Proven Ways Renters Can Show Proof of Income

When you’re searching for a new place to live, one thing is almost certain—your future landlord will want to see proof of income. In fact, providing proof of income for renters specifically, is a standard part of the application process. While some landlords may request specific documentation, there are multiple reliable ways to verify your income. Knowing your options helps you stay prepared. It also improves your chances of getting approved for the rental you want.

Table of Contents

How Can Renters Show Proof of Income

Renters have several options when it comes to showing proof of income to landlords. Keep in mind that some landlords may request multiple documents to fully verify your financial stability. Be ready to show income that’s two to three times the monthly rent. This is a common affordability benchmark.

W-2 Income Forms

W-2 forms are a reliable way to show past income, as they reflect your earnings from the previous year. However, they may not always satisfy a landlord’s need for current financial information. If you’ve recently changed jobs or experienced a shift in income, your W-2 won’t capture that update.

Because of this, landlords may ask for extra documents to confirm your income. This includes recent paystubs or a letter of employment.

Another strong alternative is submitting a federal tax return (Form 1040). This helps renters with multiple income sources. It gives a full picture of earnings over the year.

Pay Stubs

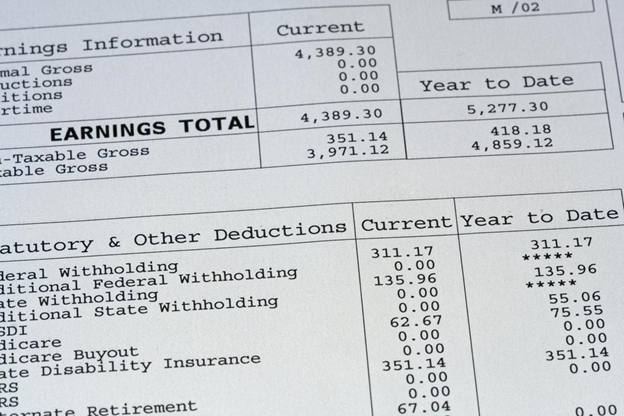

Pay stubs are one of the most common and reliable ways renters show proof of income to potential landlords. These documents typically include your full name, your employer’s name, and contact information, making them easy to verify. Most renters get pay stubs from their employer or payroll system. This makes it a quick way to prove income.

Landlords usually ask for two months of pay stubs. They check your pay frequency and monthly earnings. They’ll look closely at your income per pay period and year-to-date earnings to confirm consistency and affordability. Some applicants make fake pay stubs. To combat this, landlords may request extra documents to verify your income.

If you’re missing recent pay stubs, you may need to create a paystub using a reputable paystub maker—just be sure the information is accurate and verifiable.

Bank Statements

Self-employed individuals often face challenges when it comes to proving their income, as they typically don’t receive traditional pay stubs or regular paychecks. While some may choose to create their own pay stubs to verify income, another effective option is to provide recent bank statements. Supplying at least two months of statements can help demonstrate a steady cash flow—though some landlords may request additional months to confirm income consistency.

Bank statements not only show proof of income but also offer landlords insight into the applicant’s overall financial health. However, because these documents can reveal sensitive personal information, some renters may be reluctant to share them.

An alternative method for self-employed renters is to submit 1099 forms. As official tax documents, they are easily verifiable and widely accepted, though you may need to provide multiple 1099s to show stable income over time. If you’re looking for how to make check stubs as a self-employed worker, using a trusted paystub generator can help you create professional-looking documents that reflect your income accurately.

Letter of Employment

A letter of employment or employment agreement is another common way landlords verify a renter’s income and job status. These letters typically include details such as your position, length of employment, and current salary. Many companies issue standard employment verification letters, but you can also ask your manager or supervisor for a personalized version. A well-written, personal letter can double as a character reference, offering landlords additional reassurance about your reliability.

However, because letters of employment can be easily fabricated, landlords may follow up with a phone call to your employer to confirm the information. Additionally, these letters can take more time to obtain than other types of income documentation.

It’s also worth noting that a employment agreement may be requested alongside other documents—such as W-2 forms—to give landlords a more complete picture of your financial situation.

Create an Employment Agreement

Social Security Benefits

Social Security benefits can serve as valid proof of income when renting. The easiest way to verify this is by providing an award letter from the Social Security Administration (SSA), which outlines your monthly benefit amount. You can get this letter through your mySocialSecurity account or by contacting the SSA. Because Social Security income is stable, it’s often seen as reliable by landlords.

Pension Statement

If you’re retired, a landlord may ask for a 1099-R form to verify your pension income. This tax document details your pension distributions and is generally considered a reliable source of proof. However, since pension amounts can fluctuate, some landlords may view this form with caution and request additional documentation to confirm consistent income.

Unemployment Statement

Renters who get unemployment benefits may be less desirable to landlords; however, through unemployment statements, they have a way to prove steady income. The only concern is that unemployment benefits may run out, in which case the tenant may no longer be able to pay rent, presenting a form of risk to the landlord.

Worker’s Compensation Letter

If you’re receiving workers’ compensation due to a job-related injury, it can be used as proof of income when applying for a rental. Your insurance provider can issue an official letter confirming your compensation benefits, which serves as documentation of a steady income stream. This letter can be submitted to your landlord to help demonstrate your ability to meet monthly rent obligations.

Other Less Common Methods of Verifying Income

- Court-ordered awards letter: This document verifies income awarded through legal judgments, such as alimony or child support, and can be submitted as proof of consistent payments.

- Severance statement: A severance agreement from a former employer outlines post-employment payments, which can temporarily serve as proof of income.

- Incentive payments: These are performance-based earnings—such as bonuses or commissions—that can supplement regular income when documented clearly.

Understanding How to Show Proof of Income

Providing proof of income is a crucial step in the rental process—it reassures landlords that you can reliably meet your monthly rent obligations. Fortunately, renters have a variety of options to verify their income, from paystubs and tax forms to employment letters and benefit statements. However, because landlords may be cautious about the authenticity or sufficiency of a single document, it’s a good idea to prepare multiple forms of proof whenever possible.

FormPros makes this easier by helping you generate essential documents like W-2 forms, pay stubs, and employment agreements quickly and accurately—saving you time and increasing your chances of rental approval.

FormPros Can Help!

- Create Pay Stubs Instantly

- Saves time and headaches

- Preview and share easily

- Easy to follow steps