What Are Withholding Allowances?

When starting a new job, employees must complete a W-4 (Employee’s Withholding Certificate). This form helps employers determine how much federal income tax to withhold from each paycheck. Each state also has its own tax withholding form. Employers use it to calculate the appropriate deductions based on an employee’s withholding allowances. But exactly what does withholding allowance mean, and how does it affect take-home pay? Understanding withholding allowances is essential for both employers and employees, as they directly impact paycheck deductions and overall tax liability.

What are Withholding Allowances?

A withholding allowance is a tax exemption that reduces the amount of income tax deducted from an employee’s paycheck. But what is a withholding allowance, and why does it matter? Some other names include “tax withholding exemptions” and “payroll tax exemptions“. When starting a new job, employees claim withholding allowances on their W-4 form. Employers use this information to determine the correct amount of tax to withhold.

The relationship is straightforward: the more exemptions an employee claims, the less tax the employer withholds. This leads to a higher take-home pay. Conversely, claiming fewer allowances increases tax withholding, reducing take-home pay but potentially lowering the risk of owing taxes at year-end. This raises another important question: what does withholding allowances mean, and how does it differ from other tax deductions?

Who Can Have Income Tax Allowances?

Employees must have tax withheld if they meet all of the following criteria:

- Their annual income exceeds $1,050.

- Someone else can claim them as a dependent.

- They have more than $350 in unearned income (e.g., interest, dividends).

Single filers who aren’t dependents can earn up to $12,400 in gross income. They don’t have to pay federal income taxes until they exceed that amount.

Claiming Withholding Allowances –

Employees can claim as many tax withholding exemptions as applicable to their filing status. Factors influencing how many allowances they may claim include:

- Marital status (single, married)

- Spouse’s employment status (if married)

- Number of jobs held

- Whether wages from a second job are below $1,500

- Number of children or dependents

- Filing as head of household

For employees wondering what annual withholding allowance means, the answer depends on how many allowances they claim during the year. It also depends on how their tax situation changes over time.

Employer Withholding Obligations –

If an employee does not submit a W-4 form, the employer must withhold taxes at the highest rate. This assumes the employee is single with no exemptions. Employers must also understand the withholding allowance definition to ensure accurate payroll calculations.

Calculating Income Tax Allowances

The amount of federal income tax withheld from an employee’s paycheck depends on their income. It also depends on how many withholding allowances they claim. Many employees ask, what does withholding allowances mean in the context of paycheck deductions? Simply put, it determines how much tax the employer withholds each pay period. The IRS provides guidelines to help employees calculate the right number of allowances to claim. These guidelines help ensure they withhold the correct amount.

Employer Withholding Responsibilities

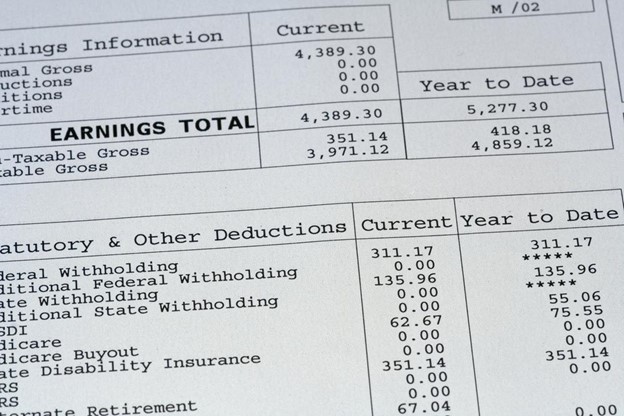

As an employer, the amount you withhold from each employee’s wages depends on:

- The employee’s income

- The number of withholding allowances they claim on their W-4

- The company’s payroll frequency (e.g., weekly, biweekly, monthly)

To determine the correct withholding amount, employers use IRS-provided tax tables. These tables outline how much federal income tax to deduct based on income, allowances, and pay frequency. For employees who ask, what is annual withholding allowance, it refers to the total tax the employer withholds throughout the year. That amount depends on how many allowances the employee claims.

