What is the official name of Form 1099-INT and what is its purpose?

The official name of Form 1099-INT is “Interest Income.” Its purpose is to report interest income paid to individuals by banks, financial institutions, and other payers during a tax year. This information must be reported on the recipient’s federal income tax return to ensure accurate and compliant tax reporting.

Why is Form 1099-INT important?

Form 1099-INT is important because it provides a detailed record of the interest income that individuals receive from banks, financial institutions, and other entities during the tax year. This essential documentation ensures that taxpayers report the accurate amount of interest received, which is necessary for compliant and precise federal income tax reporting. By detailing taxable interest, tax-exempt interest, and other relevant financial information, the form assists taxpayers in fulfilling their tax obligations correctly, thereby avoiding potential errors and penalties associated with underreporting income.

Who is required to submit a Form 1099-INT?

Banks, financial institutions, and other entities that pay interest totaling $10 or more during the tax year to any one person are required to submit a Form 1099-INT. This requirement also applies to entities that withhold and pay any foreign tax on interest, or from whom foreign tax is withheld and paid, regardless of the amount of the payment. Additionally, if an entity pays at least $600 in interest to an individual as part of its trade or business, it must also file Form 1099-INT.

What are the specific steps to obtain and correctly complete Form 1099-INT?

To obtain and correctly complete Form 1099-INT, follow these steps:

Obtain the Form: Form 1099-INT can be obtained from the IRS website. Download the form directly for free. Alternatively, financial institutions and entities that must issue the form might use software that generates the form, should provide Form 1099-INT to the recipient either electronically or by mail.

Gather Information: Collect all necessary information including the taxpayer identification numbers (TINs) for both the payer and the recipient, as well as the total amount of interest paid during the tax year.

Fill in Payer’s Information: Enter the name, address, and TIN of the payer in the designated boxes at the top left of the form.

Fill in Recipient’s Information: Fill in the name, address, and TIN of the person who received the interest income in the corresponding section.

Report Interest Income and Other Details: Input the total amount of interest paid in the tax year in Box 1. If applicable, report tax-exempt interest in Box 8, specified private activity bond interest in Box 9, and any foreign tax paid or investment expenses in Boxes 6 and 5 respectively.

Review Form for Accuracy: Double-check all entries to ensure accuracy in the reported amounts and personal information.

Copy and Distribute: Complete Copy A of Form 1099-INT for IRS reporting. Copy B and Copy C must be provided to the recipient for their records. The due date for furnishing Copy B to the recipient is generally January 31 of the year following the payment of the interest.

File with the IRS: Submit Copy A to the IRS. For those filing electronically, the threshold is 250 or more forms, and the submission deadline can vary. For paper filings, ensure it is postmarked by the general filing date, commonly February 28 or March 31 if filing electronically.

By carefully following these steps, the form will be correctly completed and in compliance with IRS requirements. Remember that the controlled procedures, including deadlines, might change, so it’s always good practice to check the latest guidelines from the IRS or consult with a tax professional.

When and how often do you need to file Form 1099-INT, and are there any associated deadlines?

Form 1099-INT needs to be filed by banks, financial institutions, and other payors annually. They must send this form to each payee as well as the IRS by January 31st of the year following the tax year in which the interest payments were made. For example, for interest payments made in 2023, the form should be sent by January 31, 2024. This timeline ensures that recipients have the information in time to file their own income tax returns by the tax filing deadline.

Are there any consequences for late submission of Form 1099-INT?

Yes, there are consequences for the late submission of Form 1099-INT. If the form is not filed by the deadline, the issuing entity may be subject to penalties imposed by the IRS. The amount of the penalty depends on how late the form is filed and can range from $50 to $280 per form, with a maximum penalty based on the size of the entity and when the form is eventually filed. Additionally, if the failure to file is intentional, more severe penalties can be applied.

