What is Durable General Power of Attorney?

A Durable General Power of Attorney (POA) grants someone you trust—the “agent”—the authority to make decisions on your behalf. It remains in effect even if you become mentally incapacitated, ensuring your agent can still manage your financial, legal, or personal affairs. You control the extent of their authority, tailoring it to your needs and preferences. If you need a free durable power of attorney form, an online tool simplifies the process while maintaining legal accuracy.

Why Would You Need a Durable General Power of Attorney?

When you grant someone legal authority to act on your behalf, you can choose between a regular (non-durable) power of attorney and a durable power of attorney. A regular power of attorney loses validity if you become incapacitated, while a durable power of attorney remains in effect, allowing your agent to continue managing your affairs.

Powers of attorney can also be general or limited. A general power of attorney template gives your agent broad authority, while a limited power of attorney restricts their control to specific tasks or transactions. For example, you might authorize someone to sign real estate closing documents, with their authority expiring once the transaction is complete.

When Do You Need a Durable General Power of Attorney?

Use a Durable General Power of Attorney template to authorize someone to manage your financial and business affairs, especially if you become incapacitated. This document grants broad authority over various transactions, including:

- Buying and selling real estate and other assets

- Managing investments

- Handling bills and bank accounts

- Applying for government benefits

- Filing tax returns

- Managing a business

- Signing contracts on behalf of an incapacitated business owner

- Overseeing the business operations of an incapacitated owner

- Signing checks and depositing government payments

However, an agent (also known as an attorney-in-fact) has limitations. They cannot:

- Vote on your behalf

- Create, amend, or revoke a will

- Enter into or dissolve a marriage

If you need a free durable power of attorney form, setting one up in advance ensures your affairs stay on track without legal delays or complications.

Are there any deadlines or times for when this form is needed?

A Durable General Power of Attorney does not have a specific deadline, but it’s crucial to establish one before it becomes necessary. The best time to create this document is when you are in good health and can make informed decisions about who will manage your affairs if needed. It is especially important if you are planning for potential incapacity due to aging, illness, or an upcoming medical procedure. Business owners may need it to ensure continuity if they become unable to manage operations.

Additionally, if you frequently travel or live abroad, having a trusted person handle financial matters in your absence can be beneficial. Without this document in place, your loved ones might have to go through a lengthy and costly legal process to gain authority over your affairs. Setting it up in advance provides peace of mind and ensures your interests are protected.

What are the Main Elements of This Form?

A Durable General Power of Attorney must include specific details to ensure it is legally valid and clearly defines the agent’s responsibilities. Below are the key elements that should be included in this document:

