Differences Between Payday, Pay Period And Pay Cycle

Employers, workers, and independent contractors must understand three important payroll terms: payday, pay period, and pay cycle. In order to manage payroll effectively, business owners must be able to set up payroll systems that accurately calculate and pay workers. Moreover, the pay process must be explained to the entire staff.

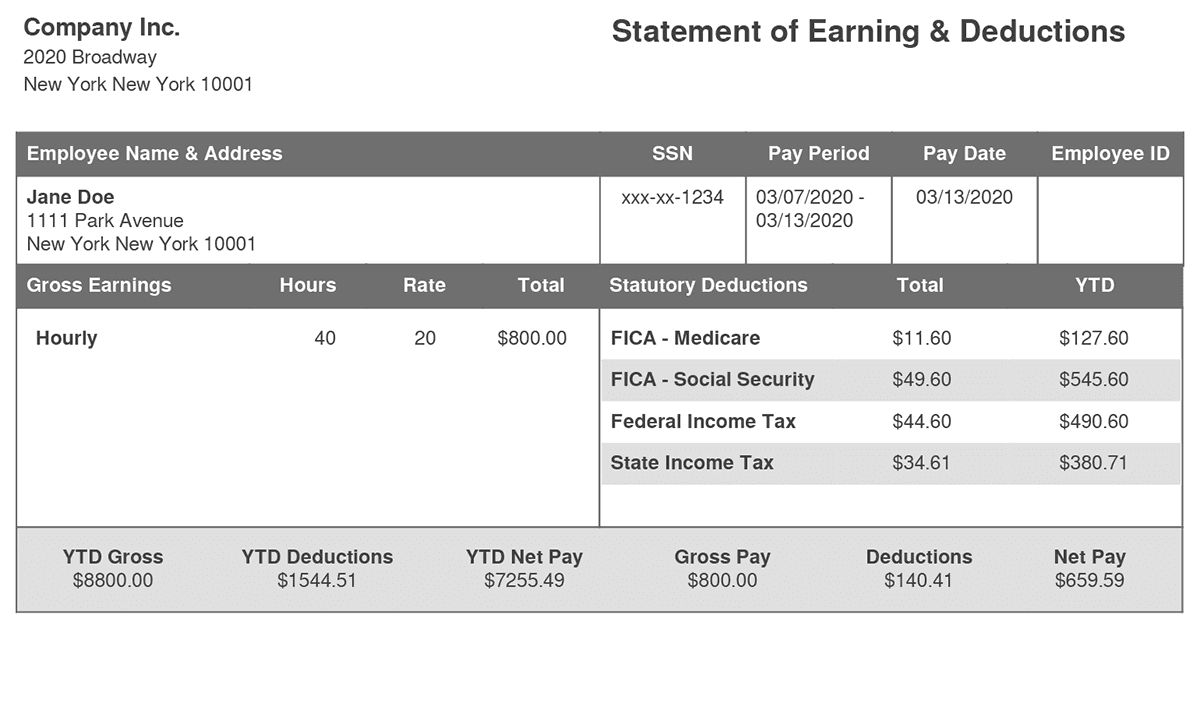

In this article, we will not only define these payroll terms, but also explain the information that is reported on a paystub and provide a real-world payroll calculation example.

Understanding the Definitions Associated with Pay Period

To fully grasp how income and tax withholdings are calculated and presented on your pay stub, it is important to first understand three key terms: payday, pay period, and pay cycle. These terms define when and how you receive your wages and clarify what timeframe your paycheck covers.

– Payday –

A payday is the specific date on which employees or independent contractors receive their wages. It is the day an employer issues payments, either through direct deposit, paper check, or payroll card.

For instance, if a company follows a biweekly pay schedule, meaning employees are paid every two weeks, their April paydays might fall on April 5th and April 19th. On the other hand, if the company follows a semimonthly schedule (twice a month), paydays could be on April 15th and April 30th.

Ultimately, payday is crucial for budgeting, as it determines when employees have access to their earnings and when tax deductions are officially processed.

– Pay Period –

The pay period, on the other hand, is the timeframe for which employees are compensated. It starts on a specific date and ends on another, covering the work performed or hours logged during that time. Depending on the employer’s pay cycle, the length of a pay period can vary.

For example, using the biweekly pay schedule mentioned earlier, a company paying employees on April 5th would have a pay period covering March 22nd to April 4th. Then, the next pay period would be April 5th to April 18th, with payday falling on April 19th.

For semimonthly pay, the two pay periods for April could be April 1st to April 15th and April 16th to April 30th. Even though both biweekly and semimonthly involve two paychecks per month most of the time, their pay periods don’t always align due to differences in how months are structured.

Therefore, understanding the pay period is important because your paycheck’s earnings, tax deductions, and benefits contributions apply specifically to this timeframe.

– Pay Cycle –

A pay cycle refers to the company’s payroll structure—how often employees are paid and how payroll calculations are processed. This structure is determined by company policy and, in many cases, can differ based on industry standards, employment classification (hourly vs. salaried), and regulatory requirements. Common pay cycles include:

- Weekly – Employees receive wages every seven days (e.g., every Friday). This is especially common in construction, retail, and gig work.

