How to Avoid 4 Common Mistakes While Making Paystubs

Well-managed businesses work hard to minimize errors—especially when it comes to payroll. However, common mistakes while making paystubs can still happen, even with the best intentions. These errors often require time and effort to correct, taking your focus away from growing your business.

Creating pay stubs is a vital part of the payroll process, and having the right systems in place is key to producing accurate, compliant documents. In this article, we’ll define what pay stubs are, explain the role of the Form W-4, and outline the essential information every pay stub should include. You’ll also learn about four of the most frequent paystub mistakes—and how the FormPros paystub generator can help you avoid them.

What is a Pay Stub?

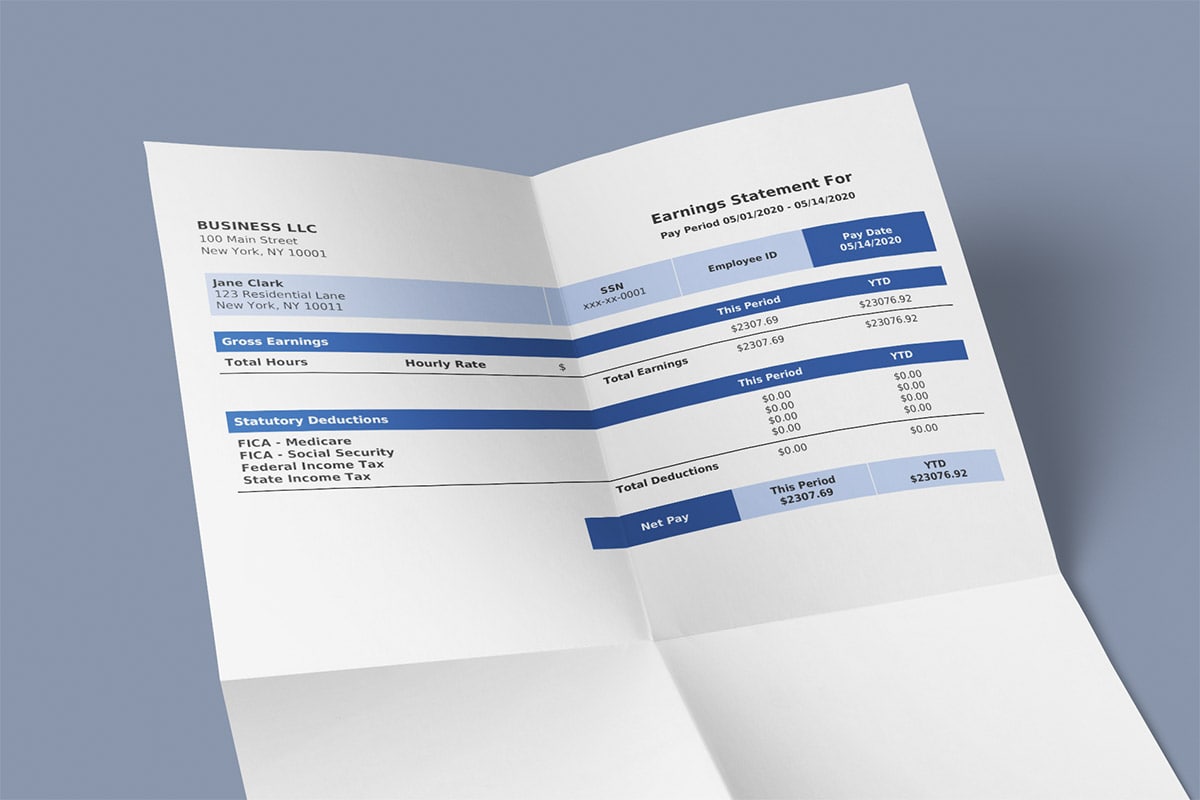

A pay stub lists all of the key information related to an employee’s pay.

When you review a pay stub, it’s important to note the difference between current (current pay period) and year-to-date (YTD) amounts. Both are important, and the YTD balances help the employer and the worker understand if the amounts are correct.

The pay stub provides information on wages, tax withholdings, and benefit withholdings.

The rules regarding pay stubs vary by state. Some states require employers to provide pay information to workers, while other states do not. Businesses should confirm the requirements in each state where they employ workers.

