What is a Paystub?

Ever stared at your paycheck and wondered where your money went? You’re not alone. For many employees, a paystub is just another slip of paper or digital file—but it holds vital information that explains exactly how much you earned, what was deducted, and what you actually get to take home.

Whether you’re an employer issuing paychecks or an employee trying to understand them, knowing how to read—and even create—a paystub is essential. In this guide, you’ll learn what a paystub really is, what details it must include, and how to generate one correctly to ensure compliance and clarity for everyone involved.

Table of Contents

Paystubs Explained

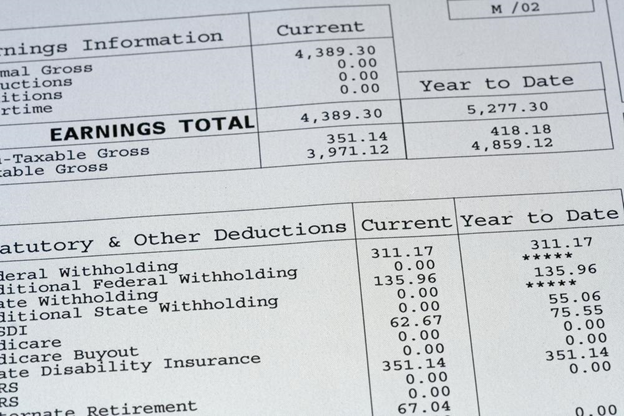

A paystub is a form that lists details about an employee’s pay, such as taxes and other deductions taken out of their earnings.

A pay stub shows wages earned for that specific pay period (current pay period), as well as year-to-date amounts (YTD). Deductions also appear on an employee’s pay stub. In the end, the pay stub reveals the employee’s actual take-home pay (net pay) to be deposited into their account.

Deductions That You Will Find on a Pay Stub Include:

- Employee tax deductions: These are taxes mandated by government agencies, such as federal income tax, state and local taxes (if applicable), and the employee’s portion of FICA tax.

- Benefits and other deductions: These deductions depend on the extra benefits that the employer provides and what the employee wants to be deducted, such as insurance premiums, retirement plans, or charitable donations.

- Employer contributions: Items contributed from an employer may also appear on an employee’s pay stub, including the employer’s contribution to employee benefits or the portion of FICA tax.

Pay stubs let employees ensure that they get the correct paycheck amount and employers a way to settle discrepancies in an employee’s pay. As an employee, you are responsible for keeping a copy of each of your pay stubs. Your employee must also keep a copy.

How to Create a Pay Stub

Employers must know how to properly create a paystub to accurately pay their employees on time and avoid any discrepancies in pay.

If you are an employee, it is useful to know the process your employer uses to create your pay stubs so you can better understand your pay.

Information needed to create a paystub –

An employer creates employees pay stubs using the following information:

- Payroll cycle

- Wages for all employees

- Tax withholdings

- Benefit withholding for each employee.

You can use your employees’ W-4 forms to determine their withholdings and allowances that should be deducted from each pay period.

Determine the Payroll Cycle

The payroll cycle is important as it determines how often you pay your employees. The four different types of payment schedules are:

- Weekly: once a week

- Bi-weekly: every 2 weeks

- Semiweekly: twice a week

- Monthly: once a month

Most companies pay their employees bi-weekly, but the payroll period you choose will largely depend on how you want to approach your business’s yearly schedule.

Calculate Pay and Gross Wages

As an employer, you must track your employees’ hours to calculate their pay. The easiest way to do that is by keeping the information in a spreadsheet.

To calculate an employee’s gross wages, multiply the number of hours the employee has worked during that pay period by their hourly rate.

From there, you will have to calculate payroll deductions and allowances (or exemptions). Your employees specify their allowances on their W-4. A deduction is what can be deducted from your income when you do your taxes, and you will have to pay close attention to your employees’ tax-related forms to make proper withholdings.

You must also factor in other aspects of payroll processing on top of deductions and allowances, such as federal tax and employee benefits. This step can be time-consuming, so it is important to have all of the information organized on a spreadsheet.

You may have to consider:

- Federal taxes

- Local taxes

- Social Security

- Medicare

- Workers’ compensation contribution

- 401(k) contribution

Calculate Net Pay

To calculate net pay, you must subtract withholdings from the employee’s gross pay. Net pay is how much each employee takes home at the end of each pay period.

Net pay is the amount that employees often look at first in their pay stub, and from there, they verify that their gross pay and deductions are properly calculated.

Other Things to Know About Pay Stubs

Here are some additional tips for understanding pay stubs:

- There is no federal regulation on pay stubs, but each state has its own laws about providing pay stubs for employees, so you will want to review state laws to ensure that your business complies by issuing pay stubs.

- For employees, it is important to know that some states don’t require employers to provide pay stubs at all. If your employer does not provide pay stubs, it is worth requesting them anyway in order to keep a record of your pay.

