How to File Taxes as a 1099 Worker: What You Need to Know

As a 1099 worker, managing your taxes can feel overwhelming, but understanding the basics can help you stay on track. Unlike W-2 employees, 1099 workers operate as independent contractors and must report their own income. Filing as a 1099 worker takes extra effort, but you can keep it simple.

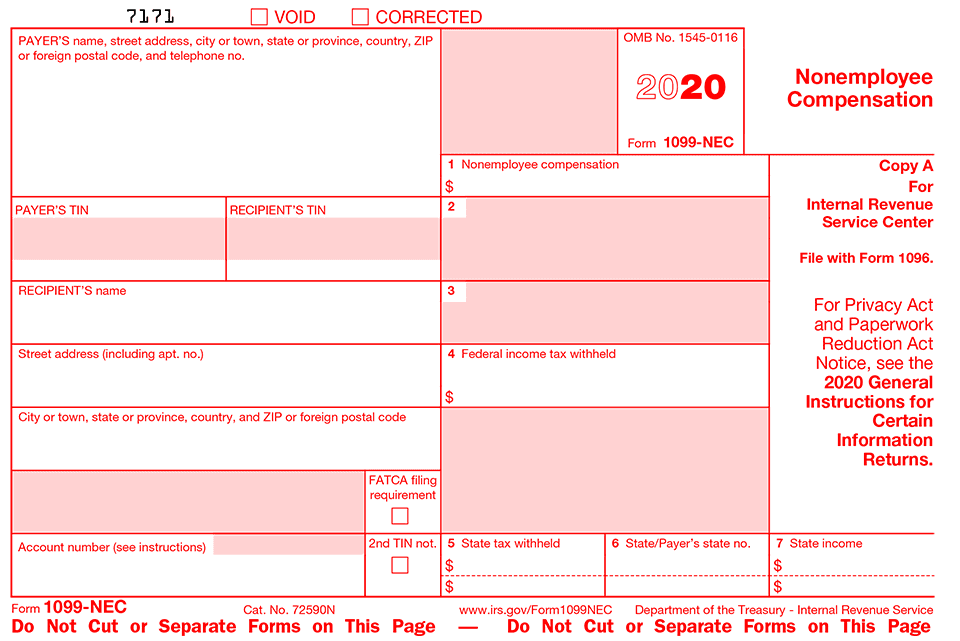

In this guide, we’ll walk you through the essential steps to file your taxes as a 1099 worker, including how to use Form 1099-NEC. With the right tools and knowledge, like those available at FormPros, you can easily complete and file your tax forms with confidence.

Table of Contents

Understanding Form 1099-NEC:

Businesses use Form 1099-NEC to report payments to independent contractors. If you’re a 1099 worker, this form is crucial for reporting the income you earned throughout the year.

The form typically reports payments of $600 or more from a client or business. Use 1099-NEC to report nonemployee compensation—income from freelance work, consulting, or gig jobs. Use 1099-MISC for other income, like rents or royalties.

By January 31st, businesses must send you a 1099-NEC for the prior year. If one doesn’t arrive, report the income anyway and keep your own payment records.

Filing Your Taxes:

Filing your taxes as a 1099 worker may seem complicated, but breaking it down into steps can make it manageable. To start, you’ll need to gather your 1099-NEC form(s) and any other income documentation, such as paystubs. Once you have your forms, follow these steps:

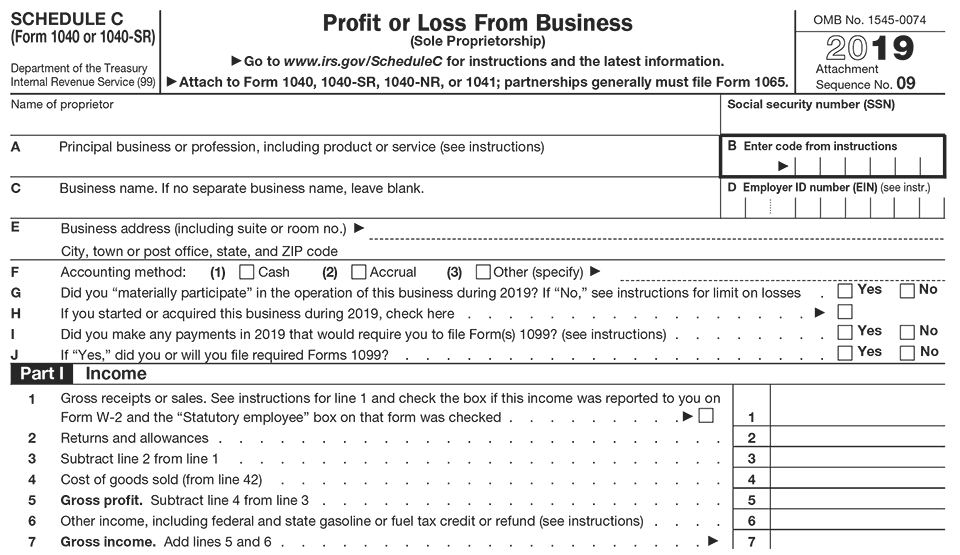

- Report Your Income: On your tax return, use the information from your 1099-NEC to report your total earnings. You’ll include this on Schedule C (Profit or Loss from Business), seen above, as part of your tax return.

- Double-Check Your Numbers: If you didn’t receive a 1099-NEC or received an incorrect one, you’re still required to report all income. Be sure to track your earnings independently, whether through invoices, bank statements, or other records.

- File on Time: Be mindful of the tax deadlines, and avoid common mistakes like failing to report all income or filing late.

Using tools like FormPros can simplify the process by allowing you to easily generate and file your 1099-NEC forms. This ensures you’re on track with your filing and helps prevent costly mistakes.