Changing Withholding Allowances

An employee may change their income tax allowances at any time. This usually happens after a change in life circumstances, such as marriage, divorce, or having a child. To apply the changes, employees have to fill out a new W-4 form. It’s important to keep an accurate count of allowances. Misunderstanding the definition of a withholding allowance could lead to under or over-withholding taxes.

Withholding Allowances Facts

In 2020, the IRS introduced a revised Form W-4. It eliminated the use of income tax allowances to simplify the tax withholding process. However, many states continue to use withholding allowances to determine state income tax withholding.

Key Considerations:

1) Dependents and Withholding: Employees with children or other dependents should carefully complete the relevant sections of Form W-4. This helps ensure proper federal tax withholding.

2) State-Specific Requirements: Some states still use tax withholding exemptions. Employees should check with their state’s tax authority or employer to ensure they comply with state requirements.

3) IRS Tax Withholding Estimator: The IRS provides an online Tax Withholding Estimator to assist both employees and employers in determining the appropriate amount of federal tax to withhold.

4) Reviewing Withholding Amounts: Employees should check their withholding amounts at least once a year. They should also review them after any major financial changes. Adjusting withholding can help avoid unexpected tax bills or large refunds. These usually mean they paid too much tax during the year. By checking their withholdings, employees can ensure they understand what is annual withholding allowance and adjust their tax planning accordingly.

Employees who stay informed about both federal and state withholding requirements can ensure accurate tax withholding. This also helps prevent surprises during tax season.

Understanding Withholding Allowances

Understanding tax withholding exemptions can be challenging. Still, employees must claim the correct amount to ensure accurate tax withholding. Federal income tax withholding varies for each employee. Employers use the information on the W-4 form to calculate deductions and withhold the right amount.

FormPros simplifies this process with its user-friendly W-4 generator. It allows employers to quickly generate and print W-4 forms for their employees. Additionally, FormPros makes creating paystubs effortless, streamlining payroll management and saving both time and money. Employees who need help understanding withholding allowances meaning can use these tools to make informed tax decisions.

FormPros Has You Covered

Simplify your paperwork with FormPros! From creating paystubs, W-2s, and 1099-NEC forms to generating LLC Operating Agreements and even voided checks, our easy-to-use platform has you covered. Save time, reduce errors, and handle your business documents with confidence. Start now and see how FormPros makes professional form generation fast, affordable, and hassle-free!

What Are Withholding Allowances? FAQs

-

How often can I update my W-4 form during the year?

You can update your W-4 form as often as necessary throughout the year. It's a good idea to submit a new form whenever you experience a major life change—such as marriage, a new job, or having a child—that could affect your tax situation.

-

What happens if I claim too many withholding allowances?

If you claim too many allowances, less tax is withheld from your paycheck. While this increases your take-home pay, it may result in a tax bill when you file your return, and possibly penalties if you underpay by too much during the year.

-

Do freelancers and independent contractors use withholding allowances?

No, freelancers and independent contractors don’t typically use withholding allowances because taxes aren’t withheld from their income. Instead, they make estimated quarterly tax payments directly to the IRS using Form 1040-ES.

-

Can I claim zero allowances and still get a refund?

Yes, claiming zero allowances results in more tax being withheld from your paycheck. This could lead to a refund at tax time if too much was withheld, but it also means smaller paychecks throughout the year.

-

Is there a penalty for not submitting a W-4 to my employer?

Yes. If you don’t submit a W-4 form, your employer is required to withhold taxes as if you’re single with no allowances—usually the highest withholding rate. This could mean more taxes taken from each paycheck than necessary.

We Can Help You!

- Create W-4 Instantly

- Saves time and headaches

- Preview and share easily

- Easy to follow steps