Understanding Your Pay Stub: Earnings & Deductions Explained

Both employers and workers need to understand the information on a pay stub.

Employers must generate accurate pay stubs that match gross pay, tax withholdings, and other payroll amounts. Workers should review their pay stubs to ensure they received the correct wages, especially when confirming annual income on paystub documents for loans or financial planning.

But first….

What is a Pay Stub?

A paystub lists all of the key information related to an employee’s pay.

When you review a pay stub, it’s important to note the difference between current (current pay period) and year-to-date (YTD) amounts. Both are important, and the YTD balances help the employer and the worker understand if the amounts are correct.

The pay stub provides several types of information:

- Wages: Gross pay and net pay. Wages may be based on a salary, or calculated using an

hourly rate of pay. - Tax withholdings: Federal, state, and possibly local amounts withheld for taxes, including FICA on paycheck deductions.

- Benefit withholdings: Amounts cover the employee’s share of insurance premiums or go toward retirement plan investments.

The rules regarding pay stubs vary by state. Some states require employers to provide pay information to workers, while other states do not. Businesses should confirm the requirements in each state where they employ workers.

Employees should keep their most recent pay stubs as proof of income. If an individual applies for a loan, the pay stub confirms the borrower’s annual income on paystub records. Employers should keep pay stubs on file, if they are generated.

What does a pay stub look like?

A pay stub includes detailed breakdowns of gross wages, tax withholdings, deductions, and net pay. It helps employees track earnings, verify withholdings, and understand their total compensation.

The pay stub information should match the data on each employee’s W-2 form, which individuals use to file their personal tax returns. FormPros can help you with that as well.

Specific Information on a Pay Stub

This information should be posted to each pay stub:

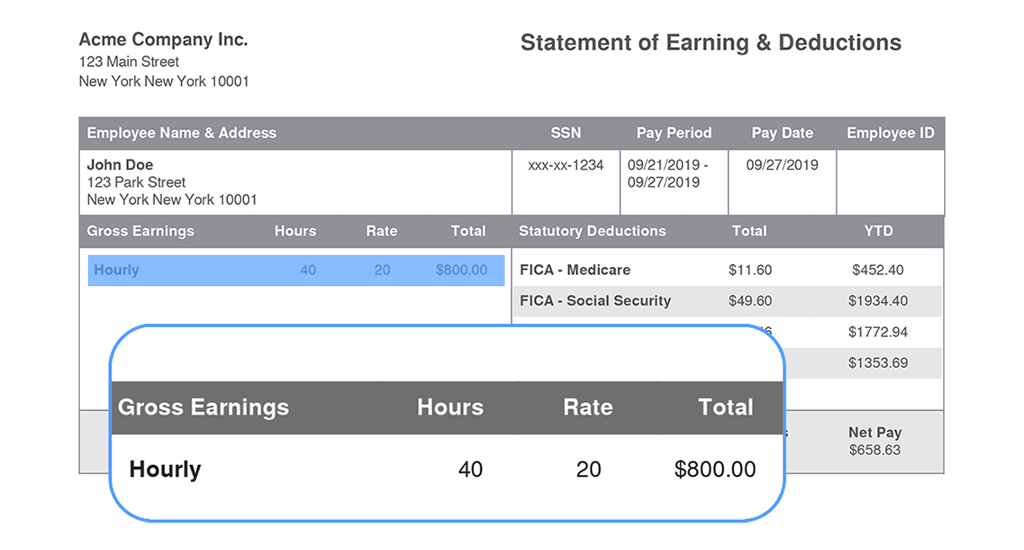

Gross Wages

Wages earned before any withholdings or deductions are subtracted. Gross wages for a pay period amount are calculated in one of two ways:

- Salaried employees: (annual salary / number of pay periods in a year)

- Hourly employees: (hours worked X pay rate per hour)

*Gross wages may include additional compensation, including sick pay, holiday pay, or bonuses.*

Hours Worked & Pay Rate

The hours worked total is particularly important for non-exempt (hourly) workers. The salary pay stub should include regular hours (up to 40 hours per week) and overtime hours.

