A purchase order (PO) helps businesses outline the details of a planned purchase so both buyer and seller have clear expectations. Learn when a PO is appropriate, the essential fields to include, and how it differs from an invoice.

What is a Purchase Order?

A purchase order is a formal document a buyer sends to a seller to confirm the details of a future purchase. It lists the products or services requested, the quantity, price, delivery date, and other terms. When a seller accepts the PO, it becomes a legally binding agreement.

When to Use a Purchase Order

Use a PO whenever you need a written agreement before buying goods or services. Common situations include:

- Ordering inventory or supplies for your business

- Requesting contract services (repairs, maintenance, consulting)

- Placing large or repeated orders where accuracy matters

- Managing budgets and tracking approved expenses

Required Fields for a Purchase Order

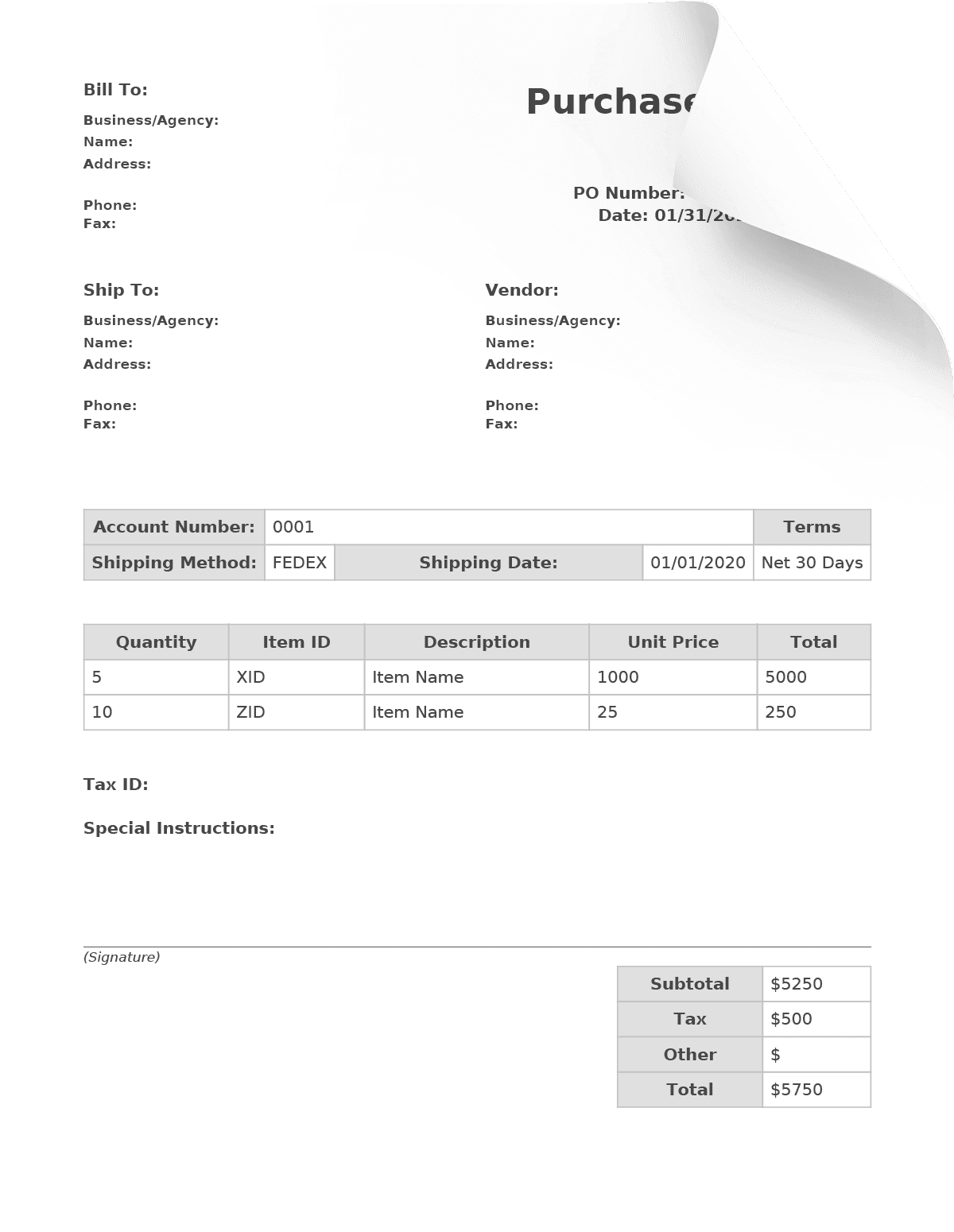

A complete purchase order lists the fields both parties need to understand the purchase and its terms:

1) Buyer and Seller Details –

- Legal business names

- Billing and shipping addresses

- Contact information

2) PO Information –

- Purchase order number (a unique tracking ID)

- Issue date and expected delivery date

3) Itemized Order List –

- Product or service description

- Quantity

- Unit price and total amount

- Applicable taxes or discounts (defined clearly)

4) Payment and Delivery Terms –

- Accepted payment methods

- Payment due date

- Shipping instructions

Purchase Order vs. Invoice: What’s the Difference?

The buyer issues a PO before receiving goods or services. The seller issues an invoice after delivery to request payment.

| Document | Sent By | Sent When | Purpose |

|---|---|---|---|

| Purchase Order | Buyer | Before purchase | Confirms the order details |

| Invoice | Seller | After delivery | Requests payment |

Preview and Create Your Purchase Order Today

Save time and reduce errors by starting with a professional purchase order. Download a free preview of our PO template to see the layout and required fields. If it meets your needs, you can generate a complete, customizable purchase order in minutes using FormPros.

Purchase Order FAQs

-

Can I edit a PO after it’s been issued?

Yes, but any changes should be formally documented. If the supplier has not yet processed the order, you can issue a revised PO or a PO amendment. If the order is already in progress, you may need to negotiate modifications directly with the supplier.

