Don’t Use AI to Make Paystubs – A Safer Alternative

AI can draft emails, write code, and even compose resumes but generating paystubs is a different problem. Paystubs serve as legal and financial records that verify income, calculate taxes, and prove employment. When you rely on general-purpose AI or unreliable online “generators” to create them, you risk generating incorrect income figures, missing tax details, exposing sensitive data, and worst of all, facing accusations of producing fraudulent documents.

Table of Contents

What Goes Wrong When You Use AI For Paystubs

AI tools might seem like a quick fix, but when it comes to creating paystubs, speed often comes at the cost of accuracy and legality. From math mistakes to missing tax details and data security risks, AI-generated paystubs can cause serious problems and even raise red flags with employers or lenders.

1) Inaccurate calculations. AI models can hallucinate numbers or apply wrong tax/withholding logic. Small math errors in gross/net pay, taxes, or deductions break the document’s utility.

2) Missing legal elements. Paystubs need employer identification, correct tax line items, and consistent YTD (year-to-date) totals. Generic AI outputs often omit or format these incorrectly.

3) No verifiable audit trail. Lenders, landlords, and auditors may require evidence (payroll reports, employer confirmation). AI-created files typically lack metadata or export logs proving authenticity.

4) Security & privacy risks. Putting employee names, SSNs, or payroll data into a non-secure AI tool risks leakage and identity theft.

5) Potential fraud exposure. Intentionally creating or altering income documents can cross into illegal territory depending on intent and jurisdiction. If you’re unsure, consult a lawyer… but don’t assume AI generation is safe.

How to Tell if the AI Paystub is Fake

If someone offers you an “AI paystub” ask these questions first.

– Can the generator show where its numbers came from? (YTD figures, tax rates, payroll period calculations.)

– Is there an audit trail or export metadata? (Who created it and when?)

– Where does the service store my data, and does it follow basic privacy and security standards?

– Would my landlord/lender accept it? (Some institutions explicitly reject unverifiable documents.)

– Am I unintentionally making a falsified document? If unsure, get legal advice — do not guess.

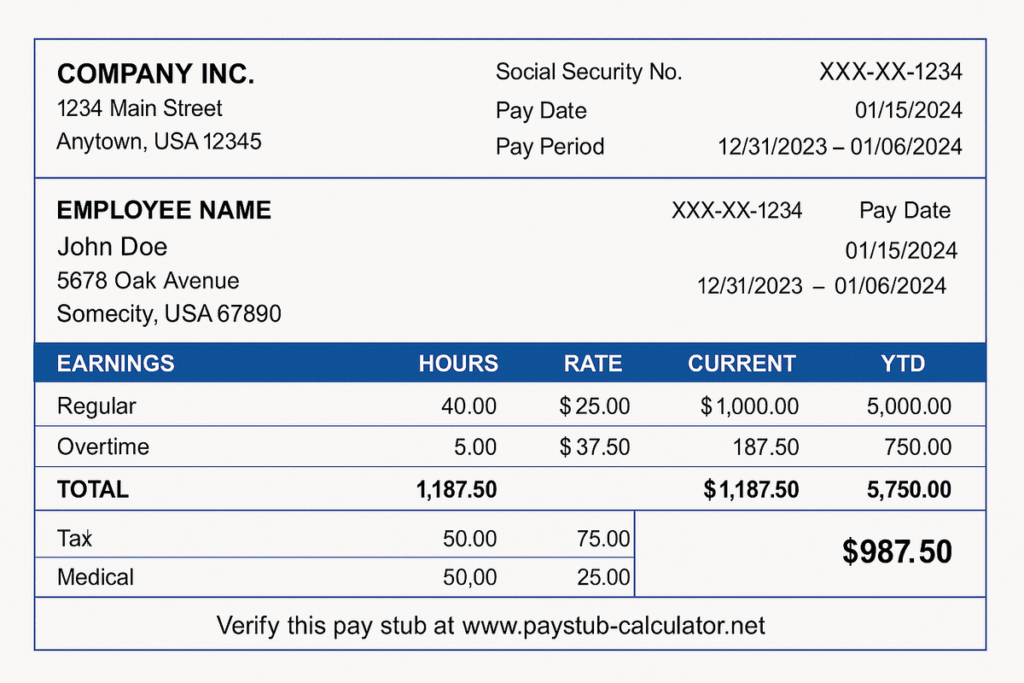

Example of an AI-Generated Paystub

AI created the image above, and it shows exactly why that’s a problem. It looks realistic at first glance, but it’s missing essential payroll information like employer identification numbers, accurate tax breakdowns, and proper year-to-date (YTD) calculations. Even small math errors or inconsistent formatting can make a paystub look suspicious to landlords, lenders, or HR departments. AI tools often guess numbers instead of calculating them, which means these documents are not reliable or compliant.

Example of a FormPros-Generated Paystub

By contrast, the FormPros paystub above is professionally generated using verified payroll logic. Every value, from overtime to deductions and net pay, is calculated accurately based on your inputs. It includes all the fields required for employment or verification purposes, formatted cleanly and clearly. That’s the difference between an AI imitation and a legitimate, audit-ready paystub built to meet real-world standards.

