What is a W-9 Form?

If you’ve ever worked as a freelancer, independent contractor, or run your own small business, a client or company likely asked you to fill out a W-9 form. But what exactly is this form, and why is it so important?

The W-9, formally known as the “Request for Taxpayer Identification Number and Certification,” is a short but essential IRS document. While you don’t send it directly to the IRS, the W-9 still plays a key role. It helps businesses report payments and individuals prepare for tax season.

In this guide, we’ll break down everything you need to know about the W-9. You’ll learn what the W-9 is, who needs to fill it out, when to use it, and why it matters. We’ll also walk through the different parts of the form. Plus, we’ll offer simple tips to help you get it right the first time.

Understanding the W-9 Form

Businesses use Form W-9 to collect key personal or business information from individuals or entities that receive certain types of payments. This form helps the requesting party — usually a business — properly report what they’ve paid you to the IRS, typically using Form 1099-NEC or 1099-MISC.

It’s important to note that you don’t file the W-9 form with the IRS. Instead, you give it to the person or company requesting it, and they keep it on file in case the IRS needs to verify payment records.

Who Needs to Fill One Out?

If you’re not a traditional employee, chances are you’ll need to complete a W-9 at some point. This includes:

- Freelancers and independent contractors

- Consultants

- Vendors or service providers

- Single-member LLCs, partnerships, and certain corporations

Essentially, anyone who earns income outside of regular wages may need to provide a W-9 when a client or business requests it. Even if you operate a business entity, you may still need to fill one out if a client or partner is reporting payments made to you.

When Do You Need It?

Clients or companies usually ask you to complete a W-9 before they issue your first payment or when you start a new contract or service agreement. It’s also important to provide an updated W-9 any time your taxpayer information changes — whether that’s your name, business structure, address, or taxpayer identification number (TIN). Businesses must collect W-9 forms from payees when they expect to issue payments totaling $600 or more in a calendar year. This helps them accurately report those payments to the IRS using the appropriate 1099 form.

Why is it Important?

Though it may seem like just another form, the W-9 has a big impact on your tax reporting. It helps:

- Ensure accurate information is used when issuing IRS forms like the 1099-NEC

- Prevent costly mistakes related to your taxpayer identification number (TIN)

- Avoid backup withholding, where the IRS requires a business to withhold 24% of your payment if your information is missing or incorrect

For businesses, collecting a correct W-9 protects them from IRS penalties. For individuals, filling it out accurately ensures smooth tax reporting and uninterrupted payments.

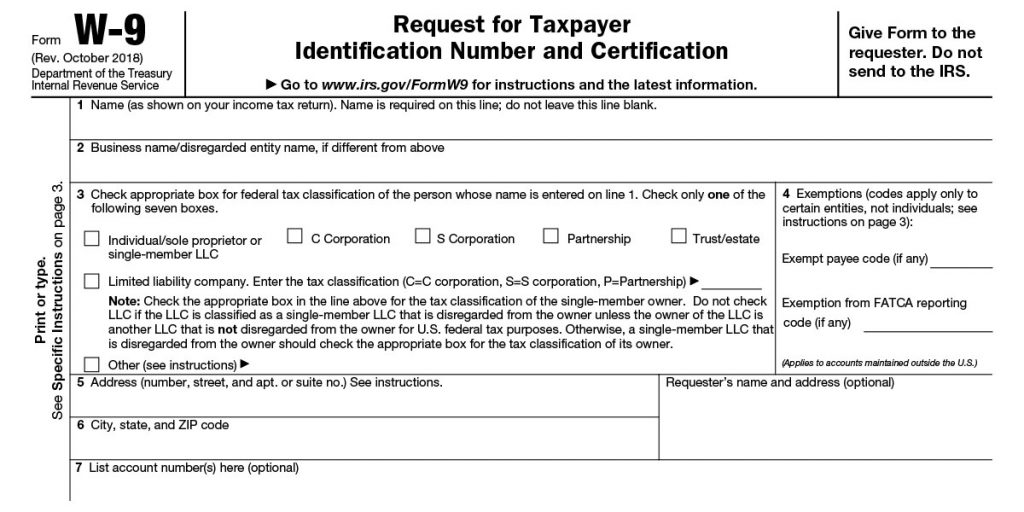

Breaking Down Form W-9

While the W-9 is only a single page long, it contains a few sections that are important to understand. Here’s a quick breakdown of what you’ll need to fill out.

Top Section: Basic Information

At the top of the W-9, you’ll provide identifying details, including:

- Your full legal name

- Your business name or disregarded entity name (if applicable)

- Federal tax classification, such as Individual/Sole Proprietor, C Corporation, S Corporation, Partnership, Trust/estate, or Limited Liability Company (LLC). If you check “LLC,” you’ll also need to indicate your tax classification (e.g., C = C corporation, S = S corporation, P = partnership).

