Are Pay Stubs Better Than Excel Spreadsheets?

You need to work efficiently to grow your business. Successful companies expand by completing more work in less time. One of the most complex tasks you must complete is payroll, and that includes pay stubs.

This article defines pay stubs, and the information needed to create pay stubs. You’ll read about common mistakes, why using Excel spreadsheets is a bad idea, and how FormPros makes the pay stub process easy.

Let’s start with the definition.

What is a Pay Stub?

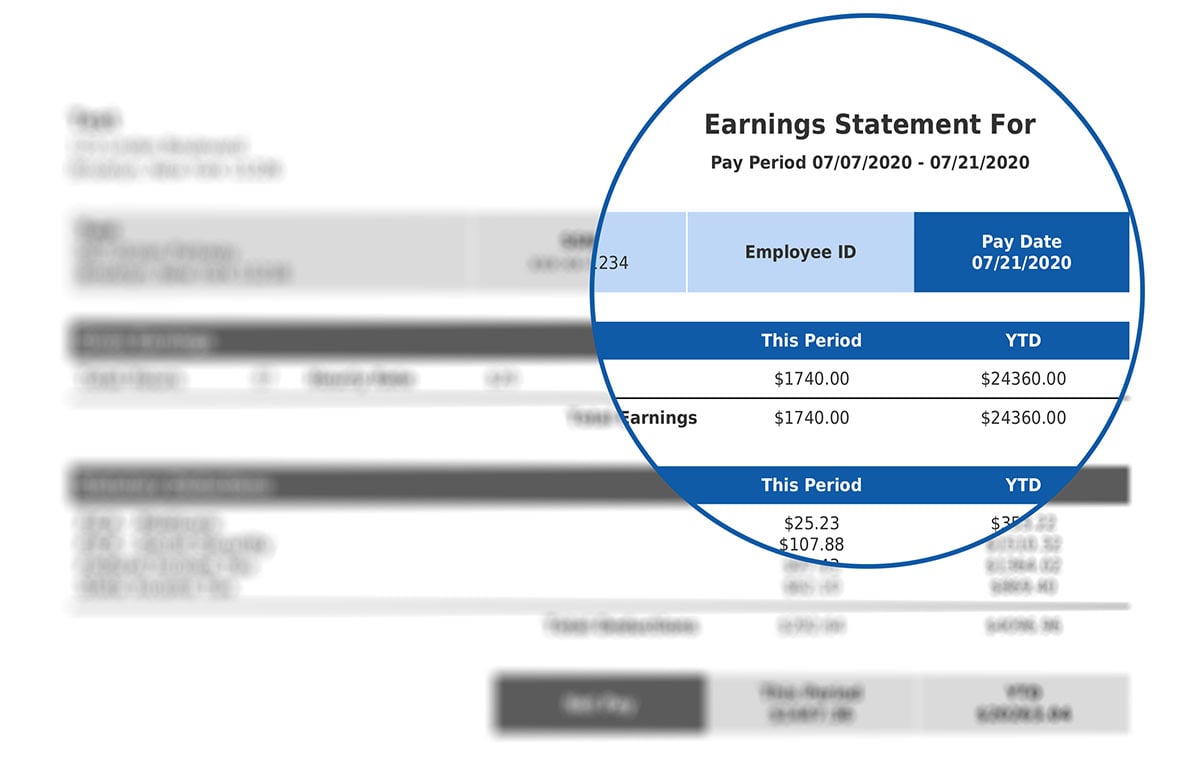

A pay stub lists all of the key information related to an employee’s pay. The pay stub provides information on wages, tax withholdings, and benefit withholdings.

The rules regarding pay stubs vary by state. Some states require employers to provide pay information to workers, while other states do not. Businesses should confirm the requirements in each state where they employ workers.

Employees should keep their most recent pay stubs as proof of income. If an individual applies for a loan, the pay stub confirms the borrower’s gross income.

Employers should keep pay stubs on file, if they are generated. The pay stub information should match the data on each employee’s W-2 form, which individuals used to file their personal tax returns.

Information Needed to Create a Pay Stub

Determine this information for each employee:

- Payroll cycle: The number of pay periods determines how much salary is paid on each payroll date. It also determines the start and ending days for computing hourly payroll.

- Wages: Gross pay and net pay. Wages may be based on a salary, or calculated using an hourly rate of pay.

- Tax withholdings: Federal, state, and possibly local amounts withheld for taxes.

- Benefit withholdings: Amounts withheld for the employee’s share of insurance premiums, or funds to be invested in a retirement plan.

Here are some common mistakes that businesses make when generating pay stubs.

Common Pay stub Mistakes

Review your pay stubs carefully, to avoid these mistakes:

#1: Current period vs. year-to-date data

Your workers must clearly understand the differences between current period and year-to-date information. If you don’t label each dollar amount correctly, your staff will be confused.

Workers use year-to-date data to confirm that their gross wages, tax withholdings, and benefit contributions are on track.

#2: Outdated W-4 information

Your employees may need to change tax withholdings, based on a pay raise, having a child, or if a worker gets married. You need the current W-4 to process payroll correctly. Ask each worker for updated W-4 information periodically, and use the updated forms on the next payroll run.

#3: Incorrect pay cycle

Workers need to plan their finances based on your company’s pay cycles. It’s important that your pay stubs clearly state the pay date, and that workers understand how frequently pay is processed (weekly, bi-weekly, monthly).

#4: Incorrect tax data

The federal and state tax laws change constantly, and your pay stub must include withholdings based on current tax law. If the withholdings are not correct, the worker may have an unexpected tax liability at the end of the year, and possible owe penalties for underpayment of taxes.

Using spreadsheets makes the pay stub process more time consuming.

Why Excel spreadsheets are a bad idea

Here are some reasons to move away from spreadsheets, and to use technology:

- Tabs: The tabs on a spreadsheet may not be properly linked.

- Version: Are you using the current version of the spreadsheet? Are you saving the data using the same file name?

- Integration: Spreadsheets can’t be integrated with software tools, including accounting software. If you have to manually enter data into software, the risk of error is higher.

- Training employees is more difficult, because using spreadsheets requires more steps and input work. You’ll spend more time on training, and the risk of error is higher when you delegate work on someone new.

As your business grows, the number of transactions increases, and so does the number of pay stubs you must produce. If you’re posting more transactions, spreadsheet data entry makes accounting more difficult.

Employers need to generate accurate pay stubs, and using technology can help.

Minimize Pay Stub Errors With FormPros

FormPros provides a pay stub generator that is user friendly, and helps you produce accurate pay stubs in less time. The software automatically calculates earnings and deductions, based on the data you input. Your information is also processed in a secure online system.

Use FormPros to take charge of the pay stub process.

Which payroll task is the most difficult for you?