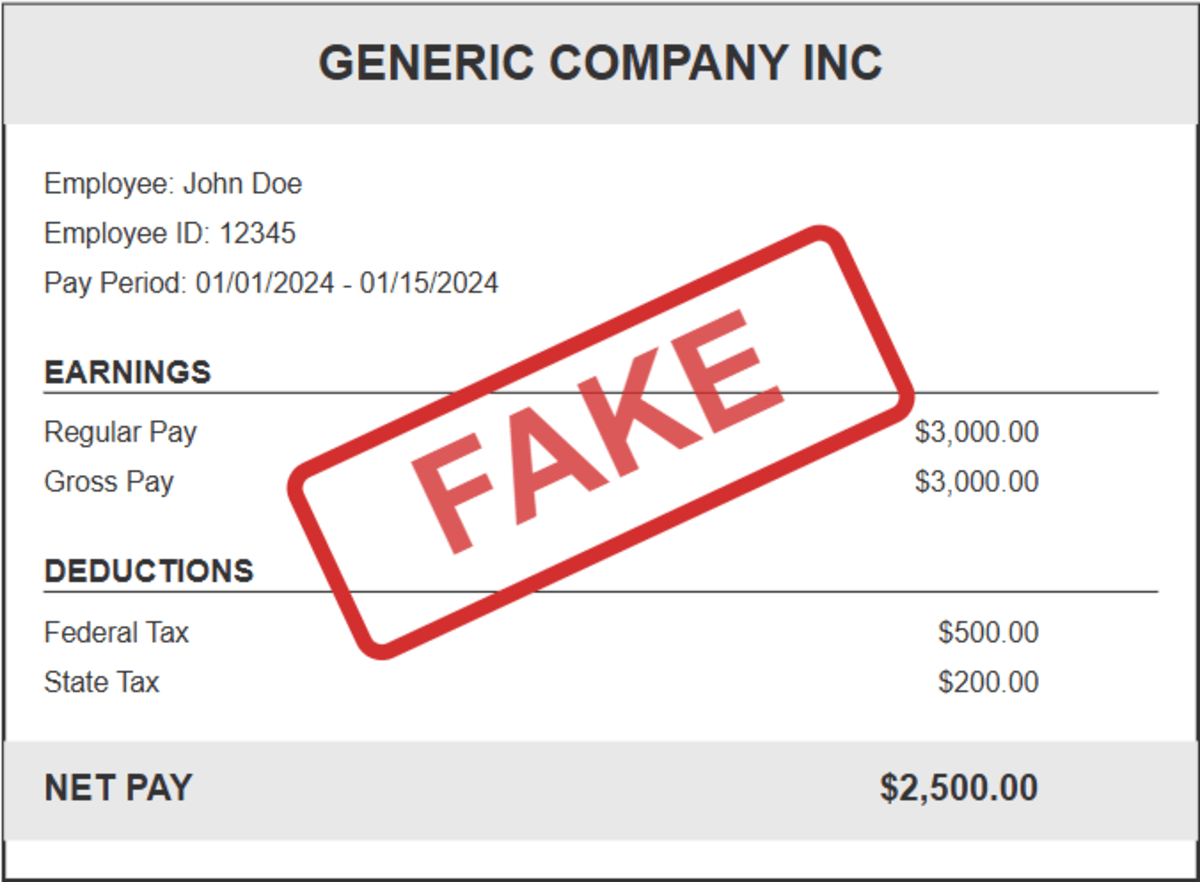

How to Tell If a Paystub is Fake

Most forgeries are easier to spot than you think. Look for inconsistent fonts, missing employer details, odd deductions, or math that doesn’t add up. You can spot fake paystubs in under 60 seconds if you know what to look for.

Table of Contents

10 Red Flags That Scream “Fake”

Even a convincing fake leaves clues. Here’s how to spot fake paystubs:

1) The Math Doesn’t Work

Deductions should equal gross pay minus net pay. Fake stubs often show random numbers that don’t calculate correctly. Grab a calculator and verify the totals.