-

What’s the difference between a PO and an invoice?

A PO is created by the buyer to request goods or services from a supplier. An invoice is sent by the supplier after the order is fulfilled to request payment. The PO comes first in the transaction process, while the invoice follows upon delivery.

-

Do PO's expire?

Yes, POs typically include an expiration date, especially if they are part of a quote-based agreement. If no expiration date is specified, it's best to confirm validity with the supplier to avoid pricing or availability issues.

-

Can I use a PO for services instead of products?

Absolutely! While POs are commonly used for physical goods, they can also be used for services, such as consulting, repairs, or software development. The PO should clearly define the scope of work, timelines, and payment terms.

-

What happens if a supplier rejects my purchase order?

If a supplier rejects your PO, it could be due to pricing disagreements, stock shortages, or policy restrictions. In this case, negotiate with the supplier, revise the PO if needed, or seek an alternative supplier that meets your requirements.

-

How do I track the status of a PO?

You can track a PO by using the PO number to check with the supplier. Many businesses use purchase order management systems or ERP software to monitor approvals, shipment status, and invoicing updates.

-

Is a digital PO as legally binding as a paper one?

Yes! Digital POs are just as legally binding as paper ones, as long as they are properly authorized and documented. Electronic signatures and automated PO systems further enhance their validity.

-

What should I do if the supplier overcharges on the invoice?

Compare the invoice to the original purchase order to verify discrepancies. If the supplier has overcharged, contact them immediately with the PO details and request a corrected invoice before making payment.

-

Can a purchase order be canceled?

Yes, a PO can usually be canceled before fulfillment, but it depends on the supplier's cancellation policies. Some may allow cancellations without penalty, while others might charge a fee for processing or materials.

-

Do PO's help with tax deductions?

Yes! POs serve as financial records that can help track business expenses for tax deductions. Keeping well-documented POs makes it easier to validate deductions during tax filing or audits.