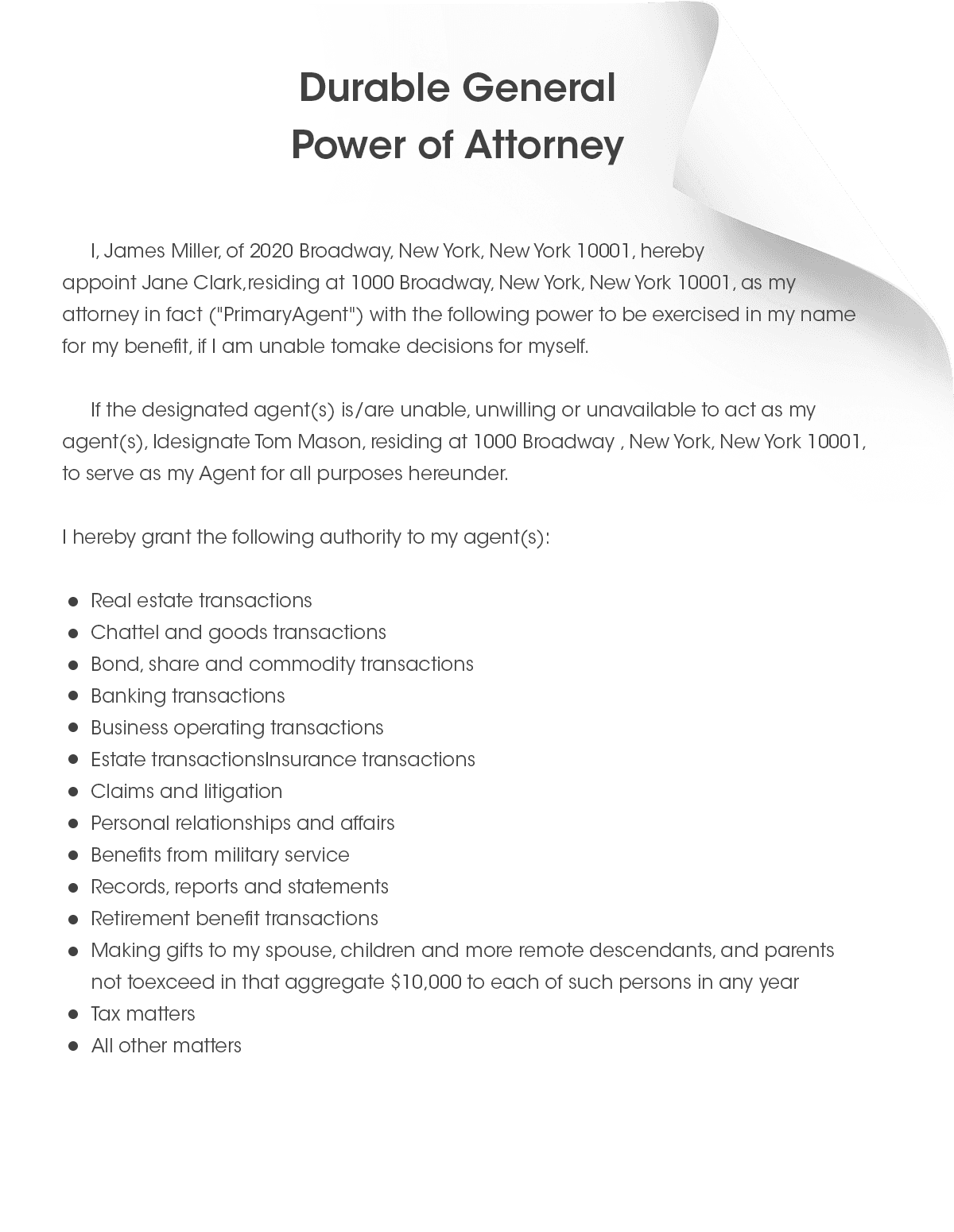

1. Names of the Principal and Agent

The form must clearly identify:

- The principal – the person granting authority (you).

- The agent (or attorney-in-fact) – the person who will act on your behalf.

Your agent should be someone you trust, as they will have the legal power to handle your affairs if you become incapacitated.

2. Scope of Authority

You can choose to give your agent broad authority over your financial and business matters or limit their powers to specific tasks. The document should specify:

- The types of transactions the agent is authorized to handle.

- Whether their authority applies immediately or only if you become incapacitated.

3. Types of Transactions Covered

A Durable General Power of Attorney can include authority over various financial and legal matters, such as:

- Buying and selling real estate

- Managing bank accounts and investments

- Signing contracts

- Filing tax returns

- Paying bills and handling insurance matters

- Overseeing business operations

If you need a legally sound general power of attorney template, using a professional tool ensures your document is properly structured and covers all necessary legal requirements.

4. Limitations and Restrictions

You can set specific restrictions on your agent’s authority. For instance, you might allow them to manage your finances but prohibit them from selling your home without your consent. These limitations ensure your agent acts within your intended boundaries.

5. Durability Clause

For the document to remain in effect after you become incapacitated, it must include a durability clause. Without this, the power of attorney will become void if you lose the ability to make decisions.

By including these key elements, you can ensure your Durable General Power of Attorney is legally sound and aligns with your personal and financial needs.

How to Revoke a Durable General Power of Attorney

You can end your agent’s authority at any time as long as you have mental capacity. Revocation is not automatic just because you changed your mind—follow these steps to ensure third parties stop relying on the old document.

Who can revoke:

- You, the principal, anytime you have mental capacity

- Not after incapacity—then a court may need to act

What to prepare:

- A brief Revocation of Power of Attorney identifying you, the agent, and the original POA date

- Signature using the same (or stricter) formalities as your state required for the original POA (often notarization; sometimes witnesses)

Make it stick:

- Notify your former agent in writing (trackable mail or acknowledged email)

- Alert third parties who might rely on the old POA: banks, brokerages, insurers, benefits agencies, your business’s vendors

- Ask for confirmation that their records are updated

If the POA touched real estate:

- Check whether the original POA was recorded with the county

- If so, record the revocation in the same office so title companies stop relying on it

If your situation changes and you need to revoke an existing power of attorney, the process doesn’t have to be complicated. FormPros can guide you through each requirement—from preparing a clear, state-aware revocation to keeping a clean paper trail. You can create a Revocation of Power of Attorney with FormPros in minutes, ensuring institutions recognize the change and your interests remain protected.

Create a Revocation of Power of Attorney

What are the Most Common Mistakes to Avoid?

Creating a Durable General Power of Attorney is an important legal step, but mistakes in drafting or execution can lead to complications. Here are some of the most common pitfalls to avoid:

1 — Choosing the Wrong Agent

One of the biggest mistakes is appointing someone who is not trustworthy or financially responsible. Your agent will have significant control over your affairs, so it’s crucial to select someone who is reliable, capable, and willing to act in your best interest. If necessary, consider appointing a backup agent in case your primary choice becomes unavailable.

2 — Failing to Clearly Define Authority

A power of attorney should specify exactly what powers your agent has. A vague or overly broad document can lead to misunderstandings, legal challenges, or even abuse of power. If you’re unsure how to structure your document, a power of attorney generator can help guide you through the process, ensuring clarity and legal compliance.