The pay stub must detail all hours worked, and the rate of pay earned for each hour. Some workers, including those covered by union contracts, must be paid a specific rate of pay for overtime or double-time hours.

Salaried workers may also see hours listed on their salary pay stub.

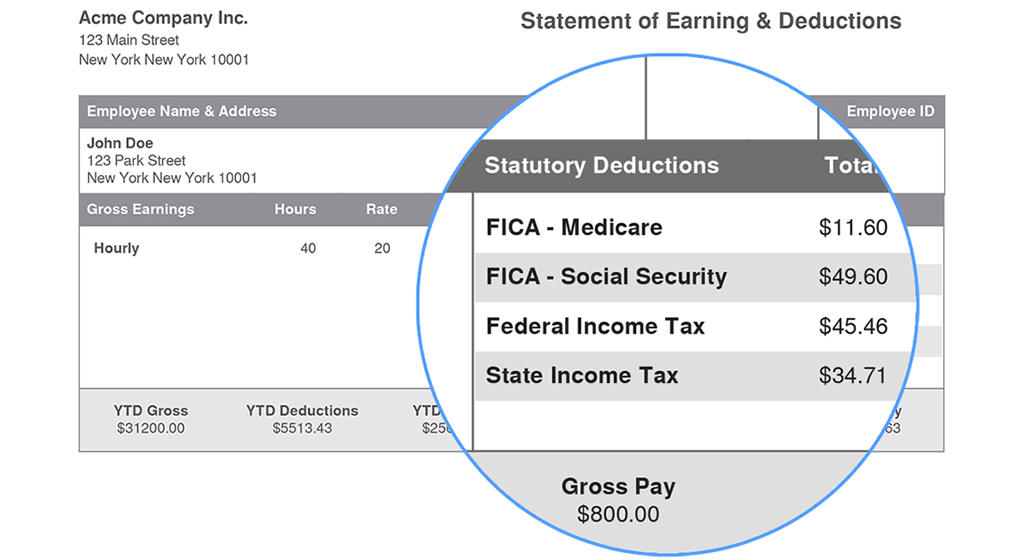

Tax Deductions

Workers determine their federal income tax withholdings amounts by completing Form W-4, and each state has a tax withholding form.

FICA (Federal Insurance Contributions Act) tax is collected to fund Social Security and Medicare programs. For 2025, the employee tax rate for Social Security remains at 6.2%, applied to income earned up to $176,100. The Medicare tax rate is 1.45% on all wages, with an additional 0.9% tax for high-income taxpayers. This brings the total employee FICA on paycheck rate to 7.65% in 2025.

Employers also contribute 7.65% for each employee, which they can deduct as a business expense. These employer contributions are typically detailed on employee pay stubs.

*FICA on a paycheck refers to the mandatory payroll taxes that fund Social Security and Medicare. Employees and employers both contribute, ensuring these essential programs remain funded. Workers should review their FICA on paycheck deductions to ensure they align with the correct rates.*

Benefit Deductions

Employees typically share the cost of employer-sponsored health insurance by paying a portion of the premiums. Additionally, many contribute to retirement plans like a 401(k), which allows pre-tax contributions, reducing taxable income. Some employers also offer matching contributions, providing an added financial benefit to employees’ retirement savings.

Unemployment Taxes

Unemployment programs are funded by the FUTA tax (federal) and the SUTA tax (state). These amounts are paid by the employer, but can also be reported on the pay stub.

Net Pay

Net pay is the actual dollars paid to the worker, after all deductions.

Take Charge of the Process

Creating accurate paystubs is essential, and technology can make the process easier and more efficient.

FormPros offers a user-friendly pay stub generator that simplifies the task, saving you time while ensuring accuracy. With FormPros, you can confidently manage your pay stub creation with ease.

FormPros Has You Covered

Simplify your paperwork with FormPros! From creating paystubs, W-2s, and 1099-NEC forms to generating LLC Operating Agreements and even voided checks, our easy-to-use platform has you covered. Save time, reduce errors, and handle your business documents with confidence. Start now and see how FormPros makes professional form generation fast, affordable, and hassle-free!