Estimate Your Federal Tax Withholding in Minutes

Skip the guesswork. Learn how to estimate your 2025 federal tax withholding fast so you can stay on track and avoid surprises at tax time.

Skip the guesswork. Learn how to estimate your 2025 federal tax withholding fast so you can stay on track and avoid surprises at tax time.

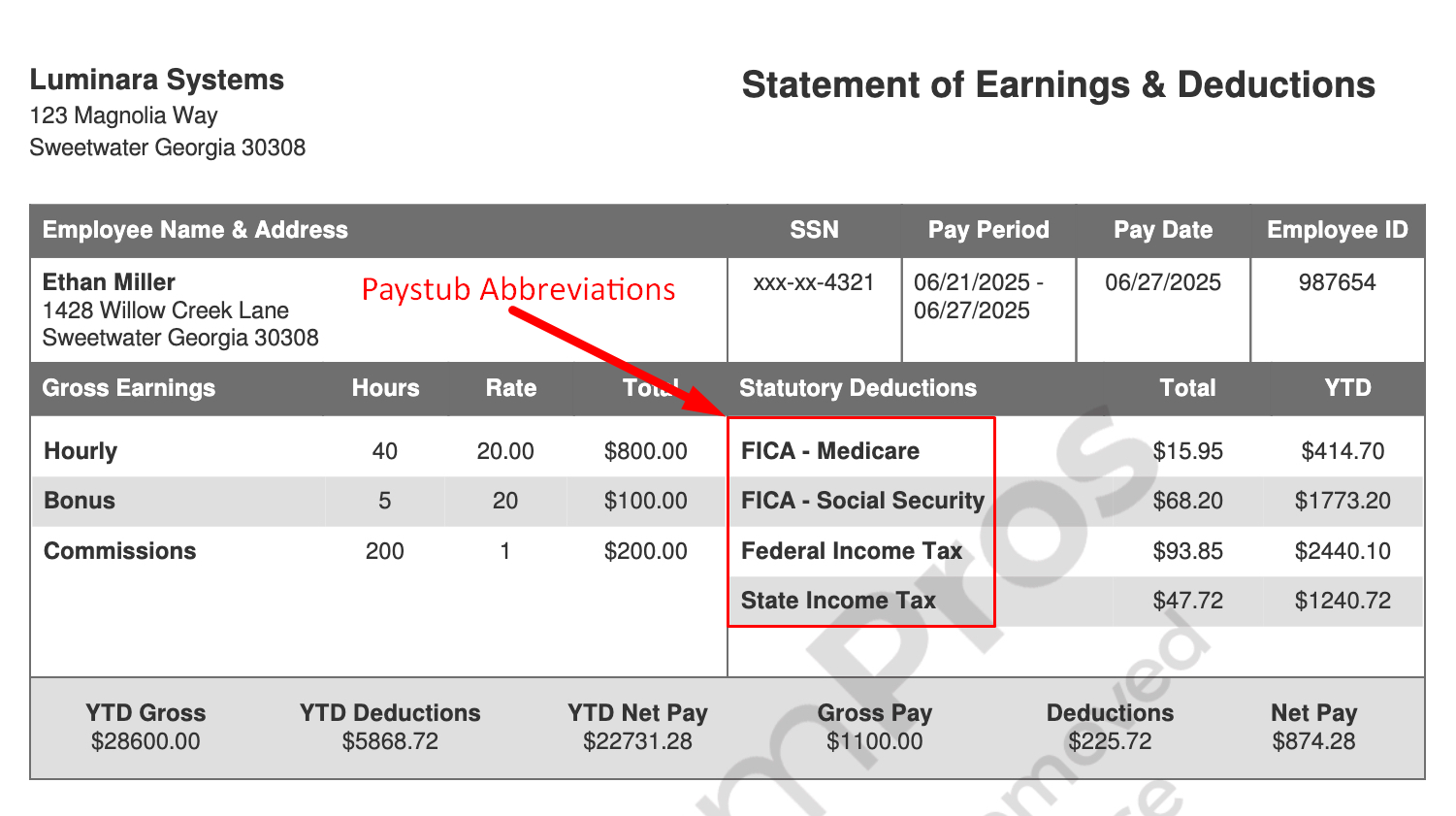

Confused by paystub abbreviations? This quick guide breaks down every code so you can read your paycheck with confidence.

