Paystub vs W-2: Key Differences

When tax season rolls around or you’re applying for a loan, it’s common to run into two key documents—your paystub and W-2 form. But when it comes to understanding paystub vs W-2, the differences can be easy to overlook. While both relate to your income, they serve very different purposes—and confusing one for the other can lead to mistakes in tax filing, financial planning, or income verification.

A paystub is an ongoing record of what you earn and what’s deducted from each paycheck, while a W-2 is an official IRS tax form that summarizes your total annual wages and withholdings. Understanding the distinction is important not only for employees and freelancers but also for small business owners responsible for issuing accurate financial records.

At FormPros, we specialize in helping individuals and businesses generate essential payroll and tax documents, including paystubs and W-2 forms, quickly and accurately online. In this guide, we’ll break down the key differences between paystubs vs W-2s—what information they include, how they’re used, and why both documents matter.

What is a Paystub?

A paystub, sometimes called a paycheck stub or earnings statement, is a document you receive each time you’re paid. It shows a breakdown of your earnings, taxes, and deductions for that pay period. Whether you’re paid weekly, biweekly, or monthly, your paystub gives you a snapshot of what you earned and what was withheld.

What Information Does a Paystub Include?

A standard paystub will usually include:

- Employee and employer details – Names, addresses, and sometimes employee ID numbers.

- Pay period dates – The start and end dates for the time worked.

- Gross pay – Your total earnings before taxes or deductions.

- Deductions – These can include federal and state income tax, Social Security, Medicare, health insurance, and retirement contributions.

- Net pay – The amount you actually take home after deductions.

- Year-to-date totals – Cumulative figures showing how much you’ve earned and had withheld so far that year.

What is a Paystub Used For?

Paystubs are useful for more than just tracking your income. You may need one to:

— Prove your income when applying for an apartment, loan, or credit card

— Double-check your withholdings to make sure taxes are being deducted correctly

— Keep financial records for personal budgeting or small business documentation

Understanding how a paystub vs W-2 is used in different situations can help you provide the right document when it matters most—like when applying for a loan or verifying current vs annual income.

While many employers issue paystubs electronically through payroll platforms, others still provide physical copies. If you’re self-employed or running a small business, you can create paystubs online using tools like FormPros.

What is a W-2 Form?

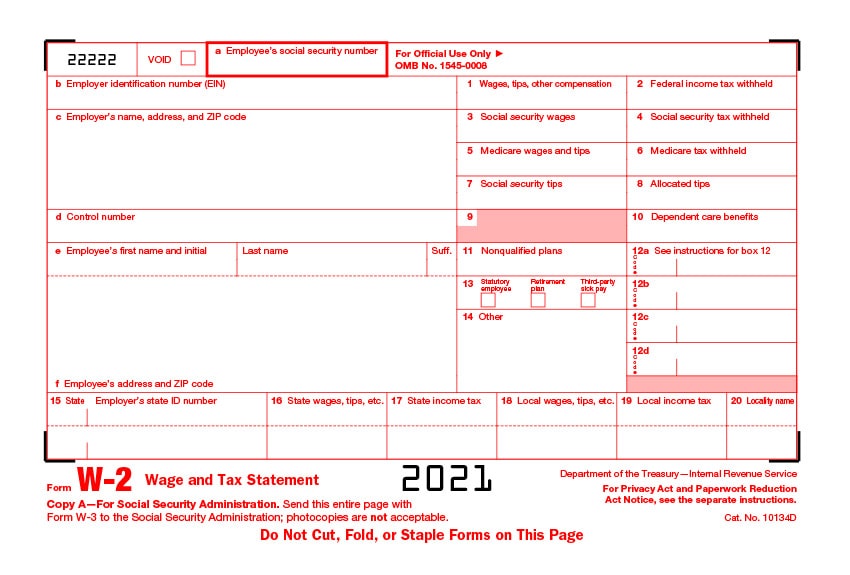

A W-2 form, officially called the Wage and Tax Statement, is a tax document that employers must send to their employees and the IRS each year. It reports an employee’s total earnings and tax withholdings for the calendar year.

Unlike a paystub, which reflects one paycheck at a time, the W-2 sums up everything earned and withheld for the entire year. It’s a key document used when filing your federal and state income tax returns.

What Information Does a W-2 Include?

Each W-2 form contains the following details:

- Employee and employer information – Your name, Social Security number, and your employer’s name, address, and Employer Identification Number (EIN).

- Total earnings – The sum of your wages, tips, and other compensation for the year.

- Federal tax withholdings – How much federal income tax was taken out.

- Social Security and Medicare – Total wages subject to these taxes, along with the amounts withheld.

- State and local tax info – If applicable, the form also includes details on state and local income taxes.

