How to Get Your W-2 Without Going Through HR

Can’t reach HR? Don’t stress — here’s how to get your W-2 online through payroll portals, IRS tools, or FormPros, safely and fast.

Can’t reach HR? Don’t stress — here’s how to get your W-2 online through payroll portals, IRS tools, or FormPros, safely and fast.

Wondering when you’ll get your W-2? Here’s what the IRS requires, what to do if it’s late, and how to stay on track for tax season.

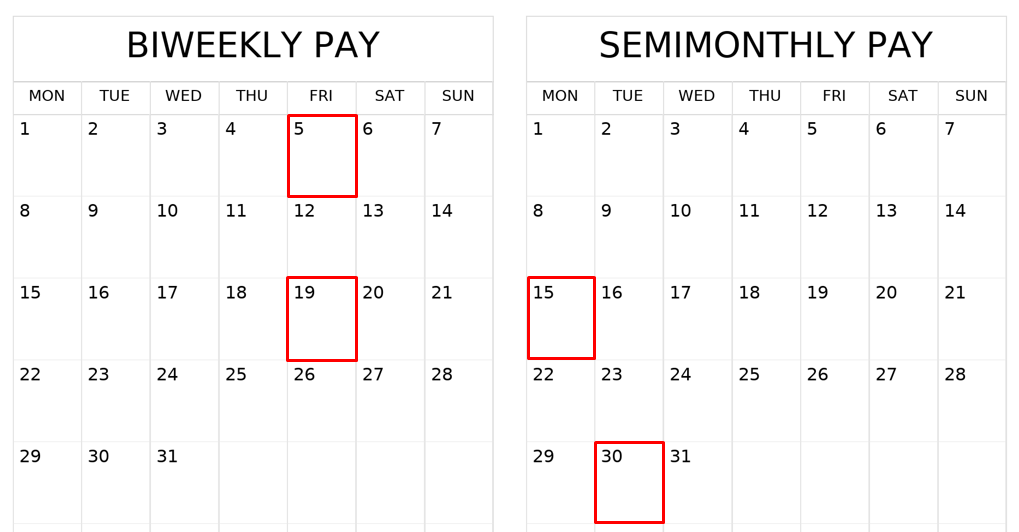

It’s not your imagination — your paycheck really does look different depending on whether you’re paid biweekly or semimonthly.

Your gross pay is what you earn. Your net pay is what you keep. Learn how to bridge the gap and see what really lands in your pocket.

Both are payroll taxes — but they fund different things. Learn how FICA vs Medicare work, who pays them, and what they mean on your paystub.

Wondering what OASDI on your paystub means? It’s simply your Social Security tax — and it plays a big role in your future benefits.

AI-generated paystubs might look real, but they can expose you to fraud risks, verification failures, and even legal trouble. Learn why using FormPros is the safer choice.

First-time renters can speed up the apartment hunt by preparing key documents in advance—like ID, proof of income, and rental references. Here’s what you’ll need and why it matters.

Paystubs are more than payroll records—they’re key to accurate tax filing and audit defense. Learn how to use them to verify income, support deductions, and stay IRS-compliant.

The “No Tax on Tips” Act could reshape how service workers file taxes by allowing up to $25,000 in reported tips to be deducted from taxable income. Learn what this means for your W-2, 1040, and refund potential.