How to Void a Blank Check to Set Up Direct Deposit

What is a Voided Check?

In today’s fast-moving world, managing finances efficiently matters more than ever. Whether you receive a paycheck, government benefits, or other income, direct deposit offers a secure and hassle-free way to get paid. By transferring funds directly into your checking account, it eliminates delays and reduces the risk of lost or stolen checks. However, many people overlook that setting up direct deposit often requires a voided check—a crucial step to ensure accurate and secure payments.

Even with electronic and automatic payments on the rise, banks and credit unions still require a voided check for verification. This may seem outdated, but it helps prevent errors and ensures funds reach the correct account.

In this guide, we’ll explain why voided checks remain essential, how they simplify direct deposit setup, and how our innovative tool streamlines the process. Let’s explore how to make setting up direct deposit easier and more secure.

Understanding Direct Deposit

Direct deposit offers a secure and efficient way to receive payments. It transfers funds directly into your checking account, eliminating the need for physical checks. Over time, it has become the preferred method for salaries, tax refunds, and government benefits. It provides a faster, safer, and more reliable alternative to paper checks.

One major advantage of direct deposit is convenience. It removes the hassle of manually depositing checks and waiting for them to clear. It also reduces the risk of lost or stolen checks. Employers and other payers benefit too, as it streamlines payroll and cuts administrative costs.

To set up direct deposit, you must complete an authorization form with your bank’s routing and account numbers. This ensures payments process accurately and without delays. However, most banks require a voided check for direct deposit—a step that may seem outdated but serves an important purpose. Let’s explore why voided checks remain necessary and how to simplify this step.

Why a Voided Check is Essential for Direct Deposit

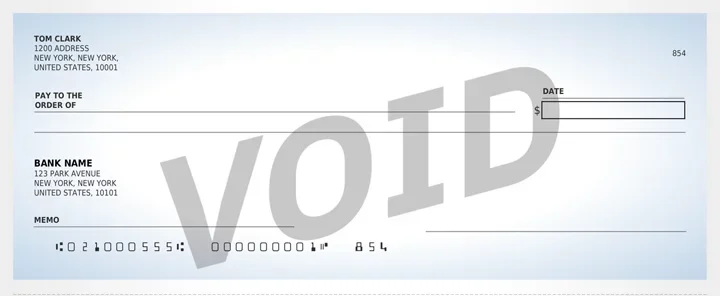

When setting up direct deposit, your employer or payee needs accurate account details to ensure funds go to the right place. This is where a void check for direct deposit becomes essential. A voided check is simply a blank check with “VOID” written across it. While it can’t be used for withdrawals, it still provides the necessary banking details.

A voided check contains key information—your routing number, account number, and sometimes the payee line. This helps create a direct link between your bank and the payer’s financial institution. It also eliminates the risk of errors from manually entering account details, where numbers can be misheard or miswritten.

Beyond accuracy, a voided check enhances security. Instead of verbally or manually sharing sensitive banking details, it ensures your information is transmitted safely. This reduces the risk of fraud or misdirected payments. Ultimately, it’s a simple but effective way to streamline direct deposit setup while protecting your financial information.

Step-by-Step Guide to Voiding a Blank Check

Voiding a check is a simple yet important task. Here’s how to write a void check for direct deposit properly:

1) Choose the Right Check: Take a counter check or a blank check from your checkbook, ensuring it’s one that hasn’t been used before.

2) Write ‘VOID’ Clearly: Use a bold blue or black pen or marker to write ‘VOID’ across the front of the check. This should be done in large letters but be careful not to obscure the routing and account numbers at the bottom.

3) Avoid Signing: Do not sign the check on the signature line, as this could lead to misuse if it falls into the wrong hands.

4) Keep a Record: Note the check number for your records. This helps in tracking and is a good practice in managing your checking account.

5) Do Not Cover Essential Information: When voiding the check, ensure that key details like the routing and account numbers are visible. These are crucial for setting up direct deposit.

6) Consider a Digital Copy: If you’re required to submit the void check electronically, or for future use, take a clear photocopy or digital image of the voided check example for direct deposit.

Voiding a check is typically straightforward, but it’s essential to avoid common mistakes, like obscuring important information or forgetting to write ‘VOID’ in a way that clearly indicates the check should not be used for a financial transaction.

How to void a check for direct deposit without a physical check?

If you don’t have a physical check, you might be wondering how to void a check for direct deposit without one. Some banks allow you to generate a digital voided check through their online banking platforms. Alternatively, services like FormPros offer a quick and easy way to generate a legally valid voided check for direct deposit without requiring a paper checkbook.

Generate Your Voided Check Instantly

Setting up direct deposit doesn’t have to be complicated. With FormPros, you can quickly generate a professional voided check in minutes—no need to track down a physical check or worry about errors. Our secure and easy-to-use tool ensures your banking details are accurately formatted and ready for submission. Whether for payroll, government benefits, or other direct deposits, FormPros simplifies the process so you can get paid faster.

Don’t wait—create your voided check now and streamline your direct deposit setup!

FormPros Has You Covered

Simplify your paperwork with FormPros! From creating paystubs, W-2s, and 1099-NEC forms to generating LLC Operating Agreements and even acquiring a Registered Agent, our easy-to-use platform has you covered. Save time, reduce errors, and handle your business documents with confidence. Start now and see how FormPros makes professional form generation fast, affordable, and hassle-free!

Let FormPros Help!

- Legal Contracts

- Tax Forms

- PDF Editor

- Document Signing