Why Fake or AI-Made Paystubs Raise Red Flags

It’s not just a theory, fraud tied to fake financial documents is rising fast. In 2024, rental-screening firm Snappt analyzed roughly five million application documents and found that 6.4% were fraudulent, often through digital edits or AI tools. The FTC reported a record $12.5 billion in consumer fraud losses that same year, showing why landlords and lenders are tightening verification. Regulators like FinCEN have also issued warnings about AI-generated “deepfake” paystubs and identity files being used to trick financial systems, making detection tools more sophisticated and the risks of using fake documents far higher.

A Real Risk: Fake Paystubs Can Trigger Criminal Charges

What feels like a shortcut can become a criminal case. If you knowingly use a falsified paystub (including one made by an AI) to obtain a loan, rent a home, get a car, or otherwise gain a financial benefit, you can be investigated for fraud, forgery, or related federal/state offenses. In serious cases lenders or prosecutors have pursued charges that lead to fines, restitution and even prison time for high-value or repeated schemes.

Real-World Example: You submit a fabricated paystub to a lender to qualify for a mortgage or car loan. If the lender’s verification flags the mismatch, they may refer the case to investigators. Prosecutors can then pursue charges such as bank fraud, forgery, or making false statements to a financial institution; offenses that carry heavy penalties under federal and state law.

Important Nuance: Intent matters…..Accidentally creating a mock or template paystub for learning or design is different from knowingly submitting a fake document to obtain credit or a rental. But if you “knew” the document was false and used it to deceive, you may face civil and criminal consequences. Laws and penalties vary by jurisdiction, so outcomes depend on the facts.

Bottom Line: Don’t gamble with AI-generated paystubs. The short-term convenience isn’t worth the potential legal exposure, financial penalties, ruined applications, and damage to your record. Use a trusted, compliant service like FormPros that produces accurate, verifiable paystubs, or get official payroll records from your employer, and consult an attorney if you’re unsure.

Why FormPros Is the Safer, Smarter Way to Create Paystubs

When it comes to paystubs, accuracy and credibility matter and that’s exactly what FormPros delivers. Unlike generic AI tools, FormPros is purpose-built for creating professional, compliant paystubs that meet employer, lender, and landlord expectations.

Every FormPros paystub includes essential details like employer information, pay periods, gross and net pay, tax withholdings, deductions, and year-to-date totals: all automatically calculated with built-in payroll logic to prevent costly math errors. You’ll receive a downloadable, consistent PDF that looks professional and retains verifiable metadata, making it easy to share and store securely.

Your personal data stays protected too. That means no risky copy-pasting into unverified AI systems. Plus, FormPros provides step-by-step guidance to ensure your paystubs accurately reflect your income and avoid verification issues.

FAQs

-

Is it illegal to use an AI-generated paystub?

Using an AI-generated paystub can be illegal if it’s used to misrepresent your income, employment, or tax information. Submitting a falsified document to a lender, landlord, or government agency may be considered fraud or forgery, which can lead to fines or criminal charges. If you need a legitimate paystub, use a compliant generator like FormPros, which produces accurate, verifiable documents.

-

How do lenders and landlords verify paystubs?

Most lenders and landlords verify paystubs by checking employer contact details, payroll consistency, and tax withholdings. They may also cross-reference information with bank deposits or IRS records. AI-generated paystubs often fail these checks because they lack proper formatting, metadata, or accurate employer data — making them easy to flag as fake.

-

Can AI-generated paystubs be detected?

Yes. Financial institutions use automated fraud-detection systems and manual verification to identify fake documents. Inconsistent tax amounts, incorrect formatting, or mismatched employer information are clear red flags. That’s why it’s best to use a trusted paystub generator like FormPros, which follows accurate payroll and tax logic.

-

What’s the difference between an AI paystub and a real paystub?

An AI paystub is often text-based or image-based output created by a general-purpose chatbot with no built-in payroll logic. A real paystub — like those made with FormPros — includes verified calculations for gross pay, deductions, and taxes, plus consistent formatting, employer details, and secure data handling. It’s compliant, verifiable, and ready for official use.

-

What should I do if I accidentally used an AI-generated paystub?

If you submitted an AI-generated paystub and realize it may be inaccurate or unverifiable, contact the recipient immediately (such as your lender or employer) and explain the situation. Provide legitimate documentation, like a paystub created with FormPros or an official employer record. Acting quickly helps avoid misunderstandings or legal exposure.

-

Can AI tools safely handle my personal payroll data?

Most general-purpose AI platforms aren’t designed for financial data security. Inputting personal details like SSNs, wages, or employer names into public AI tools can expose sensitive information. FormPros, on the other hand, uses secure data handling and doesn’t share or reuse your payroll information — keeping your privacy intact.

-

Why is FormPros a better choice than free AI paystub generators?

Free AI paystub generators may seem convenient but often produce inaccurate or noncompliant documents. FormPros provides legally sound, verifiable paystubs with accurate tax calculations, YTD tracking, and professional formatting accepted by employers, landlords, and lenders. It’s the reliable, secure alternative to risky AI shortcuts.

Don't Let AI Trip You Up

- Legal Contracts

- Tax Forms

- PDF Editor

- Document Signing