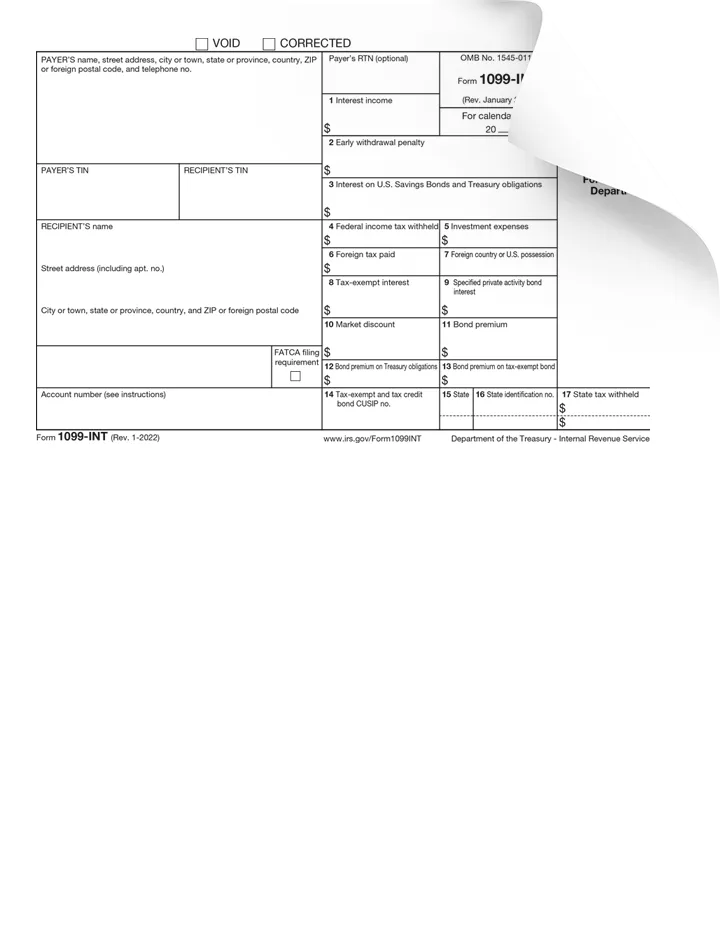

Can you list the key components or sections that Form 1099-INT comprises?

Form 1099-INT, “Interest Income,” is used to report interest income to the IRS and taxpayers. Here are the key components or sections that comprise Form 1099-INT:

- Payer’s Information:

- Payer’s Name, Address, and Telephone Number: The name, address, and contact information of the entity paying the interest.

- Payer’s TIN: The taxpayer identification number (TIN) of the entity paying the interest.

- Recipient’s Information:

- Recipient’s Name, Address, and TIN: The name, address, and TIN (such as Social Security Number or Employer Identification Number) of the individual or entity receiving the interest.

- Account Number (optional):

- An account number may be included if the payer has multiple accounts for a recipient.

- Box 1 – Interest Income:

- The total amount of taxable interest income paid to the recipient during the year.

- Box 2 – Early Withdrawal Penalty:

- The amount of any penalty charged for early withdrawal of funds from a time deposit (e.g., a certificate of deposit).

- Box 3 – Interest on U.S. Savings Bonds and Treas. Obligations:

- Interest income from U.S. Savings Bonds, Treasury bills, Treasury notes, and Treasury bonds.

- Box 4 – Federal Income Tax Withheld:

- Any federal income tax withheld from the interest income.

- Box 5 – Investment Expenses:

- The amount of investment expenses allocable to the interest income, typically reported for specified private activity bonds.

- Box 6 – Foreign Tax Paid:

- The amount of foreign tax paid on the interest income, which may be eligible for a foreign tax credit.

- Box 7 – Foreign Country or U.S. Possession:

- The name of the foreign country or U.S. possession to which the foreign tax was paid.

- Box 8 – Tax-Exempt Interest:

- The amount of tax-exempt interest income, such as interest from municipal bonds.

