The Ultimate Guide To The IRS Filing Deadlines For 2026

Tax season is the annual window—typically from late January to mid-April—when Americans must file their income tax returns and, in addition, meet IRS filing deadlines for various required forms. Specifically, for the 2026 filing season (covering income earned in tax year 2025), the season is expected to open in late January 2026 and then end on Wednesday, April 15, 2026.

In addition to filing tax returns, many individuals and businesses must make quarterly estimated tax payments. This applies to freelancers, contractors, and anyone with income not subject to withholding. Furthermore, missing deadlines can lead to penalties, interest charges, and even refund delays. Therefore, it is critical to stay informed about the exact IRS filing deadlines for each form so that you can remain fully compliant.

Table of Contents

Form 1040 — “U.S. Individual Income Tax Return”

What It Is:

The standard form is used by individuals to report income, as well as claim deductions and credits, and finally calculate whether tax is owed or a refund is due.

Deadline:

📅 April 15th, 2026

📌 With extension: October 15th, 2026 (Form 4868 required, but payment still due by April 15th)

Penalty for Missing Deadline:

If you miss the deadline, the IRS charges a penalty of 5% of unpaid taxes per month (up to 25%). Additionally, interest accrues on unpaid balances. Moreover, there is also a separate failure-to-pay penalty of 0.5% per month, which means the longer the delay, the higher the cost.

Form W-2 — “Wage and Tax Statement”

What It Is:

Used by employers to report wages paid as well as taxes withheld for each employee. In other words, it ensures both the employee and the IRS have accurate records of income and withholding.

Deadline:

📅 January 31st, 2026 (both to the employee and to the Social Security Administration)

Penalty for Missing Deadline:

- Ranges from $60 to $310 per form, depending on how late it is

- Maximum penalty: $3,783,000 per year for large businesses

Form 1099-NEC — “Nonemployee Compensation”

What It Is:

This form reports payments of $600 or more to independent contractors or freelancers. Moreover, it ensures that the IRS can properly track nonemployee compensation and that workers correctly report their earnings.

Deadline:

📅 January 31st, 2026 (to the recipient and the IRS). As a result, businesses must be prepared to issue these forms promptly to stay compliant.

Penalty for Missing Deadline:

If you fail to meet the deadline, the penalty is the same as for Form W-2, ranging from $60 to $310 per form. In addition, for large businesses, the maximum penalty can exceed $3.7 million per year, which is why timely filing is so critical.

Form 1099-MISC — “Miscellaneous Income”

What It Is:

It’s used to report other income types like rent, prizes, and royalties not covered by 1099-NEC. In addition, it ensures the IRS receives accurate reporting of miscellaneous income sources.

Deadline:

📅 January 31st, 2026 (to recipient)

📅 February 28th, 2026 (paper filing)

📅 March 31st, 2026 (electronic filing)

Penalty for Missing Deadline:

- Same as above: $60–$310 per form, escalating based on lateness. Furthermore, the penalty escalates based on how late the filing is, so early submission is strongly recommended.

Form 1099-INT — “Interest Income”

What It Is:

Reports interest earned from banks, credit unions, or other financial institutions. Additionally, it ensures that taxpayers accurately report interest income for tax purposes.

Deadline:

📅 January 31st, 2026 (to recipient)

📅 February 28th, 2026 (paper filing)

📅 March 31st, 2026 (electronic filing)

Penalty for Missing Deadline:

The penalty ranges from $60 to $310 per form. Moreover, this applies both to each recipient who was not notified on time and also to each late filing with the IRS.

Form 1099-DIV — “Dividends and Distributions”

What It Is:

This form is used to report dividend payments and capital gains distributions from stocks or mutual funds. Furthermore, it helps both taxpayers and the IRS track investment income accurately.

Deadline:

📅 January 31st, 2026 (to recipient)

📅 February 28th, 2026 (paper filing)

📅 March 31st, 2026 (e-filing)

Penalty for Missing Deadline:

- Same tiered penalty structure: $60–$310 per form. Therefore, submitting early can help you avoid unnecessary fines.