- Other benefits – This can include contributions to retirement plans, dependent care benefits, or health savings accounts.

What is a W-2 Used For?

The W-2 is essential for tax and income verification purposes. You’ll use it to:

— File your federal and state tax returns

— Confirm how much tax you’ve already paid throughout the year

— Prove your annual income when applying for loans, mortgages, or financial aid

Employers are required to issue W-2s by January 31st each year for the prior tax year. If you’re running a business or are self-employed and need to generate W-2 forms for employees, tools like FormPros make it easy to create IRS-compliant documents online.

Key Differences Between a Paystub and a W-2

While both documents deal with your earnings, a paystub and a W-2 form serve very different purposes. Understanding how they differ can help you stay organized and avoid confusion during tax season.

How Are They Different?

Here’s a breakdown of the key differences:

1) Timing – A paystub is issued with every paycheck, showing details for that specific pay period. A W-2 is issued once a year, summarizing your entire year’s income and withholdings.

2) Purpose – Paystubs are used for tracking earnings and deductions throughout the year. W-2s are used to file your annual tax return with the IRS and state tax agencies.

3) Content – Paystubs show gross pay, deductions, and net pay for a single pay period, plus year-to-date totals. W-2s focus on cumulative data only—your total wages, tax withholdings, and benefits for the full year.

4) Recipients – Paystubs are mainly for the employee’s personal use. W-2s are shared with the employee, the IRS, and sometimes state/local tax authorities.

5) Legal requirement – While employers aren’t always required to provide paystubs (this varies by state), they must provide a W-2 to any employee who earned at least $600 in a year.

Quick Comparison Table

| Feature | Paystub | W-2 Form |

|---|---|---|

| Issued | With each paycheck | Once per year (by Jan 31st) |

| Covers | One pay period | Entire calendar year |

| Used for | Income tracking, proof of pay | Tax filing, income verification |

| Includes | Gross/net pay, deductions, YTD | Total earnings, taxes, benefits |

| Shared with | Employee only | Employee, IRS, and sometimes state |

Why You Need Both Documents

Even though they serve different purposes, both paystubs and W-2 forms play an important role in managing your finances. Having access to both helps ensure your records are accurate, complete, and IRS-ready.

That’s why knowing the difference between a paystub vs W-2 isn’t just about paperwork—it’s about being prepared. Whether you’re reviewing your tax return, applying for a loan, or managing payroll, each document has its own essential role.

How They Work Together

While your W-2 gives you the big picture of your income and tax withholdings for the year, your paystubs act like the receipts along the way. Here’s how they complement each other:

Cross-checking accuracy – You can use your final paystub of the year to confirm that the totals on your W-2 match your year-to-date earnings and withholdings. If something looks off, you can catch it before filing your taxes.

Income verification – A W-2 might be required for tax filing or applying for a mortgage, but many landlords and lenders will ask to see recent paystubs as proof of current income.

Tax prep and budgeting – Paystubs help you track deductions, contributions, and other paycheck changes throughout the year. When tax time arrives, your W-2 pulls all that info into one document for filing.

Helpful for Employers and the Self-Employed

If you run a business or pay yourself a salary, issuing both paystubs and W-2s is essential. Paystubs give employees (or yourself) transparency into each paycheck, while W-2s ensure compliance with IRS reporting rules.

With tools like FormPros, it’s easy to generate both documents quickly—whether you’re managing payroll for a team or just need records for yourself.

How to Get Paystubs and W-2s (and why it’s easier than you think)

Whether you’re an employee looking for your records or a small business owner responsible for issuing them, knowing how to access or create paystubs and W-2 forms is crucial.

For Employees:

- Paystubs are usually available through your employer’s payroll system or HR department. If you’re missing one, reach out directly to your employer.

- W-2 forms must be provided by your employer by January 31st each year. You’ll typically get a paper copy in the mail or be able to download it electronically.

For Employers, Freelancers, and the Self-Employed:

If you’re managing your own payroll or running a business, it’s your responsibility to generate these documents accurately—and that doesn’t have to be complicated.

That’s where FormPros comes in. Our online tools make it easy to:

- Create professional, IRS-compliant W-2 forms

- Generate detailed paystubs in minutes

- Download and print documents instantly, with no accounting software required

FormPros Has You Covered

Simplify your paperwork with FormPros! Whether you need a 1099-NEC generator, want to make a W-4, or need to file a employment verification letter, our easy-to-use platform has you covered. You can also learn what is a LLC Operating Agreement and generate one in minutes, or even create a voided check with just a few clicks. Save time, reduce errors, and manage your business documents with confidence. Get started today and see how FormPros makes professional form generation fast, affordable, and hassle-free!