3 — Not Making the Power of Attorney Durable

If your goal is to ensure the document remains in effect if you become incapacitated, it must include a durability clause. Without this clause, the power of attorney will automatically become void if you lose mental capacity, which defeats its intended purpose.

4 — Overlooking State-Specific Requirements

Each state has its own laws regarding powers of attorney, including specific language, signing requirements, and witness or notary rules. Failing to comply with state laws could render the document invalid. Always check your state’s regulations or consult an attorney to ensure compliance.

5 — Not Updating the Document

Life circumstances change, and so should your power of attorney. Many people make the mistake of creating the document and never revisiting it. If your agent becomes unavailable, your financial situation changes, or new legal requirements emerge, you should update the document accordingly.

6 — Forgetting to Notify Financial Institutions

Even if you have a valid power of attorney, some banks and financial institutions may have their own requirements before recognizing an agent’s authority. Failing to notify them in advance can lead to delays or refusal to honor the document. Consider submitting a copy to your bank and confirming their policies.

7 — Not Keeping a Copy in a Safe, Accessible Place

A power of attorney is useless if no one knows where it is or can’t access it in an emergency. Store the original document in a secure but accessible location and provide copies to your agent, financial institutions, and relevant parties.

Do I Need to Use a Lawyer, Accountant or Notary to Help Me?

While you are not legally required to hire a lawyer or accountant to create a Durable General Power of Attorney, professional guidance can help ensure the document is correctly drafted and complies with state laws. However, most states require the document to be notarized for it to be legally valid. Some states may also require witnesses.

Using a free durable power of attorney form can help simplify the process while ensuring your document meets legal standards.

Why Use Our Durable General Power of Attorney Form Generator?

Creating a Durable General Power of Attorney with FormPros is quick, easy, and hassle-free. Our intuitive power of attorney generator guides you through a simple questionnaire, tailoring the document to match your specific needs. Once completed, you can instantly download your customized form. Need to make changes? No problem—you can revisit and update your document anytime.

At FormPros, your privacy and security are our top priorities. We use advanced encryption technology to protect your personal information, ensuring that your data remains 100% private and secure throughout the process. Whether you need a power of attorney generator or another essential legal document, you can trust FormPros for a seamless and secure experience.

Create a Power of Attorney Form Now

FormPros Has You Covered

Simplify your paperwork with FormPros! From creating paystubs, W-2s, and 1099-NEC forms to generating LLC Operating Agreements and even voided checks, our easy-to-use platform has you covered. Save time, reduce errors, and handle your business documents with confidence. Start now and see how FormPros makes professional form generation fast, affordable, and hassle-free!

Durable General Power of Attorney FAQs

-

Can a Durable General Power of Attorney be revoked?

Yes, a Durable General Power of Attorney can be revoked at any time as long as you are mentally competent. To revoke it, you must create a written revocation document, notify your agent, and inform any institutions or individuals who have received a copy of the power of attorney.

-

Does a Durable Power of Attorney expire?

A Durable General Power of Attorney typically does not expire unless you specify an expiration date in the document. However, it automatically terminates upon your death or if you revoke it while still mentally competent.

-

Can two people share Power of Attorney?

Yes, you can appoint co-agents, meaning two people share the authority to act on your behalf. However, unless you specify otherwise, they may need to act jointly, which could slow down decision-making. Many people prefer to name a single agent with a backup in case the primary agent is unavailable.

-

What happens if my Power of Attorney agent misuses their authority?

If your agent abuses their authority, they can be held legally accountable for fraud, financial abuse, or mismanagement. You or your family can take legal action, including revoking the power of attorney and pursuing civil or criminal penalties against the agent.

-

Can a Power of Attorney make medical decisions?

No, a Durable General Power of Attorney only covers financial and business matters. If you want someone to make medical decisions on your behalf, you need a Medical Power of Attorney (Health Care Proxy), which is a separate legal document.

-

Can I use a Power of Attorney to manage someone else’s Social Security benefits?

No, the Social Security Administration (SSA) does not recognize a power of attorney. If you need to manage Social Security benefits for someone else, you must apply to become their Representative Payee through the SSA.

-

Can a Durable Power of Attorney be used after death?

No, all powers granted under a Durable General Power of Attorney end upon the principal’s death. At that point, only the executor or personal representative of the estate can manage the deceased person's affairs.

-

What is the difference between a Durable Power of Attorney and a Living Will?

A Durable Power of Attorney allows an agent to handle financial and business matters, while a Living Will (Advance Directive) outlines your medical treatment preferences if you become incapacitated. These are separate documents but can be used together as part of an estate plan.

-

Can I create a Power of Attorney for someone else?

No, a power of attorney must be created and signed by the principal while they are mentally competent. If someone is already incapacitated, you cannot create a power of attorney for them; instead, you may need to go to court to request guardianship or conservatorship.

-

Can a Power of Attorney be used for online banking and digital accounts?

Yes, if the document specifically grants digital asset management authority, your agent can manage your online banking, investments, and other digital accounts. However, some institutions have additional security requirements, so you should check with your bank or financial provider.