- Biweekly – Employees are paid every two weeks (e.g., every other Friday). Many corporate and healthcare organizations use this schedule.

- Semimonthly – Employees receive two paychecks per month (e.g., on the 15th and last day of the month). This is often preferred for salaried workers.

- Monthly – Employees receive one paycheck per month (e.g., on the last business day). Although less common, it is used in some industries, particularly for executive positions.

By understanding your pay cycle, you can better plan your finances, since it determines how frequently you receive your wages and how taxes and deductions are spread throughout the year.

Why These Terms Matter

A pay stub breaks down an employee’s earnings, tax withholdings, and deductions based on these terms. When reviewing a pay stub, it’s especially important to distinguish between:

- Current Amounts – Earnings and deductions for the most recent pay period.

- Year-to-Date (YTD) Amounts – Cumulative earnings and deductions from the beginning of the year up to the current paycheck.

By having a clear understanding of the differences between payday, pay period, and pay cycle, employees and independent contractors can better manage their finances, anticipate deductions, and ensure they are paid correctly.

Specific Information on a Pay Stub

Employers provide this information to each employee and contractor:

— Payroll Cycle: The number of pay periods determines how much salary is paid on each payroll date. Additionally, it determines the start and ending days for computing hourly payroll.

— Wages: Gross pay and net pay. Wages may be based on a salary, or calculated using an hourly rate of pay.

— Tax Withholdings: Federal, state, and possibly local amounts withheld for taxes.

— Benefit Withholdings: Amounts withheld for the employee’s share of insurance premiums, or funds to be invested in a retirement plan.

As a result, every business must collect data to calculate gross wages and net pay. However, if you employ independent contractors, you don’t need to withhold taxes from pay.

Calculating Net Pay

Here are the details you need to calculate net pay:

1) Gross Wages

Wages earned before any withholdings or deductions are subtracted. Gross wages for a pay period amount are calculated in one of two ways:

- Salaried Employees: (Annual salary / number of pay periods in a year)

- Hourly Employees: (Hours worked X pay rate per hour)

Gross wages may include additional compensation, including sick pay, holiday pay, or bonuses.

2) Hours Worked and Pay Rate

The hours worked total is especially important for non-exempt (hourly) workers. The pay stub should include regular hours (up to 40 hours per week) as well as overtime hours.

The paystub must detail all hours worked, and the rate of pay earned for each hour. Some workers, including those covered by union contracts, must be paid a specific rate of pay for overtime or double-time hours.

*Salaried workers may also see hours listed on their pay stubs.*

3) Tax Deductions

Workers determine their federal income tax withholdings amounts by completing Form W-4, and each state has a tax withholding form.

Social Security Tax:

- Employee Contribution: 6.2% of earnings, up to a wage base limit of $176,100. This means the maximum Social Security tax an employee will pay in 2025 is $10,918.20.

- Employer Contribution: Employers match this 6.2% rate, contributing an equal amount for each employee.

Medicare Tax:

- Employee Contribution: 1.45% of all wages, with no wage base limit.

- Employer Contribution: Employers also contribute 1.45% of all employee wages.

- Additional Medicare Tax: Employees earning over $200,000 annually are subject to an additional 0.9% Medicare tax on earnings above this threshold. Employers are required to withhold this additional tax but do not match it.

In total, for employees earning up to $176,100, the combined FICA tax rate is 7.65% (6.2% for Social Security and 1.45% for Medicare). Employers also pay a combined rate of 7.65%, which is deductible as a business expense.

Here’s an example that you can review to understand the payroll process.

Example Payroll Calculation

Sally’s annual income is $60,000, and her firm processes payroll 26 times a year. Sally’s gross wages each pay period total ($60,000 / 26), or $2,308 per pay period.

Based on the allowances on her W-4, her company withholds 20% of her gross pay ($462) for federal taxes, and 5% ($115) for state taxes. Sally also pays $50 each pay period for her share of the company health insurance plan.

Sally’s net pay is $2,308, less a total of $577 for taxes, and $50 for her health insurance premiums. Her net pay is $1,681.

The pay stub must include all of this information for the current payroll period and year-to-date. The pay stubs you generate may also include unemployment tax payments. Hourly workers need details about their total hours worked, and any hours that are paid as overtime wages.

Employers need to generate accurate pay stubs, and thankfully, using technology can help.

Take Charge of the Process

FormPros provides a pay stub generator that is not only user-friendly but also helps you produce accurate pay stubs in less time. Use FormPros to take charge of the pay stub process.

FormPros Has You Covered

Simplify your paperwork with FormPros! From creating paystubs, W-2s, and 1099-NEC forms to generating LLC Operating Agreements and even voided checks, our easy-to-use platform has you covered. Save time, reduce errors, and handle your business documents with confidence. Start now and see how FormPros makes professional form generation fast, affordable, and hassle-free!