How To File For Taxes As A 1099 Worker

Millions of people work as freelancers or independent contractors. If that definition applies to you, you’ll file taxes as a 1099 worker. The process of filing your personal tax return is different from the steps needed to file as an employee.

This article defines independent contractors, explains Form 1099-NEC, and provides the steps you need to file your tax return.

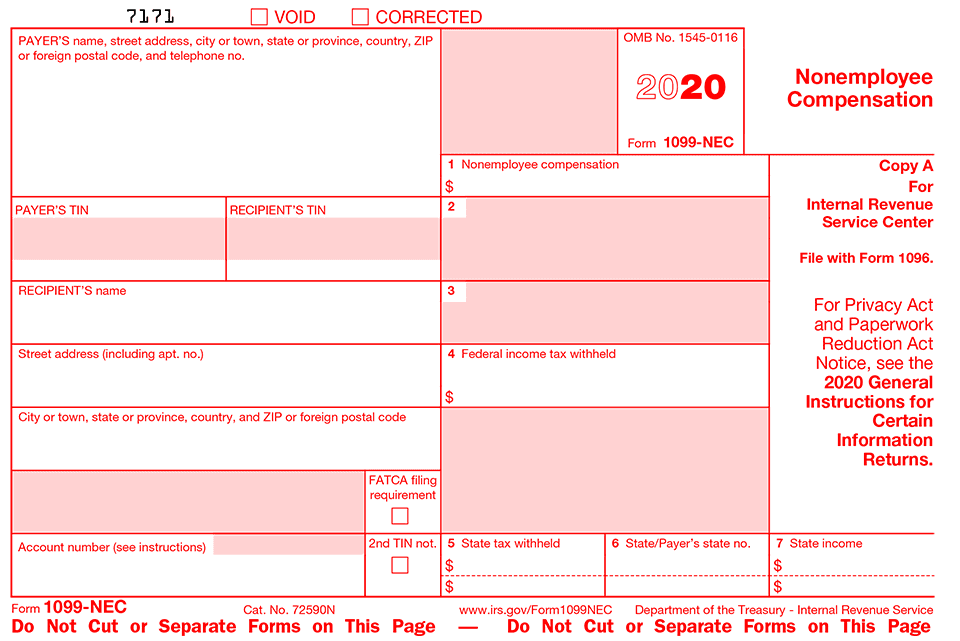

Form 1099-NEC

Companies use Form 1099-NEC to report income earned by people who work as independent contractors, rather than employees.

The IRS requires businesses to mail a copy of Form 1099-NEC to the independent contractor, so the contractor can include the income in his or her tax calculation. The IRS also receives a copy of the 1099-NEC, and uses it to estimate how much tax revenue to expect from self-employed individuals.

Businesses use the IRS guidelines to determine if a particular worker is an independent contractor or an employee.

Independent Contractors vs. Employees

The IRS distinguishes independent contractors from employees by using three criteria:

- Behavioral control: Does the company have a right to control what the worker does and how they perform the job?

- Financial control: Does the company have a say in the material aspects of a worker’s job? In other words, does the business decide which expenses are reimbursed, or who provides the necessary tools and supplies?

- Contractual Relationship: Is there a written contract? Are benefits, such as pension, insurance, and vacation days, part of the contractual obligation?

When these three criteria are met, the IRS considers the worker to be an employee of the company, and the firm is responsible for filling out a W-2 and paying a share of the FICA taxes. If any of these criteria are not met, the worker is an independent contractor who is responsible for paying their own taxes, including income tax and FICA tax.

Not all independent contractors receive a 1099-NEC, however.

1099-NEC Income Threshold

If a business pays you less than $600, you will not receive a 1099-NEC form. Keep in mind that you still have to include the income on your tax return. Review your checkbook and online payment systems, such as PayPal, to confirm the total amount of income received from all of your customers.

The 1099-NEC contains several lines of important data. Here’s the form:

The 1099-NEC form includes:

- Recipient Data: Your name, address and taxpayer ID number

- Payer (Company) Data: The name, address and taxpayer ID number of the company or individual issuing the form

- Nonemployee Compensation (Box 1): The amount of income paid to you during the year.

- Tax Withholdings (Boxes 4 and 5): The amount of federal or state income tax withheld on that income, if any. In most cases, no taxes are withheld.

