How to Fill Out Form W-4 in 5 Simple Steps

When starting a new job, one of the first tax documents you’ll fill out is the IRS Form W-4, also known as the “Employee’s Withholding Certificate.” This deceptively simple form plays a critical role in determining how much federal income tax your employer should withhold from your paycheck.

In this guide, we’ll go beyond just defining the W-4. We’ll break down each section of the form—Steps 1 through 5—so you can complete it accurately and strategically.

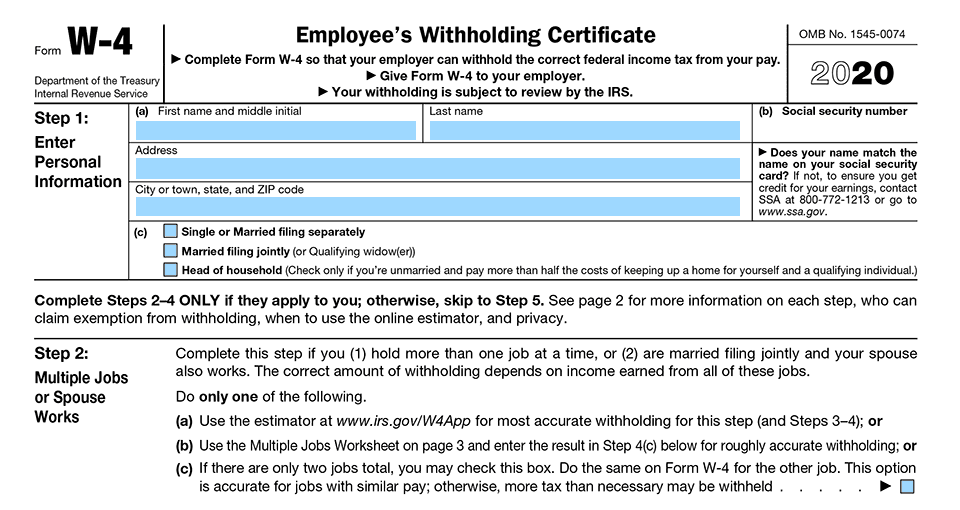

Here is the W-4 form, Steps 1 and 2:

Step 1: Enter Personal Information

This section collects basic personal information, but it also impacts your withholding status:

- Full name, address, Social Security Number

- Filing status: Single, Married filing jointly, or Head of household

*Why it matters: Your filing status affects how much tax is withheld. For example, selecting “Married filing jointly” typically results in less withholding compared to “Single.”*

Step 2: Multiple Jobs or Spouse Works

If you or your spouse has more than one job, this step ensures more accurate withholding. You can choose one of three methods:

- Use the IRS online estimator

- Use the worksheet on Page 3 of the form (shown below)

- Check the box if both jobs have similar pay and you only have two jobs total

*Important tip: Failing to complete this step correctly could result in under-withholding, leading to a tax bill at the end of the year.*