Employees should keep their most recent pay stubs as proof of income. If an individual applies for a loan, the pay stub confirms the borrower’s gross income. Employers should keep pay stubs on file, if they are generated.

The pay stub information should match the data on each employee’s W-2 form, which individuals used to file their personal tax returns.

To create a pay stub, the first step is to have each employee complete a Form W-4.

*Learn the differences between a W-2 and W-4 here.*

Working with Form W-4

The Employee’s Withholding Allowance Certificate (Form W-4) is a form that the federal government requires employees to fill out when they are newly hired. Information submitted on the form (allowances) lets employers know how much salary to withhold from a paycheck for tax purposes.

Keep these points in mind:

- As an employer, you should keep an employee’s most current W-4 form in his or her payroll file. The IRS may request a copy of the form.

- You need to make sure that you add the correct number of allowances into your payroll processing system.

The W-4 collects the worker’s basic information (name, address, filing status) and provides guidance for employees who have multiple jobs, or who have working spouses. There are extra resources provided to calculate withholdings for these situations.

Once you have a completed W-4, you’ll need to collect additional information for the pay stub.

Information Needed to Create a Pay Stub

Keeping this information accurate is crucial—especially since common mistakes while making paystubs often happen when employers rush through these details or rely on outdated records. A single oversight in data entry or calculation can lead to confusion, rework, or even compliance issues down the road. Determine this information for each employee:

- Payroll cycle: The number of pay periods determines how much salary is paid on each payroll date. It also determines the start and ending days for computing hourly payroll.

- Wages: Gross pay and net pay. Wages may be based on a salary, or calculated using an hourly rate of pay.

- Tax withholdings: Federal, state, and possibly local amounts withheld for taxes.

- Benefit withholdings: Amounts withheld for the employee’s share of insurance premiums, or funds to be invested in a retirement plan.

Here are four common mistakes that businesses make when generating pay stubs….

4 Common Paystub Mistakes

Here are four common mistakes while making paystubs that every business should be aware of. By understanding these pitfalls, you can take simple steps to improve payroll accuracy and avoid unnecessary complications. Review your pay stubs carefully, to avoid these mistakes:

#1: Current Period vs. Year-to-Date Data

One of the most common—and often overlooked—paystub mistakes is failing to clearly differentiate between current period amounts and year-to-date (YTD) totals.

Your employees rely on both of these figures for different reasons. Current period data shows the earnings, deductions, and taxes applied during that specific pay cycle—whether that’s weekly, biweekly, or monthly. YTD data, on the other hand, accumulates those figures over the course of the calendar year. It helps workers track their total gross income, federal and state tax withholdings, Social Security and Medicare contributions, and benefit deductions like health insurance or retirement contributions.

If you don’t label these figures correctly—or worse, if you omit one entirely—employees may become confused or concerned about their finances. They might think they’ve been underpaid, overtaxed, or that their benefits haven’t been deducted properly. This can lead to unnecessary HR headaches and even compliance issues if errors go unchecked.

*Pro Tip: Use clear labels like “Current” and “YTD” next to each amount, and double-check that all columns are consistently formatted. It’s a small detail that makes a big difference in clarity and trust.*

#2: Outdated W-4 Information

Another common error in paystub generation is relying on outdated W-4 forms—and it can lead to serious tax discrepancies for your employees.

Life changes fast. A pay raise, the birth of a child, marriage, or even a second job can all affect how much tax an employee wants withheld from their paycheck. That’s exactly what the W-4 form is designed for—it tells you how much federal income tax to withhold based on the employee’s current personal and financial situation.

If you’re using an old W-4, you might withhold too much or too little tax. That can result in frustration come tax season—either because the employee owes money or because their refund is smaller than expected. Worse yet, if the IRS flags withholding errors, you could find your business facing compliance issues.

*Best practice? Put a system in place to regularly remind employees to review and update their W-4 forms—especially after major life changes. And make sure your payroll team is using the most current version of each form when processing paychecks. Even a quick update between pay periods can save everyone a lot of trouble.*

#3: Incorrect or Unclear Pay Cycle Information

Your employees rely on consistent, predictable pay—not just in terms of amount, but also timing. That’s why failing to clearly communicate your company’s pay cycle on the paystub is a mistake that can cause unnecessary stress and confusion.