- Box 9 – Specified Private Activity Bond Interest:

- The amount of tax-exempt interest from private activity bonds, which may be subject to the alternative minimum tax (AMT).

- Box 10 – Market Discount:

- The amount of market discount that accrued on a bond purchased below its face value.

- Box 11 – Bond Premium:

- The amount of bond premium amortization allocable to the interest income reported in Box 1.

- Box 12 – Bond Premium on Tax-Exempt Bond:

- The amount of bond premium amortization allocable to the tax-exempt interest reported in Box 8.

- Box 13 – Bond Premium on Treasury Obligations:

- The amount of bond premium amortization allocable to the interest reported in Box 3 for Treasury obligations.

- Box 14 – Tax-Exempt and Tax Credit Bond CUSIP No.:

- The Committee on Uniform Securities Identification Procedures (CUSIP) number for the tax-exempt bond or tax credit bond.

Additional Information:

- Instructions for Recipient:

- Detailed instructions for the recipient on how to use the information provided on Form 1099-INT for their tax return.

Each of these components provides specific information necessary for both the payer to report and the recipient to correctly file their tax returns. Accurate completion of each section ensures compliance with IRS requirements and helps the recipient correctly report their income and calculate any applicable taxes.

What documents should I have on hand to help me complete these sections accurately?

To complete Form 1099-INT accurately, ensure you have access to bank statements or savings account statements that detail the interest paid throughout the tax year. Additionally, gather any relevant information regarding investments from brokers or financial institutions, including statements from bonds or certificates of deposit. Records of any foreign taxes paid related to interest income or investment-related expenses should also be available. These documents collectively will help provide the accurate figures needed for reporting on the form.

A case study showcasing the importance of Form 1099-INT.

Consider the scenario of Emma, a freelance graphic designer, who has invested her savings in several high-yield savings accounts and bonds. Throughout the year, these investments generate significant interest earnings. As tax season approaches, Emma relies on accurate and detailed records to meet her tax obligations and avoid any discrepancies with the IRS.

For the tax year in question, Emma receives multiple 1099-INT forms from her banks and financial institutions. These forms indicate not only how much taxable interest Emma received from each account but also provide additional financial details such as tax-exempt interest and any foreign taxes paid. By accurately reporting this data on her federal income tax return, Emma ensures that she pays the correct amount of taxes and utilizes any applicable tax credits or deductions for foreign taxes paid.

In Emma’s case, the collective information from the 1099-INT forms allows her to verify the total interest income reported and match it against her own records. Furthermore, having this official documentation is essential if her return were to be questioned or audited by the IRS. This instance highlights the critical role that Form 1099-INT plays in not only ensuring tax compliance but also in providing taxpayers the detailed information required for precise tax reporting and planning. The form’s structured format and the mandatory reporting by the financial entities help in simplifying and streamlining the tax filing process, reducing errors, and avoiding potential legal implications due to underreporting income.

How do I file Form 1099-INT?

If you received a Form 1099-INT reporting interest income, you are not responsible for filing the form itself with the IRS. Instead, you should include the information from Form 1099-INT on your tax return. Generally, the interest income reported on Form 1099-INT should be entered on Form 1040 or 1040-SR on the line for “Taxable interest.” If any federal income tax was withheld, as shown in box 4 of Form 1099-INT, you should also report this on your income tax return, typically on the payments section to credit against your total tax liability. Make sure to retain a copy of Form 1099-INT for your records.

Are there any specific regulations or compliance requirements associated with Form 1099-INT?

Yes, there are specific regulations and compliance requirements associated with Form 1099-INT. The filer must issue Form 1099-INT for each person to whom they have paid at least $10 of interest during the tax year. This includes interest on bank accounts, bonds, and other financial instruments. The information provided must be accurate and filed with the IRS by January 31st of the year following the payment of the interest. Financial institutions must also furnish a copy to the taxpayer by the same date.