2) Perfect Round Numbers Everywhere

Real paystubs show cents: $2,847.63, not $2,850.00. If every line item ends in .00, someone probably made it up.

3) Missing or Generic Employer Info

Legitimate stubs include full company names, addresses, and phone numbers. “ABC Company” with no location is a massive tell.

4) Year-to-Date Figures Are Off

YTD totals should match the pay period. If someone claims it’s their 10th paycheck but YTD gross is way too high or low, the numbers were invented.

5) Fonts Look Inconsistent

Real payroll software uses standard fonts throughout. Mixed typefaces or alignment issues suggest someone built it in Word.

6) No Company Logo or Watermark

Most corporate paystubs include branding. A plain document with zero security features is easier to fake.

7) Pay Period Dates Don’t Align

Companies pay weekly, bi-weekly, or monthly on set schedules. Random dates that don’t follow a pattern? Red flag.

8) Tax Withholdings Seem Wrong

Federal, state, and FICA deductions follow formulas. If someone earning $50K has $20 in federal tax withheld per check, the math is broken.

9) Employee Information Has Errors

Misspelled names, wrong Social Security number formats (like 9 digits with no dashes), or missing employee IDs suggest someone filled out a template carelessly.

10) They Can’t Provide Multiple Stubs

Real employees have months of pay history. If someone only has one or two stubs and can’t produce more, dig deeper.

*Pro tip: Real paystubs are generated by verified payroll software. Fakes are usually cobbled together with templates or “edit PDF” tools.*

What Lenders and Landlords Actually Check

They’re not just glancing at the paper. Here’s their process:

They call the employer directly. Most verification services contact HR to confirm employment and salary. Fake company names fall apart here.

They request bank statements. Deposits should match paystub amounts. If the bank account shows different numbers, the pay stub is likely forged.

They use third-party verification. Services like The Work Number pull payroll data directly from employers. There’s no way to fake that.

They look for patterns. Someone making $100K shouldn’t be applying for a $400/month apartment. Income inconsistencies trigger deeper investigation.

Why People Fake Paystubs (and Why It Backfires)

Desperation drives most forgeries. Someone needs an apartment, a car loan, or wants to qualify for credit they can’t afford.

The problem? It’s illegal, and it’s getting easier to spot fake paystubs with modern verification tools. Using fake paystubs is fraud, punishable by fines and jail time. Even if you get approved initially, lenders can reverse the loan and demand immediate repayment when they discover the deception.

You’ll also wreck your credit, face eviction, or lose the car you financed. Short-term gain, long-term disaster.

What To Do If You Need Legitimate Income Proof

If you’re self-employed, a gig worker, or paid in cash and you need proof of income, you have legal options:

- Profit and loss statements show business income

- 1099 forms verify contractor payments

- Bank statements demonstrate consistent deposits

- Tax returns prove annual earnings

- CPA letters can document income for non-traditional earners

Lenders increasingly accept alternative documentation. Being upfront about your situation works better than faking numbers.

Create Legitimate Paystubs for Your Records

Need a legitimate paystub for record-keeping or independent contractor work? Use our trusted paystub generator that creates accurate, verifiable documents for lawful purposes only.

FAQs

-

Can employers tell if a paystub is fake?

Yes, easily. They compare it against their own payroll records or call the listed company. Most fakes fall apart within one phone call.

-

What happens if I submit a fake paystub to a landlord?

You'll likely be rejected once they verify employment. If you're already living there and they discover it later, expect eviction and potential legal action.

-

Are online paystub generators illegal?

The generators themselves aren't illegal. Using them to commit fraud, like lying about income to get a loan, is a crime.

-

How do lenders verify paystubs?

They contact your employer, request bank statements, or use third-party services that access payroll databases directly. Fakes rarely survive this process.

-

What if I genuinely lost my paystubs?

Contact your employer's HR or payroll department. They can reissue legitimate copies. Most companies keep records for years. If that doesn't work, use FormPros to generate accurate records for self-employed or contractor income.