Form 1099-R — “Distributions from Retirement Plans”

What It Is:

Reports distributions from pensions, annuities, IRAs, and retirement accounts. In addition, it ensures the IRS receives accurate information about taxable withdrawals.

Deadline:

📅 January 31st, 2026 (to recipient)

📅 February 28th, 2026 (paper IRS filing)

📅 March 31st, 2026 (electronic filing)

Penalty for Missing Deadline:

If you miss the deadline, the penalty ranges from $60 to $310 per form. Moreover, for large filers, the total penalties can quickly add up to millions annually, which is why timely filing is especially important.

Form W-4 — “Employee’s Withholding Certificate”

What It Is:

Used by employees to inform their employer how much federal income tax to withhold from wages.

Deadline:

📅 No set IRS filing deadline; however, it must be submitted as needed and implemented by the employer within 30 days.

Penalty for Missing Deadline:

- No direct penalty, but incorrect withholding can lead to underpayment penalties or tax surprises at year-end.

Form 8862 — “Claiming Credits After Disallowance”

What It Is:

Required if you’re reclaiming credits like the EITC (Earned Income Tax Credit) after being previously denied.

Deadline:

📅 April 15th, 2026 (submitted with Form 1040)

Penalty for Missing Deadline:

- Return may be rejected or credit denied

- If you file late, the IRS may reduce or deny credits

Form 8962 — “Premium Tax Credit”

What It Is:

Used to reconcile health insurance premium tax credits for Marketplace plans.

Deadline:

📅 April 15th, 2026 (included with Form 1040)

Penalty for Missing Deadline:

- Tax return may be rejected

- You may need to repay advanced subsidies

Form 2441 — “Child and Dependent Care Expenses”

What It Is:

This form lets you claim credits for qualifying child or dependent care costs. Additionally, it helps reduce your overall tax liability if you have eligible expenses.

Deadline:

📅 April 15th, 2026 (and, importantly, it must be filed together with your Form 1040)

Penalty for Missing Deadline:

If you miss the deadline, the result is a complete loss of the credit for that tax year. Moreover, no partial credit is allowed after the filing deadline, so timely submission is essential.

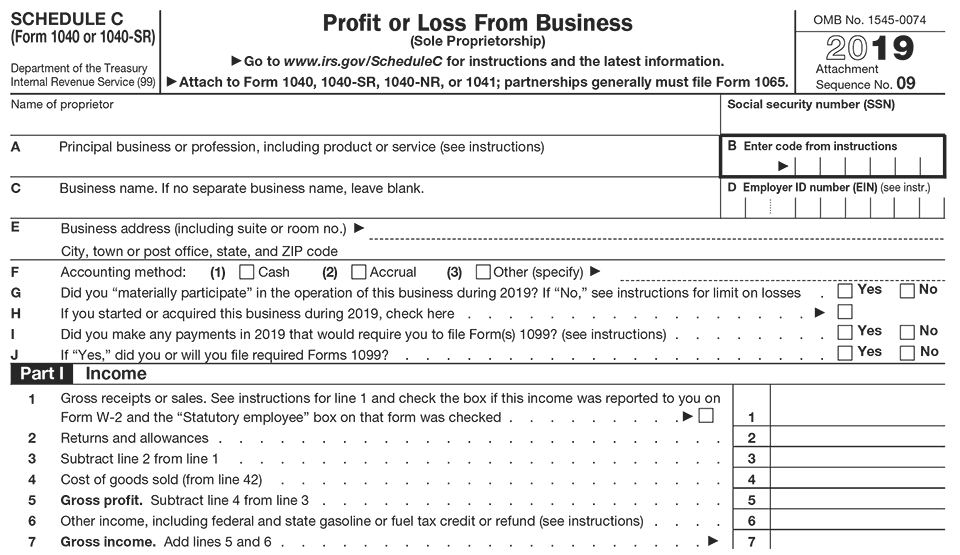

Schedule C — “Profit or Loss from Business”

What It Is:

Used by sole proprietors and freelancers to report business income and expenses. In other words, it provides the IRS with a complete picture of your self-employment earnings.