- Pay stubs are available in paper format or online. As an employer, you want to make sure that pay stubs are accessible to all of your employees. If paper is your preferred method of administering pay stubs, you may want to keep electronic records as a backup. In the event of uncontrollable circumstances, such as a natural disaster, having relied on paper copies of documents may make it difficult to recover.

- Excel is a great spreadsheet tool to create pay stubs, but it is prone to errors. FormPros is a more reliable alternative that will save you time and is less expensive than an account.

- If you continue to have trouble generating pay stubs, enlist the help of an accountant. You want to make sure that your pay stubs are always accurate.

States that do not require paystubs:

The following states don’t require employers to provide a pay statement, but it’s a good practice to regularly issue pay stubs in line with your pay period. Since there’s no required format, employers can choose to deliver pay statements electronically if they opt to provide them.

| Alabama | Arkansas | Florida |

| Georgia | Louisiana | Mississippi |

| Ohio | South Dakota | Tennessee |

States requiring access pay stubs:

The following states require employers to provide a statement detailing an employee’s pay information, though it doesn’t have to be in writing or as a paper pay stub. Employers can generally meet this requirement by offering electronic pay stubs, as long as employees can access them.

Note: While most states accept this approach, some may require additional features, such as the ability to print the electronic statements.

| Alaska | Arizona | Idaho | Illinois |

| Indiana | Kansas | Kentucky | Maryland |

| Michigan | Missouri | Montana | Nebraska |

| Nevada | New Hampshire | New Jersey | New York |

| North Dakota | Oklahoma | Pennsylvania | Rhode Island |

| South Carolina | Utah | Virginia | West Virginia |

| Wisconsin | Wyoming |

States requiring access or print paystub options:

These states require employers to provide a written or printed pay statement detailing the employee’s pay information. However, the statement doesn’t need to be delivered with the paycheck or in a specific format.

A common interpretation of the law allows employers to provide electronic pay stubs, as long as employees can access and print them. Employers must ensure that employees have both access to the electronic pay stubs and the ability to print them if needed.

Note: While most state agencies follow this interpretation, some may have additional requirements, such as obtaining employee consent to receive pay stubs electronically.

These states include:

| California | Colorado | Connecticut |

| Iowa | Maine | Massachusetts |

| New Mexico | North Carolina | Texas |

| Vermont | Washington |

States requiring opt-out option:

Some states require employers to allow employees the option to opt out of any paperless pay program. This typically applies when the employer implements an electronic pay stub system. In these opt-out states, employees who choose to opt out will start receiving paper pay stubs again.

| Delaware | Minnesota | Oregon |

Note: Hawaii is currently the only opt-in state that requires employee consent before implementing an electronic paperless pay system. Employers must provide a written or printed pay statement detailing the employee’s pay unless the employee consents to receive it electronically.

My Quick Summary

Paystubs are important documents to help employees keep track of their pay and know exactly how much they take home each paycheck. Employers need to generate accurate pay stubs for their employees, and using technology can help.

FormPros allows you to create pay stubs using a few simple steps, saving you the trouble of hiring an accountant for payroll. Utilize FormPros to simplify the paystub process.

FAQs

-

What should I do if my paystub shows incorrect information?

If you notice errors—like incorrect hours worked, wrong deductions, or a missing benefit—report the issue to your HR or payroll department immediately. Keep a record of your communication and request a corrected paystub. Mistakes can affect your taxes and financial planning, so they should be resolved promptly.

-

Can independent contractors receive paystubs?

While employers are not required to issue paystubs to independent contractors, they can still provide payment records for transparency. Contractors can also create their own paystubs using tools like FormPros for proof of income, especially for things like renting an apartment or applying for loans.

-

How long should I keep my paystubs?

It's a good idea to keep paystubs for at least one year or until you’ve verified your W-2 or annual tax return. For purposes like loan applications or disputes with employers, keeping them longer—up to 3–5 years—is smart. Always store them in a secure, backed-up location if kept digitally.

-

What’s the difference between a paystub and a W-2 form?

A paystub details your earnings and deductions per pay period, while a W-2 is an annual summary of your total wages and tax withholdings submitted to the IRS. You’ll use your W-2 to file your taxes; your paystubs can help you verify that information throughout the year. You can read more about the relationship between a paystub and a W2 here.

-

Can a pay stub be used as proof of income for loans or rentals?

Yes. Many lenders, landlords, and government programs accept recent pay stubs as proof of income. Typically, they will ask for your most recent two to three stubs to verify stable employment and earnings.

-

What if I lose my pay stub—can I request a replacement?

Yes. Most employers can reissue a pay stub if you lose it, especially if they use digital payroll systems. If your employer uses paper-only methods, replacement may take longer. Always check your state’s rules regarding employee access to payroll information.

-

Is it legal for an employer to alter a paystub after it’s been issued?

An employer can correct a paystub if it contained an error, but they must clearly communicate the change and provide a corrected version. Any intentional alteration to deceive or manipulate wages is illegal and can be reported to your state labor board.

FormPros Can Help!

- Instant Download

- Preview Pre-Purchase

- Expert Help

- Step-by-Step Instructions