The information on each 1099-NEC is included on your personal tax return. Most independent contractors use Schedule C to report business income and expenses.

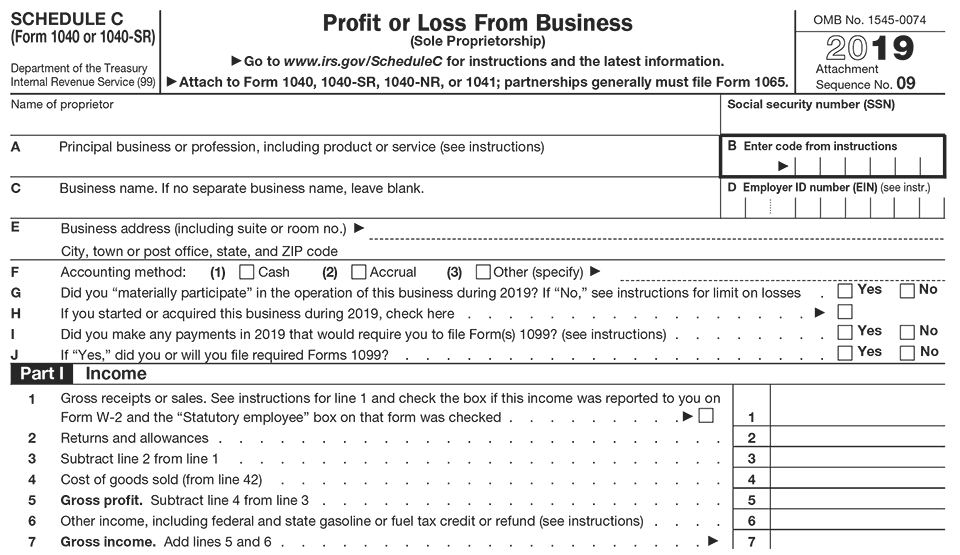

Schedule C

Schedule C is used to record profit and loss from a business, and the schedule’s information is added to other income on the personal tax return (Form 1040). Here is the top portion of Schedule C:

On Part 1, line 1, the independent contractor posts the amounts paid on each 1099-NEC received from customers. You’ll also include other customer payments that totaled less than $600. All client payments are posted to Part 1, line 1.

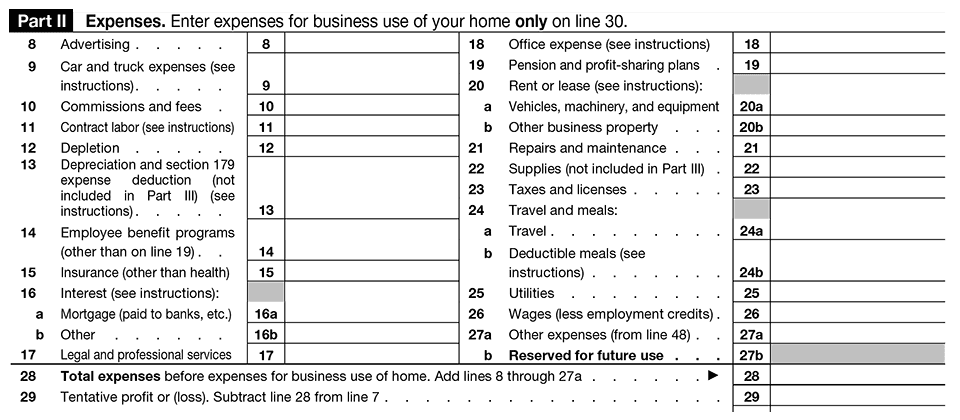

Independent contractors post expenses in Part 2 of Schedule C, and calculate the profit and loss on line 28:

The Schedule C profit is added to other sources of income on Form 1040, your personal tax return. If you file a joint return with your spouse, for example, the spouse’s W-2 employee income is added to your independent contractor profit.

As mentioned above, independent contractors pay their own income taxes, and must calculate and pay FICA taxes for Medicare and Social Security. Work with a tax accountant to plan for and pay these taxes.

How FormPros Can Help

FormPros offers expertly customized business and tax forms. Our intuitive forms that ask the right questions, so you can quickly generate documents at a fraction of the cost of hiring a lawyer.

Your business can generate 1099-NEC documents, Form W-2, and W-9 forms using FormPros. The process is quick and painless, and you’ll have more time available to grow your business.