A Step-by-Step Guide to Filling Out Form 1099-MISC

The 1099-MISC contains a number of standard fields, or boxes, in which the payer enters only information that is relevant to a recipient’s particular situation.

The following is a quick overview of the information you will need to enter in the boxes. For more detailed information, you should consult the IRS’s instructions for filling out the 1099-MISC form.

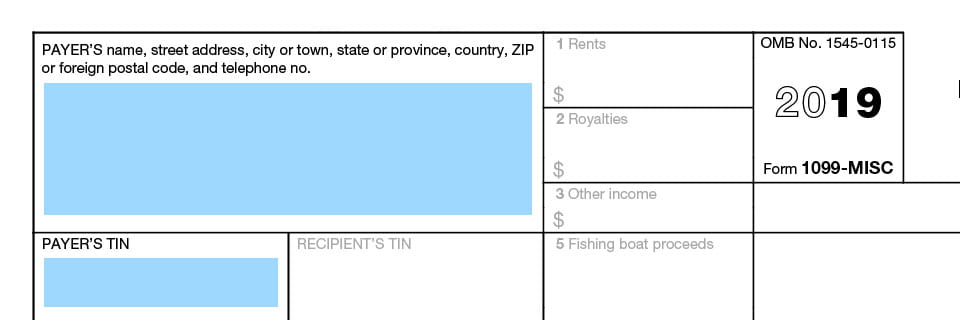

Payer and Recipient’s Information

The IRS provides large field in the upper right-hand corner of the 1099-MISC form for the payer (that’s you, the business owner) to enter their full name, address, town, state or province, zip code or foreign postal code, and telephone number.

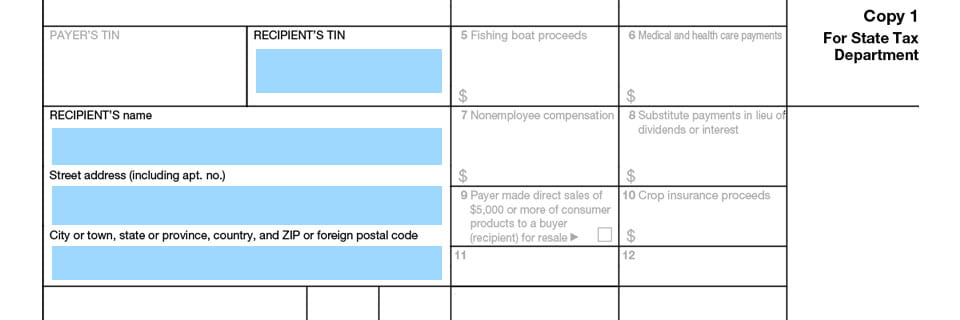

Directly beneath that field are two side-by-side boxes, one for the payer’s federal tax identification number (TIN) and the other for the recipient’s. The TIN may be a social security number or an employer identification number (EIN). The next three fields on the right-hand side are where you enter the recipient’s information: their full name, their street address, their city, state or province, country, and zip or foreign postal code.

Account Information

Beneath the recipient’s information is a field labeled Account Information. The payer only enters information in this field if they are issuing multiple 1099-MISC forms to a single recipient.

You will need multiple copies of the 1099-MISC. The table below showcases the purpose of the different copies:

| Copy A | For the IRS |

| Copy 1 | For the state tax department (if applicable) |

| Copy B | For the recipient |

| Copy 2 | For the recipient’s state tax return (if applicable) |

| Copy C | For your records |

FATCA Filing Requirement

The Foreign Account Tax Compliance Act (FATCA) mandates that participating foreign financial institutions report the financial earnings of U.S. account holders. Payers who check this box are generally U.S. citizens reporting interest or dividends earned from a foreign bank or lender.

2nd TIN Notice

You need to check this box if the IRS notified you twice that the recipient’s TIN was incorrect.

Enter the Total Payment Information

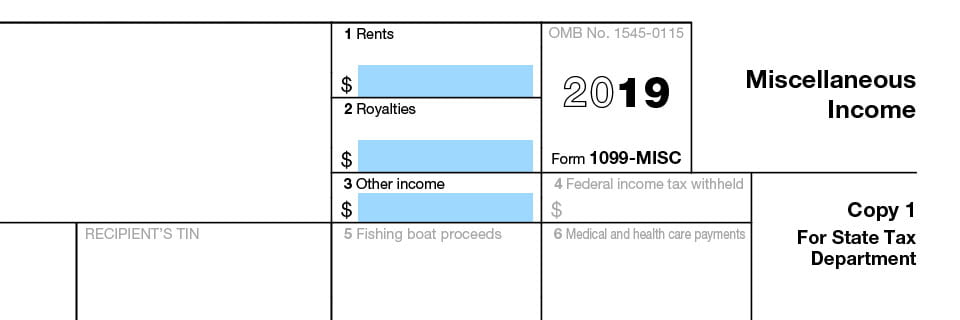

Box 1 : Rents

In this field you report rents from real estate listed on either Schedule E or Schedule C of your tax form.