Additionally, discrepancies in amounts reported and withholding information must be rectified promptly to avoid penalties. Non-compliance or failure to file a required form can result in fines and penalties from the IRS. Non-resident aliens and foreign entities typically are subject to different reporting requirements under specific tax treaties or IRS rules governing international taxation.

What resources are available for assistance in completing and submitting Form 1099-INT (e.g., professional advice, official instructions)?

For assistance in completing and submitting Form 1099-INT, taxpayers and reporting entities can consult several resources. The IRS provides official instructions that detail how to fill out the form on its website. Professional accountants or tax advisors are also valuable resources for personalized guidance, especially in complex scenarios involving multiple types of interest income or international taxation issues.

Additionally, many software programs designed for tax preparation support the correct handling and filing of Form 1099-INT, ensuring compliance with IRS requirements. These resources can help ensure accurate and timely filing of interest income reports.

What are some common errors to avoid when completing and submitting Form 1099-INT?

When completing and submitting Form 1099-INT, it’s important to avoid common errors to ensure accurate reporting and compliance with IRS requirements. Here are some common errors to avoid:

1. Incorrect Taxpayer Identification Numbers (TINs):

- Ensure that the TINs for both the payer (entity issuing the form) and the recipient (individual or entity receiving the interest) are accurate. Incorrect TINs can lead to reporting issues and potential penalties.

2. Inaccurate or Incomplete Recipient Information:

- Verify that all recipient information, including names and addresses, is accurate and complete. Incomplete or incorrect information can cause processing delays and errors in reporting.

3. Misreporting Interest Income (Box 1):

- Accurately report the total taxable interest income paid to the recipient during the year. Misreporting this amount can lead to incorrect tax calculations for the recipient.

4. Incorrect Reporting of Early Withdrawal Penalty (Box 2):

- Ensure that any penalties charged for early withdrawal of funds from a time deposit are correctly reported. Incorrect amounts can affect the recipient’s tax deductions.

5. Misreporting Interest on U.S. Savings Bonds and Treasury Obligations (Box 3):

- Accurately report interest income from U.S. Savings Bonds, Treasury bills, Treasury notes, and Treasury bonds. Misreporting this amount can lead to discrepancies in tax reporting.

6. Incorrect Federal Income Tax Withheld (Box 4):

- Ensure that any federal income tax withheld from the interest income is accurately reported. Incorrect reporting can lead to discrepancies on the recipient’s tax return.

7. Failing to Report Foreign Tax Paid (Box 6):

- Accurately report any foreign tax paid on the interest income. This information is necessary for the recipient to claim a foreign tax credit.

8. Incorrect Foreign Country or U.S. Possession (Box 7):

- Accurately report the name of the foreign country or U.S. possession to which the foreign tax was paid. Incorrect information can affect the recipient’s ability to claim the foreign tax credit.

9. Misreporting Tax-Exempt Interest (Box 8):

- Ensure that the amount of tax-exempt interest income, such as interest from municipal bonds, is accurately reported. Misreporting this amount can lead to incorrect tax treatment.

10. Incorrect Reporting of Specified Private Activity Bond Interest (Box 9):

- Accurately report the amount of tax-exempt interest from private activity bonds. This information is necessary for the recipient to determine if they are subject to the alternative minimum tax (AMT).

11. Incorrect Reporting of Market Discount (Box 10):

- Accurately report the amount of market discount that accrued on a bond purchased below its face value. Incorrect reporting can lead to discrepancies in the recipient’s tax reporting.

12. Misreporting Bond Premium (Boxes 11, 12, and 13):

- Ensure that bond premium amortization amounts are accurately reported in the appropriate boxes. Misreporting these amounts can affect the recipient’s tax deductions and calculations.

13. Failing to Provide Copies to Recipients:

- Ensure that recipients receive their copies of Form 1099-INT by the required deadline. Failing to provide these copies can result in penalties and may cause recipients to underreport their income.

14. Failing to File Timely:

- Submit Form 1099-INT to the IRS and provide copies to recipients by the required deadlines. Late filings can result in penalties and interest charges.