- Address where the requester will send any related tax documents

- Account numbers or requester’s name (optional fields used only if specified)

Accuracy here is crucial, especially for the tax classification and name fields, as these must match IRS records.

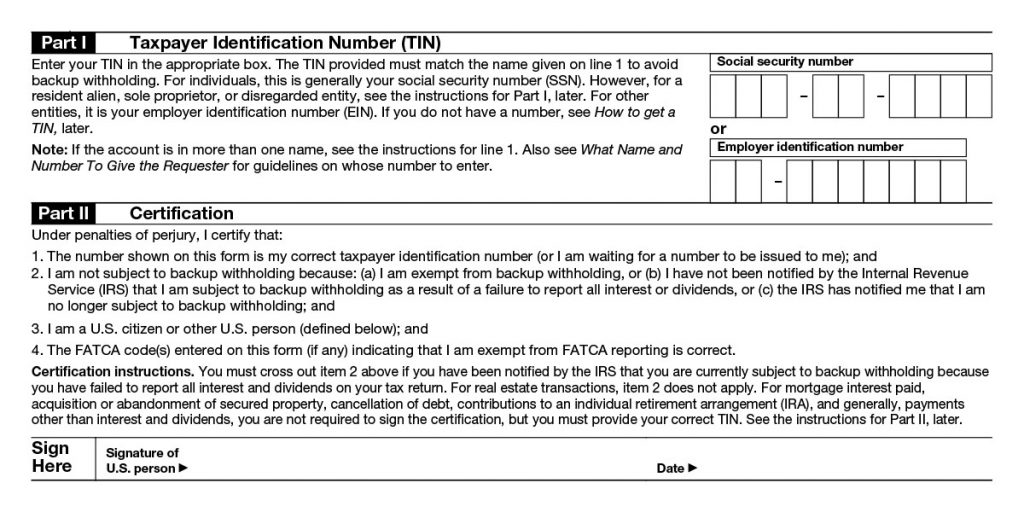

Bottom Section: Parts I & II

Part I: Taxpayer Identification Number (TIN)

In this section, you’ll enter your Social Security Number (SSN) or Employer Identification Number (EIN) — whichever applies to you or your business.

- If you’re an individual or sole proprietor, you’ll typically enter your SSN.

- If you run a registered business entity, such as an LLC or corporation, you’ll likely use your EIN.

Part II: Certification

The final section of the form is the certification, where you sign and date to confirm that:

- The information you provided is correct

- Your TIN is accurate

- You’re not subject to backup withholding (unless otherwise noted)

By signing, you’re also confirming that you’re a U.S. person (which includes individuals, corporations, partnerships, and certain trusts and estates). Failing to sign this section could result in delays or backup withholding, where a percentage of your payment is withheld and sent to the IRS.

Tips for Filling Out a W-9

Although the W-9 is straightforward, taking a few extra precautions can help you avoid common errors and ensure smooth processing.

— Use accurate, up-to-date information. Double-check that your legal name, business name (if applicable), and TIN match what’s on file with the IRS. Inconsistencies can lead to rejected forms or backup withholding.

— Double-check your TIN. Whether you’re using a Social Security Number (SSN) or an Employer Identification Number (EIN), make sure you enter it clearly and correctly in Part I. This is how the IRS tracks your income — mistakes here can cause reporting issues.

— Select the right tax classification. If you’re unsure how your business is taxed, it’s worth confirming whether you’re a sole proprietor, an LLC taxed as a partnership or corporation, or something else. Choosing the wrong box can lead to mismatched records.

— Sign and date the form. It sounds simple, but it’s often overlooked. Unsigned forms are considered incomplete and can delay payments or trigger backup withholding.

— Submit securely. Since the W-9 contains sensitive information like your TIN, make sure you only send it through secure, trusted channels — especially if sharing electronically.

— Keep a copy for your records. Even though you’re not sending the form to the IRS, it’s wise to save a copy for your own files in case you need to refer to it later.

Wrapping Up: Simplifying the W-9 Process

The W-9 form might seem like just another piece of paperwork, but it plays a vital role in the way independent workers and businesses report income. Whether you’re a freelancer, contractor, or small business owner, understanding how and when to fill out this form can save you time, prevent IRS issues, and help ensure you get paid without delays.

If you want to make a W-9 quickly and accurately, FormPros offers an easy-to-use online W-9 generator that guides you through each section step by step. It’s a fast, secure way to create a compliant W-9 you can download and send to any client or company.

FormPros Has You Covered

Simplify your paperwork with FormPros! Whether you need a W-2 generator, want to make a paystub, or need to file a 1099-NEC, our easy-to-use platform has you covered. You can also learn what is a LLC Operating Agreement and generate one in minutes, or even create a voided check with just a few clicks. Save time, reduce errors, and manage your business documents with confidence. Get started today and see how FormPros makes professional form generation fast, affordable, and hassle-free!