay.

- Tax withholdings: Federal, state, and possibly local amounts withheld for taxes.

- Benefit withholdings: Withhold amounts for the employee’s share of insurance premiums or contributions to a retirement plan.

Here are some common mistakes that businesses make when generating pay stubs.

Common Pay Stub Mistakes

Review your pay stubs carefully, to avoid these mistakes:

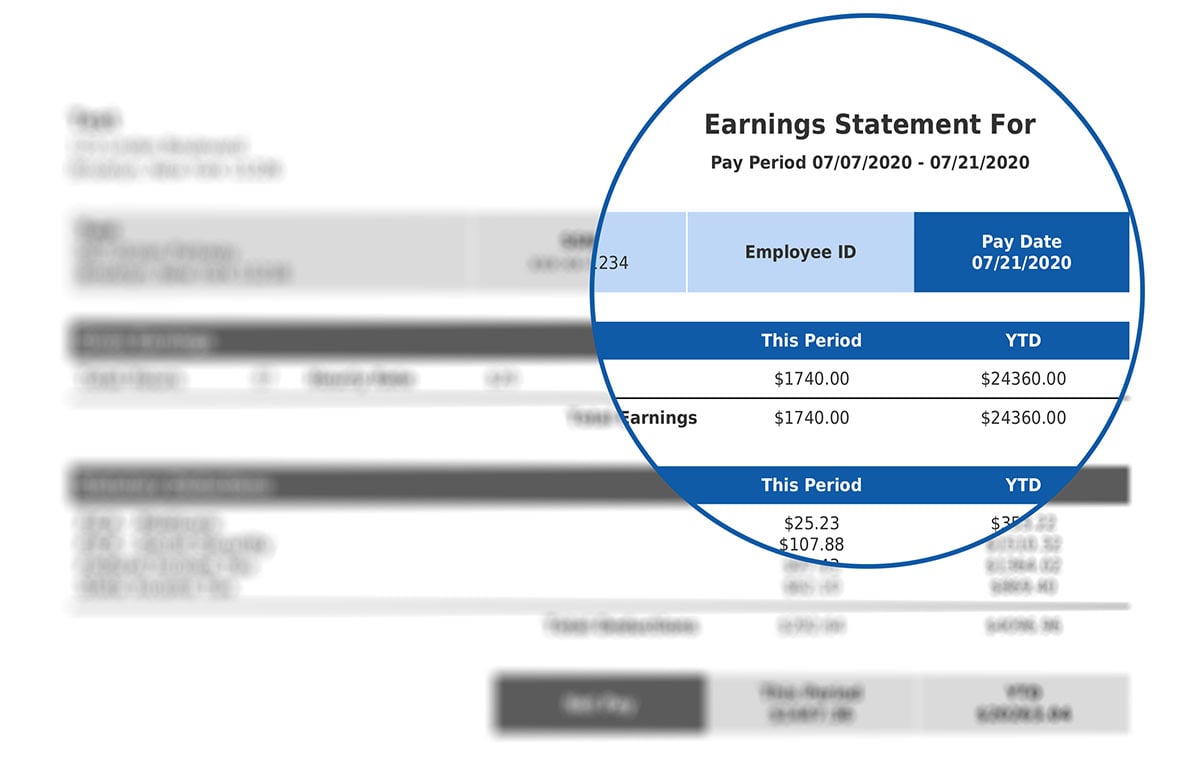

#1: Current Period vs. Year-to-Date Data

Your workers must clearly understand the differences between current period and year-to-date information. If you fail to label each dollar amount correctly, your staff may misunderstand the information.

Workers use year-to-date data to confirm that their gross wages, tax withholdings, and benefit contributions are on track.

#2: Outdated W-4 Information

Your employees may change their tax withholdings after a pay raise, the birth of a child, or marriage. You need the current W-4 to process payroll correctly. Ask each worker for updated W-4 information periodically, and use the updated forms on the next payroll run.

#3: Incorrect Pay Cycle

Workers need to plan their finances based on your company’s pay cycles. List the pay date on each stub, and explain the pay frequency to your workers (weekly, bi-weekly, or monthly).

#4: Incorrect Tax Data

The federal and state tax laws change constantly, and your pay stub must include withholdings based on current tax law. If the withholdings are not correct, the worker may have an unexpected tax liability at the end of the year, and possible owe penalties for underpayment of taxes.

Using spreadsheets can make the pay stub process more time consuming.

Why Excel Spreadsheets Are a Bad Idea

Here are some reasons to move away from spreadsheets, and to use technology:

- Tabs: You may forget to properly link the tabs on a spreadsheet.

- Version: Are you using the current version of the spreadsheet? Are you saving the data using the same file name?

- Integration: You can’t integrate spreadsheets with software tools, including accounting software. If you have to manually enter data into software, the risk of error is higher.

- Training employees: More difficult, because using spreadsheets requires more steps and input work. You’ll spend more time on training, and the risk of error is higher when you delegate work on someone new.

As your business grows, the number of transactions increases, and so does the number of pay stubs you must produce. If you’re posting more transactions, spreadsheet data entry makes accounting more difficult.

Employers need to generate accurate pay stubs, and using technology can help.

Minimize Pay Stub Errors With FormPros

FormPros provides a pay stub generator that is user friendly, and helps you produce accurate pay stubs in less time. Our software automatically calculates earnings and deductions, based on the data you input. The system securely processes your information online.

Use FormPros to take charge of the pay stub process.

FAQs

-

Can digital paystubs be used as legal proof of income when applying for government benefits?

Yes, most government programs like SNAP or Medicaid accept digital paystubs as proof of income. Make sure your stubs include key details such as employer information, pay period, and deductions. Some agencies may require multiple stubs or extra documentation for verification.

-

How can small businesses keep paystub data secure when moving away from spreadsheets?

Choose online tools that provide SSL encryption, secure storage, and follow privacy laws. Enable features like multi-factor authentication and audit logs. Send stubs through secure channels and store them in protected locations instead of shared folders.

-

What if there's a mistake on a paystub after it’s been given to an employee?

Send a corrected paystub right away and inform the employee. Record the correction in your files. If the mistake affects taxes, file amended payroll tax forms with the IRS or your state agency.

-

Do independent contractors need paystubs?

No, contractors usually get Form 1099-NEC instead of pay stubs. However, they can create their own pay stubs to show income when applying for a rental or loan.

-

Can paystubs be automated for regular payroll?

Yes, many tools support recurring pay stub generation. After you enter employee details and set the payment schedule, the system automatically creates stubs each pay period, minimizing manual work and errors.