15. Not Filing Electronically When Required:

- If you are required to file 250 or more Forms 1099-INT, you must file electronically. Failing to do so can result in penalties.

16. Incorrect Filing of Corrections:

- If a correction is needed, ensure that you file the corrected Form 1099-INT properly. Follow the IRS guidelines for submitting corrected forms to avoid confusion and potential penalties.

17. Ignoring IRS Updates and Changes:

- Stay informed about any changes or updates to IRS forms and reporting requirements. Ignoring these updates can lead to outdated or incorrect filings.

18. Poor Recordkeeping:

- Maintain accurate and detailed records of the interest payments reported on Form 1099-INT. Inadequate recordkeeping can complicate filing and hinder the ability to provide accurate information.

By avoiding these common errors, issuers can ensure accurate and timely filing of Form 1099-INT, minimizing the risk of penalties and ensuring compliance with IRS regulations.

How should you retain records or copies of the submitted Form 1099-INT and associated documents?

It is advisable to retain copies of Form 1099-INT and any associated documents for at least three years from the date you filed your original return or two years from the date you paid the tax, whichever is later. However, if you filed a claim for a loss from worthless securities or bad debt deduction, keep records for seven years. For instances involving unreported income that is 25% or more of your gross income, maintain records for six years. Store these documents in a secure, organized manner to ensure they are easily accessible for future reference, such as for audits or amendments to your tax returns.

How do you stay informed about changes in regulations or requirements related to Form 1099-INT?

To stay informed about changes in regulations or requirements related to Form 1099-INT, regularly check updates from the Internal Revenue Service (IRS) on their official website, which frequently posts updates about forms and regulations. Subscribing to IRS newsletters and attending webinars hosted by the IRS or financial regulatory bodies can also provide timely updates.

Additionally, consulting with a tax professional or accountant who is well-versed in the latest tax laws can help ensure that you receive accurate and comprehensive information about any changes to Form 1099-INT requirements.

Lastly, following trusted tax-related blogs, websites, or forums often discussing regulatory changes can be helpful.

Are there any exemptions or exceptions to the requirement of filing Form 1099-INT?

Yes, there are several exemptions and exceptions to the requirement of filing Form 1099-INT. Generally, an institution is not required to issue a Form 1099-INT if the amount of interest paid is less than $10 for the year.

Additionally, interest on an IRA, including payments from a Roth IRA, does not have to be reported on Form 1099-INT. Interest payments made to exempt recipients such as corporations, any IRA, Archer MSA, health saving accounts (HSA), U.S. agencies, states, the District of Columbia, a U.S. possession, or registered securities or commodities dealers are also typically exempt from reporting. Furthermore, interest from a bank savings account to another bank account in the name of the same depositor does not necessitate issuing this form.

Thus, while Form 1099-INT is broadly required, these specific scenarios do not require the issuance of this form for interest income reporting.

Are there any penalties for inaccuracies or omissions on Form 1099-INT?

Yes, there are penalties for inaccuracies or omissions on Form 1099-INT. Payers who fail to file correct information returns by the due date can face fines. The penalty varies depending on how late the information is filed and can range from $50 to $290 per form, with a maximum of $1,000,000 per year for small businesses. Increased penalties apply for intentional disregard of filing requirements. Additionally, fines exist for failure to provide the recipient with a correct copy of the form or for reporting incorrect information. These penalties are designed to encourage accurate and timely reporting of interest income.

How does Form 1099-INT impact an individual or entity’s tax obligations?

Form 1099-INT impacts an individual or entity’s tax obligations by detailing the amount of interest earned during the tax year, which must be reported as income on federal tax returns. This inclusion can affect the taxpayer’s taxable income level, potentially placing them in a higher tax bracket and increasing the amount of taxes owed.

Additionally, the form provides information on any related tax-exempt interest, further influencing tax liability calculations. For entities, accurately reporting this information ensures compliance with IRS regulations, thus avoiding possible penalties for underreporting income. The form also lists amounts related to foreign taxes paid and investment expenses, which may be applicable for deductions or credits, affecting the overall tax obligation.

