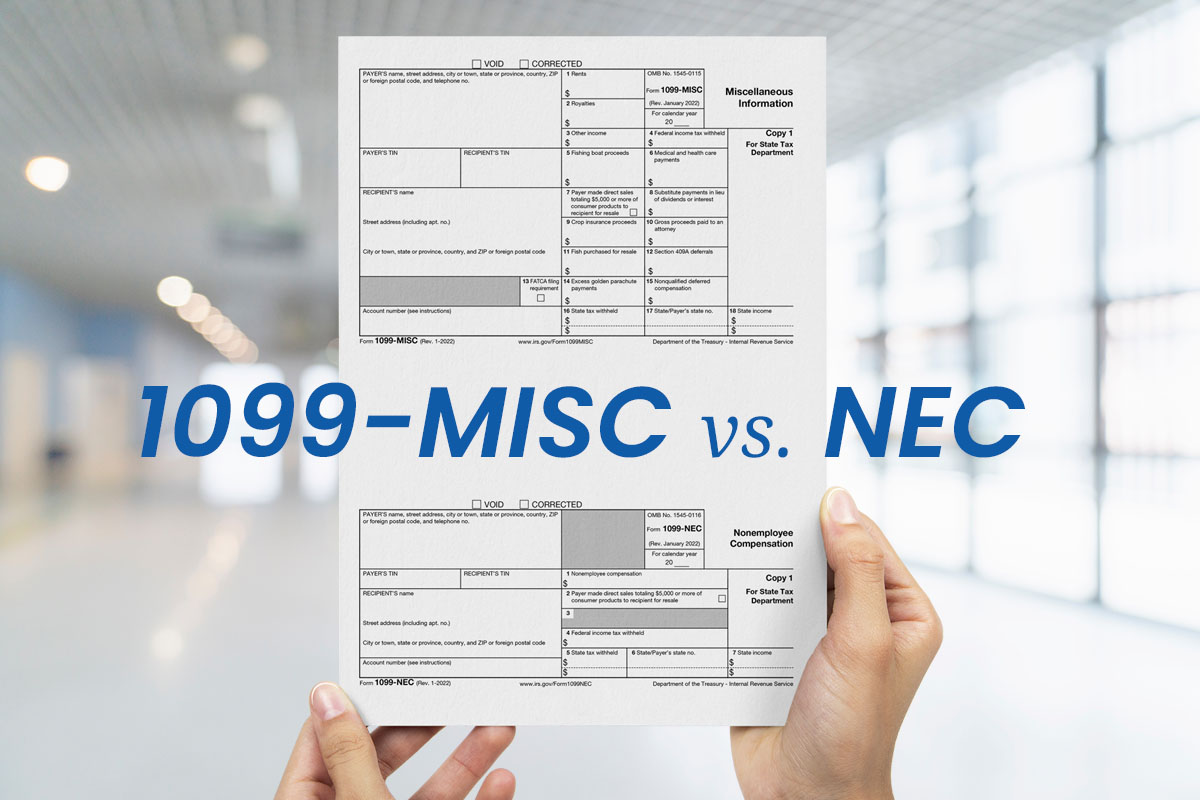

Form 1099-MISC vs 1099-NEC: What You Need To Know

Confused about 1099-NEC vs. 1099-MISC? Learn the key differences, when to use each form, and how to stay compliant when reporting contractor payments and business expenses.

Confused about 1099-NEC vs. 1099-MISC? Learn the key differences, when to use each form, and how to stay compliant when reporting contractor payments and business expenses.

Confused about what YTD means on your pay stub? Learn how to calculate it, what it includes, and why it’s essential for tracking income and deductions.

Wondering how long you should keep pay stubs? This guide breaks down the best retention practices, legal requirements, and expert recommendations to help you stay organized and prepared for tax season, loans, and disputes.

Discover the key differences between Form W-4 and Form W-9, who needs to fill them out, and how they impact tax withholdings for employees and contractors.

Decode the mysteries of your paycheck stub with our definitive guide! Learn how to understand common abbreviations, track your earnings, deductions, and YTD totals, and ensure your paychecks are accurate.

Get ahead of tax season with this complete guide to 2026 IRS filing deadlines. Learn key due dates, penalties, and how to avoid costly mistakes.

Managing payroll on your own can be challenging, but with the right tools and understanding, you can streamline the process, ensure accuracy, and stay compliant with tax laws.

Not sure what a pay stub should look like? This guide breaks down the key details every pay stub must include and how to read one with ease.

Paystubs are more than just pay summaries—they’re tools that build trust, ensure compliance, and help your business run smarter and smoother.

Independent contractors need accurate 1099 pay stubs for tax filing, proof of income, and payroll management. Learn how to create yours quickly and easily.