Self-Employment Taxes and Deductions:

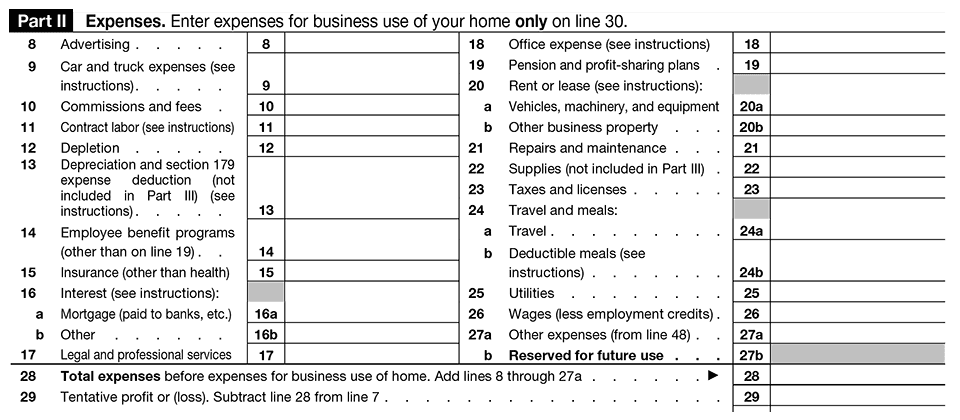

As a 1099 worker, you’re responsible for paying self-employment taxes, which cover Social Security and Medicare. These taxes are calculated based on your net earnings, and the rate is typically 15.3%. However, you may be able to reduce your taxable income by claiming various business-related deductions.

Common deductions for 1099 workers include:

- Home Office: If you work from home, you can deduct a portion of your rent or mortgage, utilities, and internet costs.

- Business Expenses: Supplies, software, and equipment used for work can often be deducted.

- Vehicle Expenses: If you use your car for business purposes, you can deduct mileage and related costs.

Additionally, be aware that as a 1099 worker, you may need to make estimated quarterly tax payments to avoid penalties at the end of the year. Setting aside a portion of your income throughout the year can help you manage these payments effectively.

1099 Filing Checklist

Ready to make this actionable? Run through this short 1099 checklist to ensure nothing slips through the cracks before you file.

1) Provide clients a completed Form W-9.

2) Keep income records all year (invoices, bank deposits, platform payouts).

3) Track expenses by category (software, supplies, phone/internet, travel, education).

4) Maintain a mileage log or track actual vehicle costs—plan to use whichever gives the bigger deduction.

5) Document home office details (square footage, utilities, internet) if used regularly & exclusively.

6) Reconcile books monthly (bank/credit statements → bookkeeping).

7) Make quarterly estimated tax payments (Form 1040-ES).

8) In January, collect all 1099-NEC forms (due to you by Jan 31st); if one’s missing or wrong, rely on your records and request a correction.

9) Total gross income (1099-NEC + any income without forms).

10) Summarize deductible expenses (keep receipts).

11) Complete Schedule C (profit/loss) and Schedule SE (self-employment tax ≈ 15.3% on net earnings).

12) File and pay by the deadline; save confirmations and keep records 3–7 years.

Stay on Track with Your Tax Filing

Filing taxes as a 1099 worker doesn’t have to be overwhelming. By understanding the importance of Form 1099-NEC, keeping accurate records of your income, and claiming all eligible deductions, you can stay on top of your tax obligations. Don’t forget to calculate and pay your self-employment taxes to avoid any surprises.

To make the process even easier, FormPros offers an intuitive platform to help you complete and file your 1099-NEC forms with ease. Get started today to ensure your tax filing is smooth and stress-free.

FormPros Has You Covered

Simplify your paperwork with FormPros! From creating paystubs, W-2s, and employment verification letters to generating LLC Operating Agreements and even voided checks, our easy-to-use platform has you covered. Save time, reduce errors, and handle your business documents with confidence. Start now and see how FormPros makes professional form generation fast, affordable, and hassle-free!

FAQs

-

Do I need an EIN, or can I use my SSN on a W9?

Generally, sole proprietors can use an SSN. That said, consider an EIN when you want more privacy, when you hire employees, or when a bank or platform requires it.

-

I get paid through apps—will I receive a 1099-K?

Maybe. Platforms issue Form 1099-K based on annual thresholds that can change by year. Regardless of whether you receive the form, you must report all income from goods/services on your return. Check the IRS’s current 1099-K guidance for the latest thresholds.

-

What if a client sends a wrong or missing 1099-NEC?

To begin, report the right income using your records; next, contact the payer for a corrected 1099-NEC. Moreover, the IRS outlines how to correct 1099-NEC/1099-MISC forms.

-

My client withheld money from a payment—what is that?

In most cases, that’s likely backup withholding (often triggered by a missing or incorrect TIN on your W-9). Nevertheless, you must still report the gross income and, in addition, claim the withheld amount as federal tax paid on your return.

-

Can I claim the 20% Qualified Business Income (QBI) deduction?

Generally, many sole proprietors can deduct up to 20% of qualified business income, though limits and phaseouts may apply. Additionally, you claim the deduction on Form 8995/8995-A; under current law, eligibility extends through tax years beginning before January 1st, 2026.

-

I have both W2 and 1099 income—how do I file?

You file one tax return: report W2 wages as usual, and report 1099 work on Schedule C and Schedule SE. Use withholding from your W2 and/or quarterly estimates to cover the self-employment tax from your 1099 income.

-

Do I need to collect or pay sales tax as a contractor?

It depends on your state and what you sell. Many services aren’t taxable in some states; others are. If you sell taxable goods or certain services, you may need a sales tax permit and to collect/remit sales tax. Check your state’s department of revenue for your exact rules.