Is there a threshold for income or transactions that triggers the need to file Form 1099-INT?

Yes, there is a threshold for reporting interest income on Form 1099-INT. Financial institutions and other entities are required to issue a Form 1099-INT if they pay at least $10 in interest to an individual during the tax year. Additionally, this form must also be issued if any federal income tax was withheld under the backup withholding rules, regardless of the amount of interest paid.

Are there any circumstances where Form 1099-INT may need to be amended after filing?

Yes, Form 1099-INT may need to be amended after filing if discrepancies or errors are identified post-submission. Such circumstances include incorrect interest amounts being reported, an error in the payee’s taxpayer identification number or name, or if transaction categories (such as taxable versus tax-exempt interest) were reported inaccurately. An amended form corrects the original submission and ensures compliance with tax reporting requirements.

How does Form 1099-INT affect financial reporting for businesses, organizations, or individuals?

Form 1099-INT primarily affects financial reporting for individuals by providing them with detailed information on the interest income they have earned over the tax year, which is essential for accurate reporting on their tax returns. For businesses and organizations, this form is relevant when they act as payers of interest. Companies must ensure they issue Form 1099-INT to all eligible recipients by the stipulated deadline, hence impacting their financial reporting responsibilities. This compliance ensures that all parties report their income correctly to the IRS, thus maintaining accurate financial records and meeting tax obligations.

Additionally, it helps in tracking and managing expenses related to interest payments, potentially influencing financial decisions and strategies for both issuing entities and income recipients.

Can Form 1099-INT be filed on behalf of someone else, such as a tax preparer or accountant?

Yes, a tax preparer or accountant can file Form 1099-INT on behalf of someone else, provided they have the necessary authorization to manage tax affairs for that person. This arrangement is common in professional tax preparation services where the taxpayer has given explicit consent for the tax professional to handle their tax filings.

Are there any fees associated with filing Form 1099-INT?

There are no fees charged by the IRS for filing Form 1099-INT. However, businesses may incur costs related to generating, printing, mailing, or electronically filing the form, depending on how they choose to process these forms and whether they utilize tax professionals or software for assistance.

How long does it typically take to process Form 1099-INT once it’s been submitted?

The processing time for Form 1099-INT itself by the IRS or other tax authorities is not specifically defined, as the form is generally used by individual taxpayers to complete their own tax returns. However, taxpayers must file their returns by April 15th for income received in the previous year, and the IRS typically processes individual tax returns within 21 days if filed electronically, and six to eight weeks if filed by paper mail.

Can Form 1099-INT be filed retroactively for past transactions or events?

Form 1099-INT cannot be filed retroactively in the sense of amending the income type or amount after the standard filing deadline without specific cause. If it was not filed by the deadline (January 31), or if corrections are needed, a corrected Form 1099-INT must be submitted as soon as possible. This form should be used to correct previously reported information or to report omitted transactions, but not to change the nature of the reported income after the filing deadline solely at the discretion of the filer. It is important to comply with IRS guidelines and deadlines to avoid penalties.

Are there any specific instructions or guidelines for completing Form 1099-INT for international transactions or entities?

For Form 1099-INT relating to international transactions or entities, there are specific details to consider:

If a U.S. account earns interest from a foreign source, the payer must report the total amount of foreign tax paid on this interest in Box 6, with the amount of interest from foreign sources reported in Box 1.

Additionally, if any foreign country’s name should be represented in Box 7, indicating where the interest income and foreign tax were paid. This information assists the recipient in properly reporting and possibly claiming a tax credit for foreign taxes on their federal tax return. Entities reporting on Form 1099-INT must ensure they follow these requirements to correctly document international aspects of interest income.

What digital tools or software are recommended for generating and managing Form 1099-INT?

