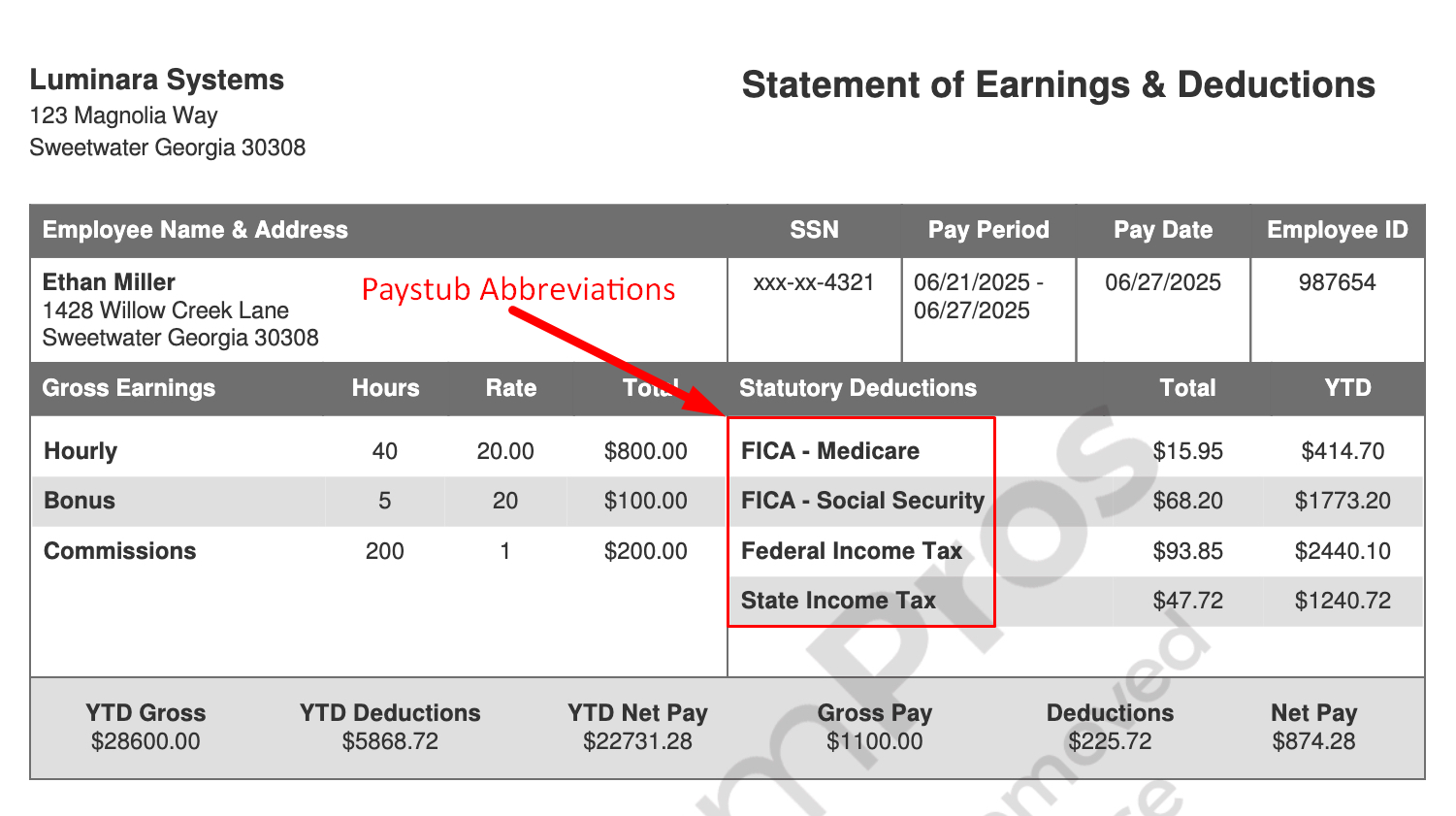

Paystub Abbreviations Explained (YTD, OASDI, MED, and More)

Paystubs are full of codes but they’re simple once you know them. Each abbreviation shows what’s earned, what’s withheld, and what’s paid out.

Table of Contents

What Those Paystub Codes Mean

Here’s a plain-English glossary you can scan fast:

- YTD (Year to Date): Total earnings or deductions since January 1st.

- OASDI: “Old Age, Survivors, and Disability Insurance”, also known as your Social Security tax.

- MED (Medicare): Federal health insurance tax.

- FIT / Fed Tax: Federal income tax withheld.

- SIT: State income tax withheld.

- SSN: Your Social Security number (usually masked).

- NET PAY: What actually hits your bank account.

- GROSS PAY: Total before taxes and deductions.

- 401(k): Retirement contribution.

💡 Tip: If you see an abbreviation you don’t recognize, it’s usually tied to a benefit or tax deduction. Check out our definitive abbreviation guide if you see a code you don’t understand.

Make Paystubs Simple

Understanding paystub abbreviations is great, but creating one that displays them correctly is even better. With FormPros, you can generate a professional paystub in minutes. Every abbreviation (YTD, OASDI, MED, and more) is automatically calculated and formatted accurately; no guesswork, no spreadsheets.

✅ 100% compliant with state and federal requirements

✅ Instant download and easy to edit

✅ Perfect for employers, freelancers, and contractors

FAQs

-

What does OASDI mean on my paycheck?

It’s your Social Security contribution. The current rate is 6.2% of wages, matched by your employer.

-

What is YTD on a paystub?

“Year to Date” totals everything you’ve earned or paid so far this year.

-

Why are there so many abbreviations?

They’re standardized payroll codes. Employers and tax agencies use short forms for space and consistency.

-

How do I read my paystub?

Start with gross pay, then look at taxes and deductions. The final line — “Net Pay” — is what you take home.

-

What’s the difference between OASDI and MED?

OASDI is for Social Security; MED is for Medicare. Both are federal programs.