Need to set up direct deposit or automatic payments? A voided check lets you share your bank details safely and accurately. Learn what a voided check is, how to make one, and the easiest ways to set up direct deposit without using paper checks.

What Does “Voided Check” Mean?

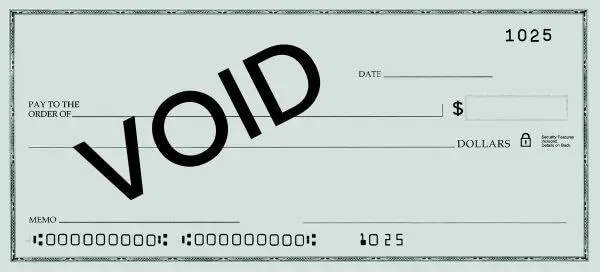

Write the word “VOID” across the front of a regular check to create a voided check. Writing “VOID” makes the check unusable for payment, but it still shows your bank routing number and account number.

These numbers tell your employer or service provider where to send or withdraw funds. You can use a voided check to set up:

- Direct deposit for payroll or government benefits

- Automatic bill payments

- Loan or mortgage payments

📘 Example: If your employer needs your banking details for payroll, a voided check ensures they have accurate account information without risking unauthorized withdrawals.

How to Void a Check (Step-by-Step)

Follow these quick steps to create a voided check correctly:

1) Get a blank check from your checkbook.

2) Use a blue or black pen. Avoid pencils or markers that can smudge.

3) Write “VOID” clearly across the front of the check; large enough to cover the payee and amount lines, but not blocking your account numbers.

4) Do not sign the check.

5) Store or send it securely — only share with trusted organizations such as your employer or bank.

If you’ve followed the steps above, your check should look like the example below: clearly marked “VOID” across the front, with your account details still visible at the bottom.

Common Reasons You Need a Voided Check

You’ll usually need a voided check when setting up direct deposit for paychecks or tax refunds, or when signing up for automatic bill pay on things like rent, loans, or utilities. You can also use a voided check to authorize ACH (Automated Clearing House) payments and verify your account for benefits or reimbursements.

How to Set Up Direct Deposit Without a Check

Don’t have a checkbook? You can still set up direct deposit easily. Most banks and employers now accept digital forms.

- Log in to your online banking account.

- Look for a tab like “Account Details” or “Direct Deposit Info.”

- Download a direct deposit authorization form.

- Many banks (like Chase, Wells Fargo, or Bank of America) provide a printable form with your routing and account numbers pre-filled.

- Share the form securely.

- Upload through your employer’s HR portal or email it through a secure channel.

- Confirm your first deposit.

- Check your account after your first payroll to confirm you entered the information correctly.

Digital Alternatives to a Voided Check

If you don’t have paper checks, here are safe digital substitutes:

Bank letter verification: Request a letter confirming your routing and account numbers.

→ This works because your bank issues it directly and confirms your account details officially.

Direct deposit authorization form: Many employers provide their own.

→ These forms collect the same information as a voided check and are designed to verify your payment details securely.

Use FormPros tools: Create professional payroll or tax forms online, such as paystubs or W9s.

→ These forms help confirm income and employer details, which some organizations accept when verifying direct deposit or tax information.

Create Financial Forms the Right Way

If you’re nervous about voiding a check yourself or worried about making a mistake, FormPros can help. Our easy-to-use tools let you create accurate, professional financial documents in minutes; no guesswork, no risk of errors. Whether you need to verify payment details, prepare paystubs, or generate a properly voided check, FormPros gives you the confidence that everything is done correctly and securely.

Voided Check FAQs

-

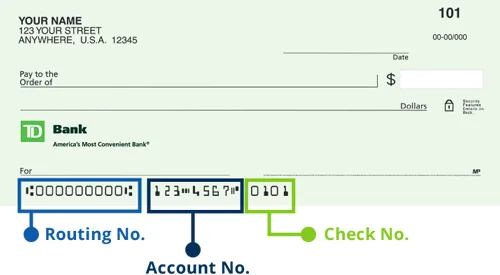

Where can I find my bank routing number and account number?

The routing number, a nine-digit sequence, can be found in the lower-left corner of your check. The account number is the set of numbers, located just to the right of the routing number. The shorter set of numbers on the far right side represents your check number. If you don't have access to a physical check, you should be able to retrieve this information by logging in to your bank's website and selecting your account.

-

What are the risks of nullified payment slips?

The main risk involves the exposure of your banking details. Always ensure you are giving the voided check to a reputable and trustworthy entity. Avoid sharing it publicly or online.

-

Can I reuse a voided check for multiple setups?

Yes, the same voided check can be used to set up multiple direct deposits or automatic payments, as the account and routing numbers don't change.

-

What should I do with a voided check?

Keep a record of it in your check register and store the voided check securely until you've confirmed that the direct deposit or automatic payment setup is successful. Then, it can be shredded.

-

Can I void a check after sending It?

Once a check is sent, you cannot void it. If you need to stop a check you've already sent, you will have to contact your bank to issue a stop payment order, which may come with a fee.

-

Is it safe to give a nullified payment slip?

Yes, it is generally safe as it can't be used to withdraw money. However, it does contain sensitive information, so ensure you're providing it to a trusted party.

-

What if I don't have checks?

If you don't have checks, you can ask your bank for a "pre-printed" invalid bank draft, a letter with your account information, or use an alternative method like a bank deposit slip with the account information handwritten on it. As a great alternative you can utilize the formpros.com voided check generator which allows you to easily create a invalid bank draft online.

-

How do I void a check?

Write "VOID" in large letters across the front of the check. Ensure it's readable but doesn't cover the account and routing numbers. It's also a good practice to record the voided check in your check register.

-

Can I provide a digital copy of a voided check?

It depends on the company's policy. Some may accept a digital copy, while others might require a physical check. It's best to ask the specific company for their requirements.

-

Is it safe to email a nullified payment slip?

While emailing a invalid bank draft is common, it's important to ensure the email is sent securely due to the sensitive information on the check. Use encrypted email if possible.

-

What should I avoid when voiding a check?

Answer: Avoid obscuring the account and routing numbers. Also, don't use a check that has any other writing or signatures on it, other than the word "VOID".

-

What to do if a nullified payment slip is misused?

If you suspect misuse of a nullified payment slip, contact your bank immediately to take appropriate action, which might include monitoring your account for fraudulent activity or closing the account.

-

Can I use a voided check for proof of bank account ownership?

Yes, a invalid bank draft is often used as proof of account ownership since it displays your name, account number, and bank routing number.

-

What alternatives can I use if I can't provide a invalid bank draft?

Alternatives include a bank deposit slip with your account information, a bank statement, or a direct deposit authorization form provided by your bank.