FormPros could be a suitable tool for generating and managing Form 1099-INT, as we offer customizable templates and features designed to streamline the process. Additionally, popular accounting software such as QuickBooks or Xero often include features for generating and managing tax forms like the 1099-INT. These tools can automate much of the process and help ensure compliance with tax regulations. However, it’s essential to review the specific features and capabilities of each tool to determine which best suits your needs.

Form 1099-INT FAQs

-

What is the difference between taxable interest and tax-exempt interest as reported on Form 1099-INT?

Taxable interest, reported in Box 1 of Form 1099-INT, is interest income that is subject to federal income tax. Tax-exempt interest, reported in Box 8, is interest income that is not subject to federal income tax, such as interest from municipal bonds. However, tax-exempt interest may still be subject to state or local taxes and may need to be reported for informational purposes.

-

What should I do if I believe the reported amount on a Form 1099-INT I received is incorrect?

If you believe the reported amount on your Form 1099-INT is incorrect, contact the payer (the financial institution or entity that issued the form) immediately to request a corrected form. Keep a record of your communications and any documentation you receive. If the corrected form is not received in time, report the correct amount on your tax return and include an explanation.

-

How can a recipient of interest from multiple accounts or institutions consolidate their information for tax reporting?

Recipients should gather all Forms 1099-INT received from various accounts or institutions and total the amounts reported in each relevant box. This consolidated information should then be reported on their tax return. Keeping detailed records and organizing the forms can help ensure accuracy and completeness in reporting.

-

What privacy protections are in place for the sensitive information required on Form 1099-INT?

Financial institutions and entities issuing Form 1099-INT are required to follow privacy and data protection laws, such as the Privacy Act of 1974, to safeguard your personal information. They implement security measures such as secure data storage, restricted access, and encryption to protect your sensitive information from unauthorized access and disclosure.

-

If interest is earned in a joint account, how should Form 1099-INT be handled?

For joint accounts, the Form 1099-INT is typically issued to the primary account holder’s TIN. The total interest earned is reported on this form. Both account holders should report their respective shares of the interest income on their individual tax returns based on their ownership percentage of the account.

-

Are non-residents of the U.S. subject to different reporting requirements on Form 1099-INT?

Yes, non-residents of the U.S. are subject to different reporting requirements. Interest paid to non-residents is generally reported on Form 1042-S, "Foreign Person's U.S. Source Income Subject to Withholding," instead of Form 1099-INT. Non-residents may also be subject to different withholding rates and reporting rules.

-

Can digital or electronic versions of Form 1099-INT be used for official tax filing, and are they recognized by the IRS?

Yes, digital or electronic versions of Form 1099-INT can be used for official tax filing and are recognized by the IRS. Many financial institutions provide electronic delivery of Form 1099-INT. Ensure you save and print a copy for your records and tax filing.

-

What are the requirements for reporting interest from bonds or CDs on Form 1099-INT?

Interest from bonds, including U.S. Savings Bonds and Treasury obligations, and interest from certificates of deposit (CDs) must be reported on Form 1099-INT. The total taxable interest is reported in Box 1, while specific types of interest, such as Treasury interest, are reported in Box 3. Any early withdrawal penalties from CDs should be reported in Box 2.

-

How does Form 1099-INT interact with other tax forms, such as Form 1040?

The information on Form 1099-INT must be reported on your tax return. Taxable interest (Box 1) is reported on Form 1040, Schedule B (if applicable), and tax-exempt interest (Box 8) is reported on Form 1040. Other boxes, such as early withdrawal penalties (Box 2) and foreign tax paid (Box 6), may affect specific sections of your tax return and require additional forms like Form 1116 for the foreign tax credit.

-

What actions should be taken if a Form 1099-INT is not received by the January 31 deadline?

If you do not receive Form 1099-INT by the January 31 deadline, contact the payer to request the form. Verify your mailing address and request a duplicate if necessary. If you still do not receive the form, estimate the interest income based on your records and include it in your tax return. Attach an explanation to your return about why you did not receive the form.