Deadline:

📅 April 15th, 2026 (and, as a reminder, it must be submitted together with Form 1040)

Penalty for Missing Deadline:

- Triggers late filing and underpayment penalties

- IRS may estimate your income, often to your disadvantage

Schedule SE — “Self-Employment Tax”

What It Is:

This form calculates Social Security and Medicare tax owed by self-employed individuals. In addition, it ensures that self-employed workers contribute properly to these essential programs.

Deadline:

📅 April 15th, 2026 (and, importantly, it must be filed together with Form 1040)

Penalty for Missing Deadline:

If you miss the deadline, you will face the same penalties as a late Form 1040 filing. Moreover, there is also the risk of losing timely credit toward Social Security benefits, which could ultimately reduce future retirement eligibility.

Form 941 — Employer’s Quarterly Federal Tax Return

What It Is:

This form is filed quarterly to report payroll taxes withheld from employee wages. In other words, it ensures employers stay current with their payroll tax responsibilities.

Deadlines for 2026:

- Q1: April 30th, 2026

- Q2: July 31st, 2026

- Q3: October 31st, 2026

- Q4: February 2nd, 2027 (adjusted because the regular deadline falls on a weekend)

Penalty for Missing Deadline:

- 2% to 15% of the unpaid tax, depending on how late the payment is

- Failure to file penalty: 5% of the tax due per month (up to 25%)

Estimated Tax Payments — 2026 Due Dates

What It Is:

Required for those with income not subject to withholding (e.g., self-employment, rental, investments).

Deadlines for 2026:

- Q1: April 15th, 2026

- Q2: June 15th, 2026

- Q3: September 15th, 2026

- Q4: January 15th, 2027

Penalty for Missing Deadline:

- Underpayment penalty applies

- Interest is charged based on short-term federal rates

FormPros Has You Covered

Simplify your paperwork with FormPros! From generating paystubs, W-9s, and employment verification letters to generating LLC Operating Agreements and even voided checks, our easy-to-use platform has you covered. Save time, reduce errors, and handle your business documents with confidence. Start now and see how FormPros makes professional form generation fast, affordable, and hassle-free!

FAQs

-

What happens if a tax deadline falls on a weekend or federal holiday?

If an IRS filing deadline falls on a Saturday, Sunday, or federal holiday, then the due date automatically moves to the next business day. For instance, if April 15th happens to fall on a Sunday, then the filing deadline would shift to Monday, April 16th instead. In addition, this adjustment applies to both paper and electronic filers, so taxpayers in all situations benefit from the extra day.

-

Do state tax deadlines always match federal deadlines?

Not necessarily. Although many states align their filing deadlines with the IRS, in contrast, some states have different due dates or extension rules. For example, Massachusetts and Maine often extend their deadline because Patriot’s Day or Emancipation Day may conflict with the federal date. Therefore, it is important to always confirm with your state’s Department of Revenue in order to avoid late fees.

-

Can I amend my tax return if I realize I made a mistake after filing?

Yes. If you discover an error after filing, then you can submit Form 1040-X (Amended U.S. Individual Income Tax Return). In most cases, the deadline to amend for a refund is generally within three years of your original filing date; alternatively, it may be two years after paying the tax—whichever option applies later.

-

How long should I keep copies of my tax returns and forms?

The IRS recommends keeping records for at least three years from the date you filed your return, or alternatively, two years from when you paid the tax—whichever comes later. However, if you underreport income by more than 25%, then you should hold records for six years instead. Furthermore, for major documents such as home purchase records or retirement plan contributions, it is best to keep them permanently, since they may be needed at any time in the future.

-

What should I do if I can’t pay my taxes by the deadline?

Even if you can’t pay, you should still file your return on time; otherwise, you risk facing the steep failure-to-file penalty. Fortunately, the IRS offers several payment options, including installment agreements, short-term extensions, and even temporarily delaying collection in cases of hardship. Therefore, filing on time but arranging a payment plan can still help you reduce both penalties as well as interest charges.

FormPros Can Help!

- Instant Download

- Preview Pre-Purchase

- Expert Help

- Easy to Follow Steps