Differences Between Payday, Pay Period And Pay Cycle

Employers, workers, and independent contractors must understand three important payroll terms: payday, pay period, and pay cycle. Business owners must be able to set up payroll systems that accurately calculate and pay workers, and the pay process must be explained to the entire staff.

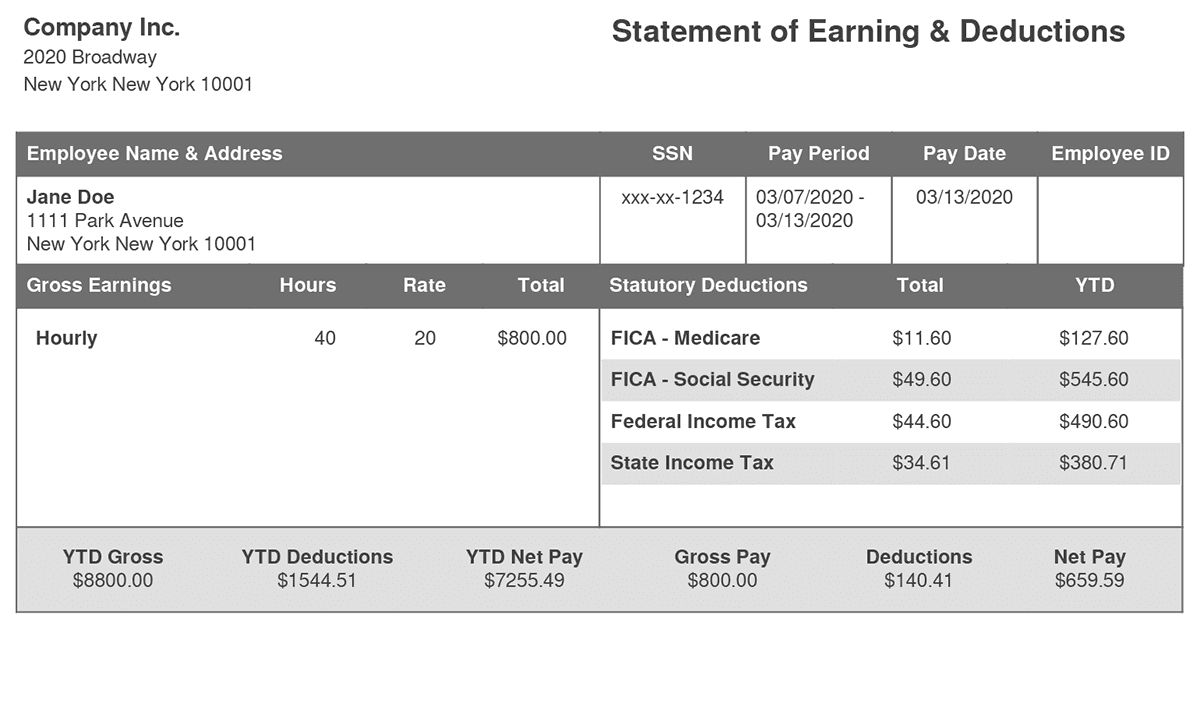

In this article we will define these payroll terms, explain the information that is reported on a pay stub, and provide a real world payroll calculation example.

Understanding the Definitions

To understand how all income and tax withholdings break down on your checkstub, you need to know these three terms:

Payday:

These are the specific days on which workers receive their pay. For example, a firm may process payroll every two weeks (14 days or biweekly) on a Friday. This April pay days may fall on April 1st, 15th and 29th.

Pay period:

The period of time that workers pay check covers. Using the same example above, the pay periods would be two weeks (14 days or biweekly) from April 2nd to 15th, then from April 16th to 29th and so on.

Pay cycle:

The rules that the firm has set to calculate and pay their workers. Employees and independent contractors may be paid weekly, every two weeks (biweekly), twice a month (semimonthly), or monthly.

A pay stub lists all of the key information related to a worker’s pay, and it’s important to understand the information on a pay stub. When you review a pay stub, note the difference between current (current pay period) and year-to-date (YTD) amounts.

Specific Information on a Pay Stub

Employers provide this information to each employee and contractor:

Payroll Cycle: The number of pay periods determines how much salary is paid on each payroll date. It also determines the start and ending days for computing hourly payroll.

Wages: Gross pay and net pay. Wages may be based on a salary, or calculated using an hourly rate of pay.

Tax Withholdings: Federal, state, and possibly local amounts withheld for taxes.

Benefit Withholdings: Amounts withheld for the employee’s share of insurance premiums, or funds to be invested in a retirement plan.

Every business must collect data to calculate gross wages and net pay. If you employ independent contractors, you don’t need to withhold taxes from pay.

Calculating Net Pay

Here are the details you need to calculate net pay:

Gross wages

Wages earned before any withholdings or deductions are subtracted. Gross wages for a pay period amount are calculated in one of two ways:

- Salaried employees: (Annual salary / number of pay periods in a year)

- Hourly employees: (Hours worked X pay rate per hour)

Gross wages may include additional compensation, including sick pay, holiday pay, or bonuses.

Hours worked, pay rate

The hours worked total is particularly important for non-exempt (hourly) workers. The pay stub should include regular hours (up to 40 hours per week), and overtime hours.

The pay stub must detail all hours worked, and the rate of pay earned for each hour. Some workers, including those covered by union contracts, must be paid a specific rate of pay for overtime or double-time hours.

Salaried workers may also see hours listed on their pay stubs.

Tax deductions

Workers determine their federal income tax withholdings amounts by completing Form W-4, and each state has a tax withholding form.

FICA tax is collected to fund Social Security and Medicare. For 2020, the employee tax for Social Security is 6.2% on income earned up to $137,700. The Medicare tax rate is 1.45% on all wages, and high-income taxpayers will pay an additional 0.9% tax for Medicare. The total employee FICA tax rate (for non-high income taxpayers) is 7.65% in 2020.

Employers also pay 7.65%, and the cost is deducted as a business expense. The employer’s payments are typically included on the pay stub.

Here’s an example that you can review to understand the payroll process.

Example Payroll Calculation

Sally’s annual income is $60,000, and your firm processes payroll 26 times a year. Sally’s gross wages each pay period total ($60,000 / 26), or $2,308 per pay period.

Based on the allowances on her W-4, your company withholds 20% of her gross pay ($462) for federal taxes, and 5% ($115) for state taxes. Sally also pays $50 each pay period for her share of the company health insurance plan.

Sally’s net pay is $2,308, less a total of $577 for taxes, and $50 for her health insurance premiums. Her net pay is $1,681.

The pay stub must include all of this information for the current payroll period and year-to-date. The pay stubs you generate may also include unemployment tax payments. Hourly workers need detail on their total hours worked, and any hours that are paid as overtime wages.

Employers need to generate accurate pay stubs, and using technology can help.

Take Charge of the Process

FormPros provides a pay stub generator that is user friendly, and helps you produce accurate pay stubs in less time. Use FormPros to take charge of the pay stub process.

Which payroll task is the most difficult for you?