Every organization has its own payroll rhythm—weekly, biweekly, semimonthly, or monthly—and your employees structure their financial lives around it. Whether it’s paying rent, budgeting for groceries, or managing childcare costs, knowing exactly when the next paycheck is coming is critical.

If your paystubs don’t clearly state the pay period start and end dates, as well as the pay date itself, employees might find it difficult to reconcile hours worked with the wages they received. Worse, if the cycle is listed incorrectly or changes without notice, it can disrupt financial planning and erode trust in your payroll process.

*What to do: Always include clear labels like “Pay Period: April 1–April 15” and “Pay Date: April 16” on every paystub. If your pay cycle ever changes—such as moving from biweekly to monthly—communicate this proactively and in multiple formats (email, meeting, HR portal, etc.). Transparency builds confidence.*

#4: Incorrect Tax Data

Tax laws don’t stand still—and neither should your payroll system. One of the costliest mistakes you can make on a paystub is displaying outdated or incorrect tax withholding data.

Both federal and state tax regulations are subject to change. These changes may include adjustments to tax brackets, withholding tables, Social Security wage caps, or local tax rates. If your payroll system doesn’t reflect the most current rates and rules, employees could be over- or under-withheld without even realizing it.

This can lead to serious consequences at tax time. An employee who’s under-withheld may face an unexpected tax bill—or worse, penalties and interest for underpayment. On the other hand, over-withholding means the employee is unnecessarily reducing their take-home pay throughout the year, essentially giving the government an interest-free loan.

*How to avoid it: Make sure your payroll software or provider is regularly updated with the latest tax code changes. It’s also a good idea to periodically audit your system to ensure that all withholdings—federal, state, and local—are being calculated correctly. Including a breakdown of each tax withheld on the paystub gives employees transparency and peace of mind.*

We Can Help You Minimize Errors

Accurate pay stubs aren’t just a luxury—they’re a necessity for compliance, employee trust, and preventing expensive payroll errors. But here’s the best part: you don’t have to do the math yourself.

FormPros makes it easy. Creating professional pay stubs is simple, fast, and secure. Our intuitive paystub generator automatically calculates earnings, deductions, and taxes based on your input—eliminating guesswork and reducing risk. Plus, by generating pay stubs through a trusted provider like FormPros, you avoid the dangers of a fake paystub, which can lead to serious financial and legal trouble. Choose accuracy and peace of mind with every stub you create.

FormPros Has You Covered

Simplify your paperwork with FormPros! From creating employment verification letters, W-2s, and 1099-NEC forms to generating LLC Operating Agreements and even voided checks, our easy-to-use platform has you covered. Save time, reduce errors, and handle your business documents with confidence. Start now and see how FormPros makes professional form generation fast, affordable, and hassle-free!

How to Avoid 4 Common Mistakes While Making Paystubs FAQs

-

Can employees request corrections on their paystub if they notice an error?

Yes. Employees should report any mistakes—like incorrect hours, pay, or tax withholdings—to HR or payroll right away. Employers are responsible for making corrections and issuing an updated stub. Prompt fixes help avoid tax issues and maintain employee trust.

-

How long should employers keep paystub records on file?

Employers should keep paystub records for at least three years, per FLSA guidelines. Some states require longer retention, often four or more years. Keeping accurate records helps with audits, disputes, and compliance.

-

Do gig workers or independent contractors receive paystubs?

No. Independent contractors usually don’t receive paystubs from clients. However, they can create their own using online tools. This helps avoid common mistakes while making paystubs, such as missing income details—especially when applying for loans, housing, or filing taxes.

-

What’s the difference between gross pay and taxable income on a paystub?

Gross pay is total earnings before deductions. Taxable income is what's left after pre-tax deductions (like insurance or retirement) and is used to calculate tax withholdings. They are not the same.

-

Are employers required to provide digital pay stubs, or can they still use paper copies?

Both are allowed, depending on state law. Many states permit digital stubs if employees can access and print them. Some states require employee consent before switching from paper to digital.