Different Types of Check Stubs

Many people don’t receive their check stubs or pay stubs in paper form anymore. Electronic check stubs are the norm, but they may not be the best type of check stub in all cases. Employers should consider their options and the needs of their employees when it comes to the different types of check stubs that can be generated.

What is a Check Stub?

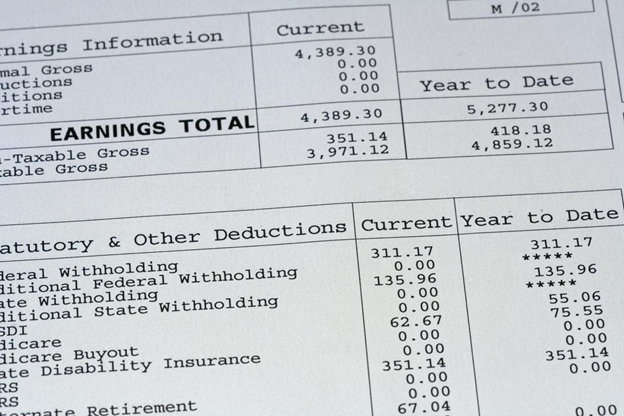

A check stub is part of a paycheck that lists details about an employee’s pay, such as taxes and other deductions taken out of the employee’s earnings. A check stub shows wages earned for that specific pay period (current pay period), as well as year-to-date amounts (YTD). Deductions also appear on an employee’s check stub. In the end, the check stub reveals the employee’s actual take-home pay (net pay) that will be deposited into their account.

Before you start creating check stubs, you need to have the following information:

- Payroll cycle

- Wages for all employees

- Tax withholdings

- Benefit withholding for each employee.

You can use W-4 forms to determine your employees’ withholdings and allowances to deduct from each pay period.

Deductions that can be found on check stubs include:

- Employee tax deductions: These are taxes mandated by government agencies, such as federal income tax, state and local taxes (if applicable), and the employee’s portion of FICA tax.

- Benefits and other deductions: These deductions depend on the extra benefits that the employer provides and what the employee wants to be deducted, such as insurance premiums, retirement plans, or charitable donations.

- Employer contributions: Items contributed from an employer may also appear on an employee’s check stub, including the employer’s contribution to employee benefits or the portion of FICA tax.

As an employer, you should keep a copy of each employee’s check stubs for your payroll records. You are responsible for providing a check stub to each employee every pay period. Check stubs let employees ensure that they get the correct paycheck amount and provide employers with a way to settle discrepancies in an employee’s pay.

There is no federal regulation on check stubs, but each state has its own laws about providing check stubs for employees, so you will want to review state laws to ensure that your business complies by issuing check stubs. Some states don’t require employers to provide check stubs at all, though it may still be beneficial to do so.

Check stubs can be given in paper form or electronically, depending on the employee’s preference.

Different Types of Check Stubs

There are generally two different options when it comes to creating check stubs.

Physical Check Stubs

Although many companies are turning to software for their payroll needs, there may still be some value in creating physical paper check stubs. Firstly, not everyone has access to a home computer, meaning not everyone would be able to access their check stubs in a time of need, such as for proof of income when completing a rental application.

Having paper check stubs available is also a great backup for a time when technology may fail. Furthermore, depending on the size of your business and the number of employees you have, paper check stubs may be less costly than a subscription to payroll software. Unfortunately, paper check stubs are not an environmentally friendly option. Likewise, if you choose not to use payroll software, the payroll process may be long and tedious.

Electronic Check Stubs

Electronic or paperless check stubs provide a variety of benefits to both small businesses and their employees. Unlike paper stubs, they are an environmentally friendly option. Plus, depending on the number of employees you have, electronic check stubs may cost you less than the produce per pay period. Using paperless payroll allows you to keep all payroll records electronically, avoiding paper clutter, as well as provides the ability to use electronic funds transfer (EFT) to quickly pay your employees promptly.

There are multiple payroll services and software that you can choose from to help create electronic check stubs. In all, electronic check stubs can help you save on time and effort, as well as paper and printing costs. The main downside is that electronic check stubs have limited accessibility; an employee without a home computer may not be able to access their electronic check stubs when needed.

It is also important to note that some states require employers to offer paper checks as a payment option or that employees can opt-out of online check stub delivery. Employees must also consent to receive their W-2 form online. If they do not, then they must receive a paper copy.

Tips for Check Stubs

- It is a good idea to give your employees the option of paper or electronic check stubs, regardless of whether your state requires it or not. Although most employees may prefer to receive their check stubs electronically, you want to ensure that check stubs are accessible to all of your employees.

- If paper is your preferred method of administering payroll, you may want to keep electronic records as a backup. In the event of uncontrollable circumstances, such as a natural disaster, having relied on paper copies of documents may make it difficult to recover.

- If you’re having trouble creating check stubs for your employees, enlist the help of an expert to help out with payroll.

Understanding Check Stubs

Understanding the different types of check stubs and how they work as a business owner is important to ensure that all information is correct and up to date for your employees. By understanding check stubs, you can easily solve pay-related issues and make tasks, such as off-boarding and employee-run, smoother. You can choose to provide check stubs electronically or on paper, but consider using both options, ensuring that each of your employees has easy access to their check stubs promptly.

Formpros can help you easily generate check stubs, pay stubs, and other relevant tax documents quickly and painlessly to help you keep track of your finances.

We Can Help!

- Instant download

- Preview before you buy

- Auto-calculations

- Money back guarantee