How to Read a Paystub

With so much information coming at us every day, it’s easy to overlook the details on a pay stub. But whether you’re an employer or an employee, understanding how to read a paystub is essential. It breaks down your earnings, tax withholdings, and other key details that can directly affect your tax return.

For starters, let’s define a paystub.

What is a Paystub?

A paystub lists all of the key information related to an employee’s pay. Many firms also issue paystubs to freelancers (independent contractors).

When you review a pay stub, it’s important to note the difference between current (current pay period) and year-to-date (YTD) amounts. Both are important, and the YTD balances help the employer and the worker understand if the amounts are correct.

The paystub provides information on wages, tax withholdings, and benefit withholdings.

The rules regarding paystubs vary by state. Some states require employers to provide pay information to workers, while other states do not. Businesses should confirm the requirements in each state where they employ workers.

Filing Paystubs —

Workers should keep their most recent pay stubs as proof of income. If an individual applies for a loan, the paystub confirms the borrower’s gross income. Employers should keep paystubs on file, if they are generated. The paystub information should match the data on each employee’s W-2 form, which individuals used to file their personal tax returns.

Completing Form W-4 —

To create a paystub, the first step is to have each employee complete a Form W-4. The Employee’s Withholding Allowance Certificate (Form W-4) is a form that the federal government requires employees to fill out when they are newly hired. Information submitted on the form (allowances) lets employers know how much salary to withhold from a paycheck for tax purposes.

Understanding the Details of a Paystub

When you read a paystub, pay attention to these details:

- Payroll cycle: The number of pay periods determines how much salary is paid on each payroll date. It also determines the start and ending days for computing hourly payroll.

- Wages: Gross pay and net pay. Wages may be based on a salary, or calculated using an hourly rate of pay.

- Tax withholdings: Federal, state, and possibly local amounts withheld for taxes.

- Benefit withholdings: Amounts withheld for the employee’s share of insurance premiums, or funds to be invested in a retirement plan.

Paystub Abbreviations –

Paystubs are often filled with abbreviations that can be confusing if you’re not familiar with payroll terminology. Understanding these codes is key to reading your pay stub correctly and spotting any discrepancies. Here are some of the most common abbreviations you might see:

- FICA – Federal Insurance Contributions Act (covers Social Security and Medicare taxes)

- MED – Medicare tax withheld

- SS – Social Security tax withheld

- YTD – Year-to-date totals for earnings, taxes, and deductions

- 401k – Retirement plan contributions deducted from your paycheck

- PTO – Paid Time Off (vacation, sick leave, etc.)

- GROSS – Total earnings before taxes and deductions

- NET – Take-home pay after all deductions

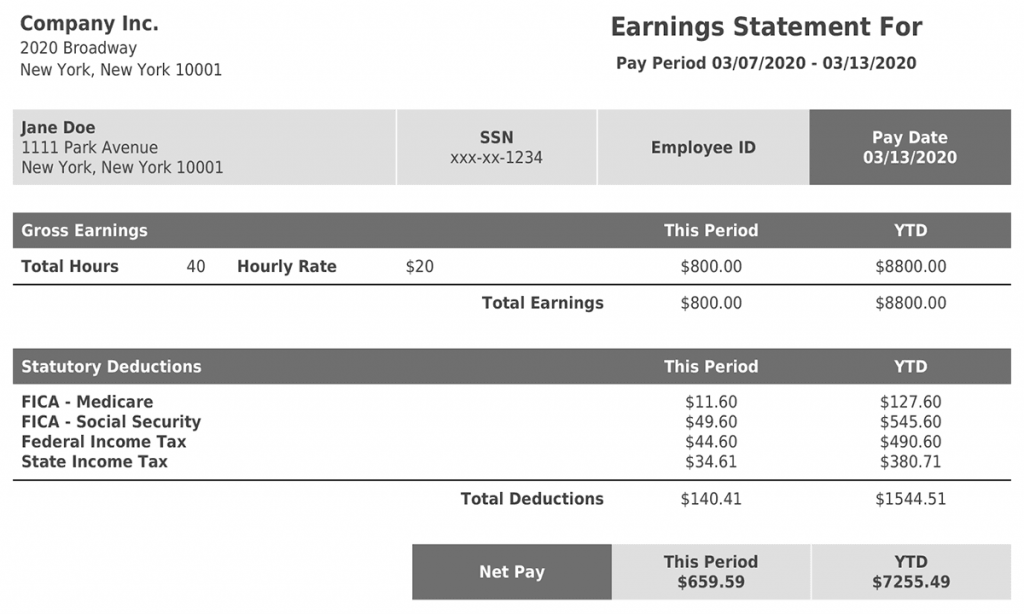

Here’s an example to help you visualize your pay stub.

Reviewing a Pay Stub Example

This pay stub was generated using the FormPros website—a fast, reliable, and affordable alternative to hiring an accountant. The streamlined process saves time and offers greater accuracy than creating one manually with a spreadsheet.

The employee’s personal information is listed in the top left, and you see the pay period (weekly payroll), and the pay date at top right.

The worker’s gross earnings are listed next, and FormPros calculates FICA and other tax withholdings automatically.

Finally, you’ll see year-to-date and current pay information listed at the bottom.

Employers need to generate accurate pay stubs, and using technology can help.

Save Time and Money on Paystubs

FormPros makes it easy to create accurate, professional paystubs in just minutes—no spreadsheets, no expensive accountants. Save time, save money, and stay in control of your payroll process.

Ready to create your first paystub? Try FormPros now and see how simple it can be.

FormPros Has You Covered

Simplify your paperwork with FormPros! From creating employment verification letters, W-2s, and 1099-NEC forms to generating LLC Operating Agreements and even voided checks, our easy-to-use platform has you covered. Save time, reduce errors, and handle your business documents with confidence. Start now and see how FormPros makes professional form generation fast, affordable, and hassle-free!

We Can Help You!

- Easy To Follow Steps

- 100% Money-back Guarantee

- Preview pre-purchase

- Instant download