Box 2: Royalties

Box 2 is where you would report payments of royalties for oil, gas, mineral properties, copyrights, and patents that appear on Schedule E.

Box 3: Other Income

You use Box 3 to report other income from Form 1040. Prize money and trade or business income that you reported on Schedule C will also be listed here.

Box 4: Federal Income Tax Withheld

This field is for recording backup withholdings or withholdings on Indian gaming profits.

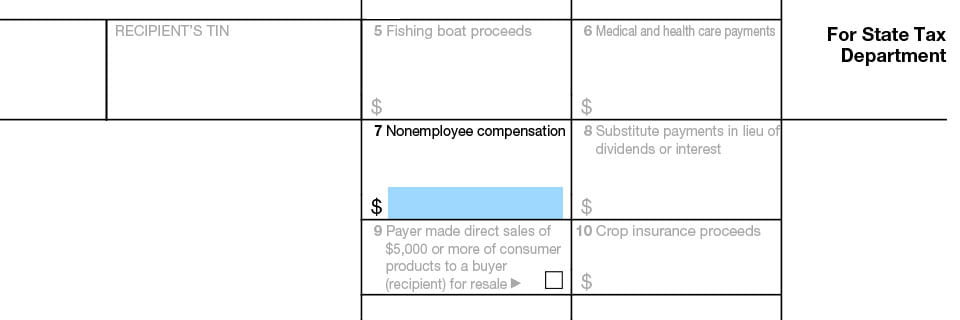

Box 5: Fishing Boat Proceeds

You enter money received from self-employed fishing boat operators here.

Box 6: Medical and Health Care Payments

Enter medical and health care payments that you reported on Schedule C.

Box 7: Nonemployee Compensation

The most commonly used box, this is where you report the amount of money you paid to independent contractors working in a given tax year.

Box 8: Substitute Payments in Lieu of Dividends or Interest

Substitute payments in lieu of dividends typically occur when a broker lends out the stock you own to short-sellers. If the stock declines as a result of the gambit, you will earn revenue that you must report in this box.

Box 9: Payer Made Direct Sales of $5,000 or More of Consumer Products to a Buyer (Recipient) for Resale

This is simply a check box to indicate whether or not the payer made more than $5,000 in direct sales. You do not have to indicate the exact dollar amount here.

Box 10: Crop Insurance Proceeds

If you received revenue from crop insurance, the amount goes in this field.

Boxes 11 & 12

While they appear on the form, these boxes are currently void, and you should not report any information here.

Box 13: Excess Golden Parachute Payments

This figure will also appear on your 1040 form.

*Good to Know: Excess golden parachute payments are subject to a 20% excise tax.

Box 14: Gross Proceeds Paid to an Attorney

If you consulted or retained an attorney for business purposes in a given tax year, that amount needs to be recorded here.

Boxes 15a & 15b: Section 409A Deferrals and Income

Companies sometimes elect to pay employees and principals via non-qualified deferred compensation. In other words, the pay is earned one year, but the payee elects to receive compensation later.

Box 15a reports the amount of deferred pay, and Box 15b reports current year income (income in Box 15b should also appear in Box 7).

*Good to Know: This area of the tax code is particularly complex; you should consult the IRS or a tax professional for further information about Section 409 rules and regulations.

Box 16: State Tax Withheld

This is where you report state taxes withheld from your income. If you worked in more than one state, you need to enter information for the other state or states as well.

Box 17: State/Payer’s State No.

Record the official state(s) number here.

Box 18: State Income

Report income you received from each of the states where you worked in this box.

FormPros Has You Covered

Backed by a team of legal and tax experts, our online fillable forms takes the guesswork out of the process of creating 1099-MISC forms.

We don’t just stop at creating an intuitive user experience. We also offer:

- Secure encryption of data.

- Pre-purchase preview of all forms.

- Friendly chat support from experts who can address any confusion or concerns you might have.

- A 100% money-back guarantee if any form we generate does not meet your complete satisfaction.

Running a small business is demanding enough. At the very least, your tax forms should be simple.