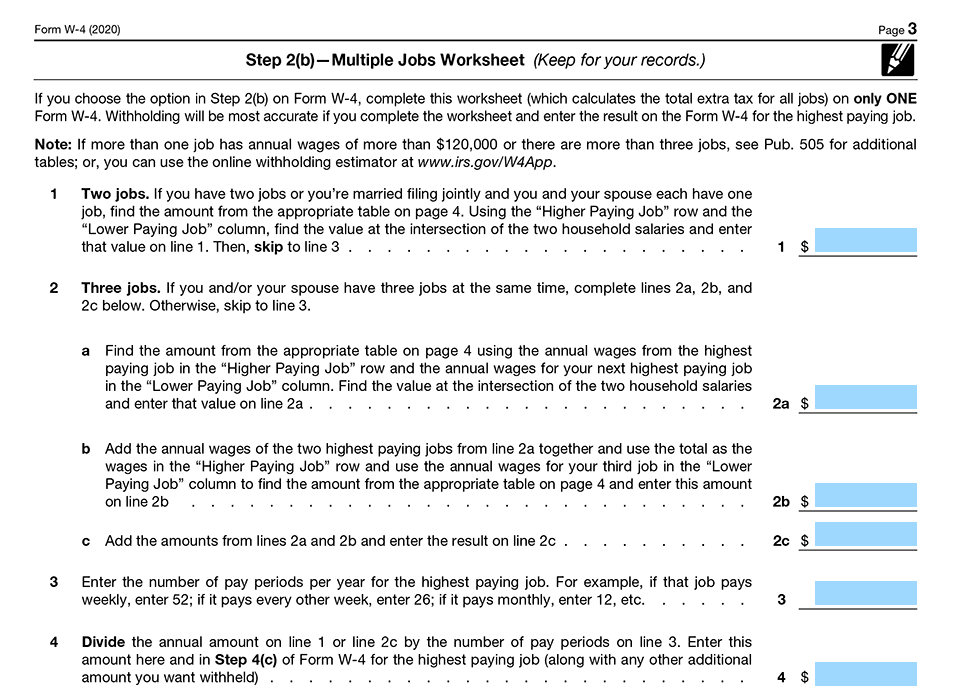

Here is the Multiple Jobs Worksheet:

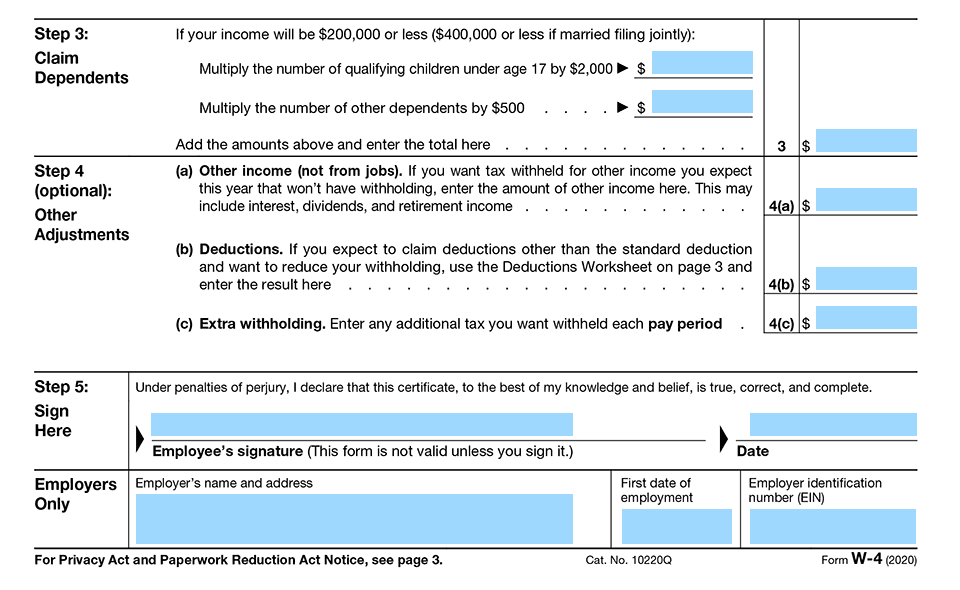

Finally, these are Steps 3, 4 and 5:

Step 3: Claim Dependents

This is where you reduce withholding based on eligible tax credits for dependents:

- Multiply the number of children under 17 by $2,000

- Multiply the number of other dependents by $500

*Note: This isn’t just about claiming children—it includes any dependents that qualify under IRS rules.*

Step 4: Other Adjustments (Optional)

This optional section allows for even more customization:

- Other income (not from jobs), like dividends or side gigs

- Deductions beyond the standard deduction (e.g., mortgage interest, charitable contributions)

- Extra withholding per pay period

*Strategy: Use this step if you’re a freelancer on the side or if you itemize deductions on your tax return.*

Step 5: Sign and Date

The final step is simple but critical: You must sign and date the form for it to be valid.

*Reminder: An unsigned W-4 is considered invalid, and your employer will withhold taxes as if you were single with no adjustments.*

Take Charge of the Process

Understanding and accurately completing a W-4 form is essential for managing your tax withholdings and avoiding surprises at tax time. Whether you’re an employee filling out the form or an employer collecting them for payroll, having the right tools makes all the difference.

FormPros offers a fast, user-friendly W-4 generator that simplifies the process—helping you create, download, and print W-4 forms in minutes. Don’t let paperwork slow you down.

Let FormPros help you streamline your payroll tasks and stay compliant with confidence.

FormPros Has You Covered

Simplify your paperwork with FormPros! From creating pay stubs, W-2s, and 1099-NEC forms to making LLC Operating Agreements and even voided checks, our easy-to-use platform has you covered. Save time, reduce errors, and handle your business documents with confidence. Start now and see how FormPros makes professional form generation fast, affordable, and hassle-free!