If you’re self-employed, you can still prove your income. Here’s how to make accurate, legal paystubs that lenders will actually accept.

Learn the key differences between Forms 1099-NEC and 1099-MISC, who needs each one, and how to file them correctly before deadlines.

Fake paystubs are easier to spot than you think. Look for bad math, round numbers, and missing employer details.

Wondering if your employer has to give you a paystub? It depends on your state — here’s how to find out, what your rights are, and what to do if you can’t get one.

Worked more than 40 hours? Here’s how to calculate your overtime pay — plus a paystub calculator to double-check your earnings.

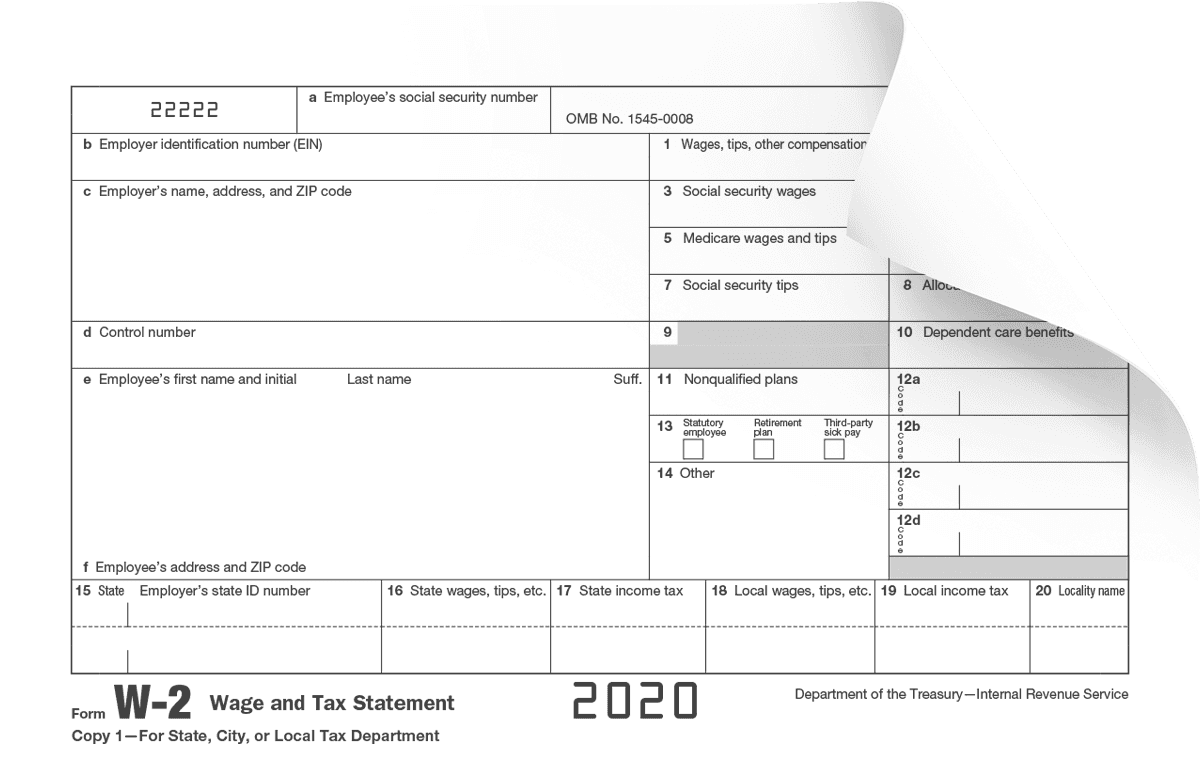

Sometimes — but it’s risky. You can technically file taxes using your final paystub, but it’s not recommended. The IRS prefers an official W2, and filing without one can cause delays, errors, or even rejections. When It’s Possible You may be able to file taxes with your last paystub if your employer hasn’t sent your […]

Confused by the boxes on your W-2? This quick guide breaks down Boxes 1–14 so you know exactly what each one means and why it matters.

W-4 vs W-2 — one you fill out, one you receive. Learn how these two essential tax forms work together and what they mean for your paycheck.