A Basic Guide to Payroll Taxes – Get Clarity Now

Payroll is the most complex task your business must complete. If you understand each step in the process- and use technology- completing payroll taxes will take less time.

This article explains the differences between independent contractors and employees, and the key information you need to process payroll. You’ll review an example of calculating payroll, and the types of tax forms you must provide to your workers.

When you process payroll, you handle independent contractors and employees differently.

Independent Contractors -vs- Employees

The IRS distinguishes independent contractors from employees by using three criteria:

- Behavioral control: Does the company have the right to control what the worker does and how they perform the job?

- Financial control: Does the company have a say in the material aspects of a worker’s job? In other words, does the business decide which expenses it will reimburse, or whether the worker must provide their own tools and supplies?

- Contractual relationship: Is there a written contract? Are benefits, such as pension, insurance, and vacation days, part of the contractual obligation?

Workers and employers both pay FICA taxes to fund Medicare and Social Security. When the three criteria above are met, the IRS classifies the worker as an employee. In that case, the company must complete a W-4 and cover its share of the FICA taxes.

If the worker doesn’t meet all three criteria, the IRS treats them as an independent contractor. Contractors are responsible for paying their own taxes, including income and FICA taxes.

Let’s start with employees, who must complete a W-4….

Working with Form W-4

Form W-4 (The Employee’s Withholding Allowance Certificate) is a form that the federal government requires employees to fill out when they are newly hired. Information submitted on the form (allowances) lets employers know how much salary to withhold from a paycheck for tax purposes.

Keep these points in mind:

- As an employer, you should keep an employee’s most current W-4 form in his or her payroll file. The IRS may request a copy of the form.

- You need to make sure that you add the correct number of allowances into your payroll processing system.

The W-4 collects the worker’s basic information (name, address, filing status) and provides guidance for employees who have multiple jobs, or who have working spouses. There are extra resources provided to calculate withholdings for these situations.

Before running payroll, you’ll also need to know the amount owed to independent contractors….

Form 1099-NEC

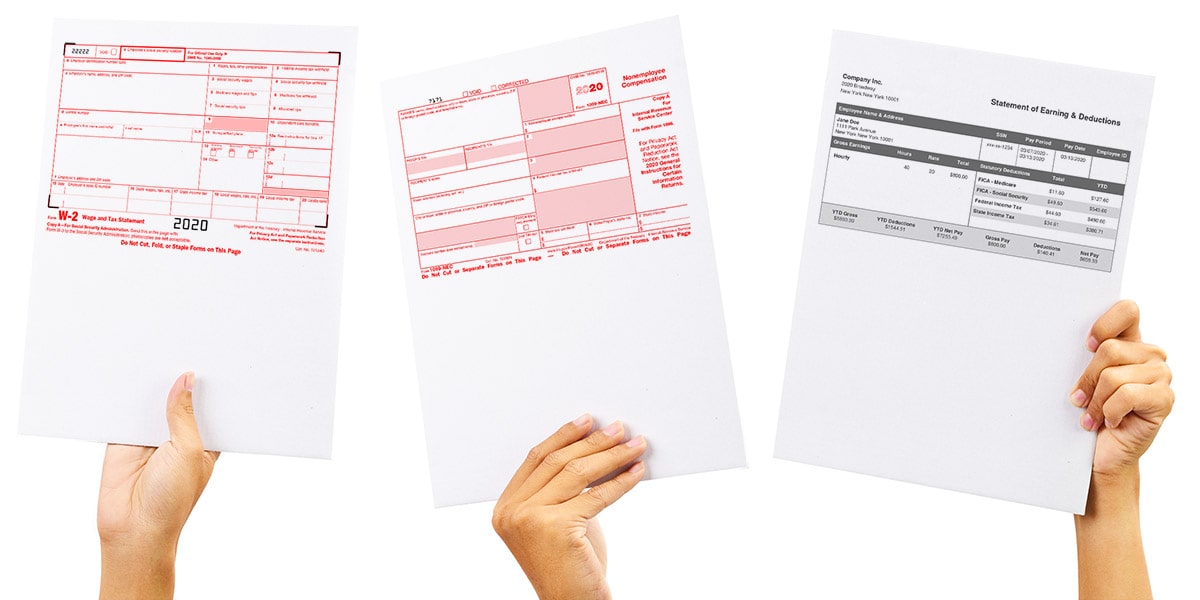

Companies use Form 1099-NEC (Nonemployee Compensation) to report income earned by people who work as independent contractors, rather than employees.

The IRS requires businesses to mail a copy of Form 1099-NEC to the independent contractor, so the contractor can include the income in his or her tax calculation. The IRS also receives a copy of the 1099-NEC, and uses it to estimate how much tax revenue to expect from self-employed individuals.

Issuing a W-2 Form

In a similar way, employees are issued a W-2 (Wage and Tax Statement), which summarizes their total earnings and tax withholdings for the year. This form includes key information like gross wages, federal and state income taxes withheld, Social Security and Medicare contributions, and other deductions. Employers are legally required to provide W-2s to their employees by January 31st each year so that workers can accurately file their personal tax returns.

Creating W-2s—and the paystubs that support them—can be a time-consuming and detail-heavy process. From calculating pre-tax deductions to keeping up with changing tax laws, even small errors can lead to costly penalties. That’s why many businesses choose to work with payroll software or tax professionals to ensure everything is filed correctly and on time.

Information Needed to Process Payroll

Determine this information for each employee and independent contractor:

- Payroll cycle: The number of pay periods determines how much salary is paid on each payroll date. It also determines the start and ending days for computing hourly payroll. A contractor’s pay may also depend on hours worked.

- Wages: Gross pay and net pay. Wages may be based on a salary, or calculated using an hourly rate of pay.

- Tax withholdings: Employers withhold federal, state, and sometimes local taxes from employee pay. Typically, they don’t withhold any taxes from a contractor’s earnings.

- Benefit withholdings: Employers also deduct amounts for the employee’s share of insurance premiums or retirement contributions. In most cases, contractors don’t receive these benefits.

Here’s a simple example to help you understand the payroll process…..

Calculating Net Pay

Let’s say Sally earns an annual salary of $60,000, and your company processes payroll biweekly—26 times a year. That means Sally’s gross pay for each pay period is $2,308 ($60,000 ÷ 26).

According to her W-4, your company should withhold 20% of her gross pay for federal taxes ($462), and 5% for state taxes ($115). In addition, Sally contributes $50 per pay period toward her share of the company’s health insurance plan.

To calculate her net pay, you subtract these deductions from her gross wages:

- Federal taxes: $462

- State taxes: $115

- Health insurance: $50

That’s a total of $627 in deductions, leaving Sally with a net pay of $1,681 for the pay period.

Most businesses provide employees with a pay stub alongside each paycheck. These stubs break down gross pay, deductions, and net pay for both the current pay period and year-to-date. For hourly employees, pay stubs also include total hours worked and any overtime wages. Depending on your payroll system, pay stubs may also show employer-paid contributions, like unemployment taxes.

At year-end, employers must issue a W-2 to each employee and a 1099-NEC to each independent contractor to ensure accurate income and tax reporting to the IRS.

FormPros Has You Covered

Simplify your paperwork with FormPros! From creating paystubs, W-2s, and 1099-NEC forms to generating LLC Operating Agreements and even voided checks, our easy-to-use platform has you covered. Save time, reduce errors, and handle your business documents with confidence. Start now and see how FormPros makes professional form generation fast, affordable, and hassle-free!