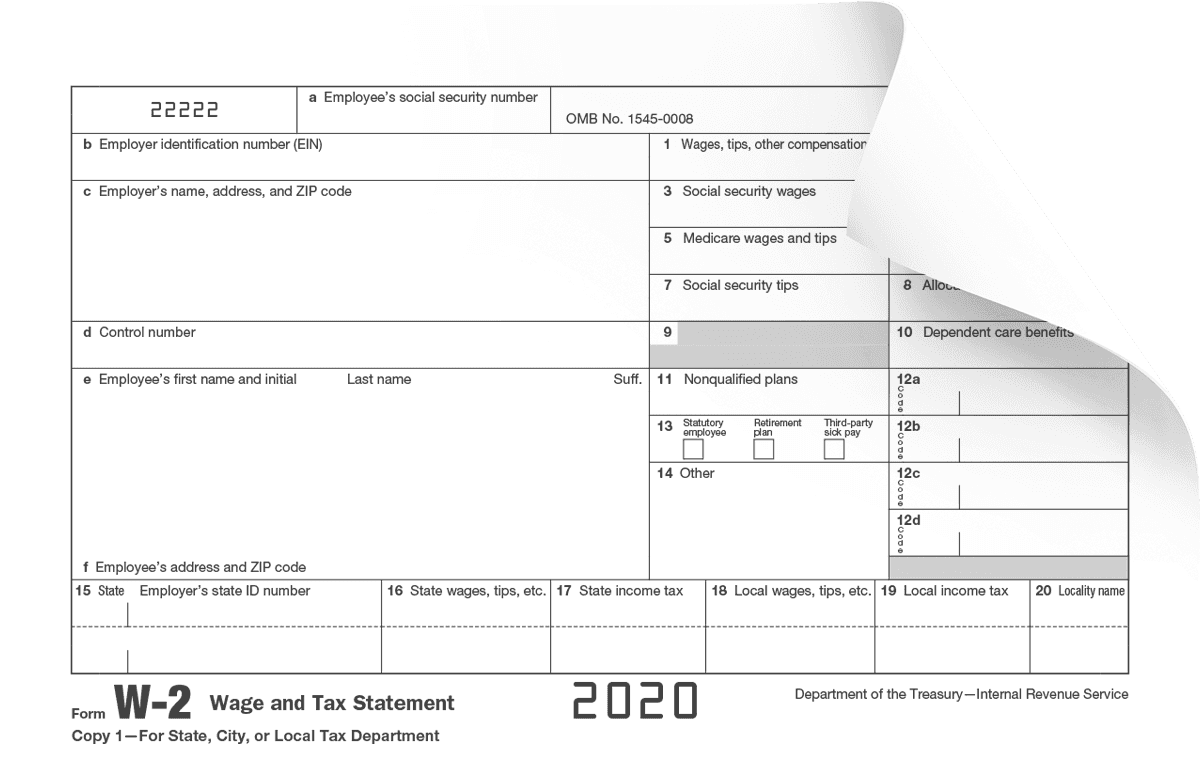

W-2 Boxes Explained: What Each One Means

Every box on your W-2 tells the IRS something specific about your income or taxes. It’s not random — and once you know what each one means, your tax form actually makes sense.

Table of Contents

Boxes 1-14 in Plain English

Don’t let the boxes scare you — each one tells part of your tax story. Here’s what they all mean:

Box 1: Wages, tips, other pay

👉 The total taxable income you earned.

Example: You made $50,000 — this number shows $50,000.

Box 2: Federal income tax withheld

👉 How much federal tax your employer already took out.

Example: $4,500 withheld = you’ve prepaid $4,500 in taxes.

Box 3: Social Security wages

👉 The income that’s subject to Social Security tax (often same as Box 1, sometimes not).

Example: If you contributed to a 401(k), this might be lower than Box 1.

Box 4: Social Security tax withheld

👉 What you paid toward Social Security — officially called OASDI (Old-Age, Survivors, and Disability Insurance) — at 6.2% of Box 3.

Example: $3,000 withheld on $48,000 of Social Security wages.

Box 5: Medicare wages and tips

👉 Income subject to Medicare tax — usually same as Box 1.

Example: $50,000 of income goes here.

Box 6: Medicare tax withheld

👉 What you paid toward Medicare (1.45% of Box 5). Together with Social Security (Boxes 3–4), this makes up your FICA taxes — short for the Federal Insurance Contributions Act.

Example: $725 withheld.

Box 7: Social Security tips

👉 Tips you reported to your employer that count for Social Security.

Example: $2,000 in tips = $2,000 here.

Box 8: Allocated tips

👉 Tips your employer assigned to you (often in restaurants).

Example: Employer added $500 here = report it on your return.

Box 9: (Blank)

👉 Used to have tax credits — now just ignore it.

Box 10: Dependent care benefits

👉 Employer-paid childcare help.

Example: $2,000 toward daycare through your job = $2,000 here.

Box 11: Nonqualified plans

👉 Money from certain retirement plans that aren’t standard 401(k)s.

Example: You got $1,200 from a deferred comp plan.

Box 12: Special codes

👉 Shows extra benefits like 401(k) contributions or adoption aid — each with a letter code.

Example: Code D = $3,000 into your 401(k).

Box 13: Checkboxes

👉 Indicates things like “Statutory Employee,” “Retirement Plan,” or “Third-Party Sick Pay.”

Box 14: Other

👉 Miscellaneous items your employer wants to note (e.g., union dues, state disability).

Example: “CA SDI $500.”

Make W-2s the Easy Way

Filling out a W-2 doesn’t have to be confusing. You can learn more in our comprehensive W2 guide, and when you’re ready you can create accurate, IRS-compliant W-2 forms in minutes — every box filled in correctly, automatically. It’s fast, simple, and ready to print or e-file today.

FAQs

-

Why are my Box 1 and Box 3 amounts different?

Because pre-tax deductions (like a 401(k)) lower Box 1 but not Box 3.

-

What do the codes in Box 12 mean?

Each letter = a benefit type. For example:

- D = 401(k)

- DD = health insurance cost

- W = HSA contributions

-

Do I need to fill these boxes myself?

No — your employer does. You just use the info for your tax return.

-

Why does Box 9 look empty?

It’s obsolete — no need to worry about it.

-

Where can I get a blank W-2 form?

You can generate one directly using the FormPros W2 generator.