Common Mistakes to Avoid in Your LLC Operating Agreement

Many LLCs make avoidable mistakes in their Operating Agreements that can lead to disputes or legal trouble. Here’s how to get it right from day one.

Many LLCs make avoidable mistakes in their Operating Agreements that can lead to disputes or legal trouble. Here’s how to get it right from day one.

Stay compliant this tax season with a clear breakdown of 2025 W2 penalties, how they’re triggered, and how to correct filing mistakes before they become expensive.

Unlock the easiest way to edit PDFs with step-by-step tips, powerful tools, and the user-friendly FormPros PDF editor.

Editing a paystub might seem rare, but when errors arise, it’s essential to handle them correctly to stay compliant and avoid legal trouble. This guide walks you through when and how to make edits the right way.

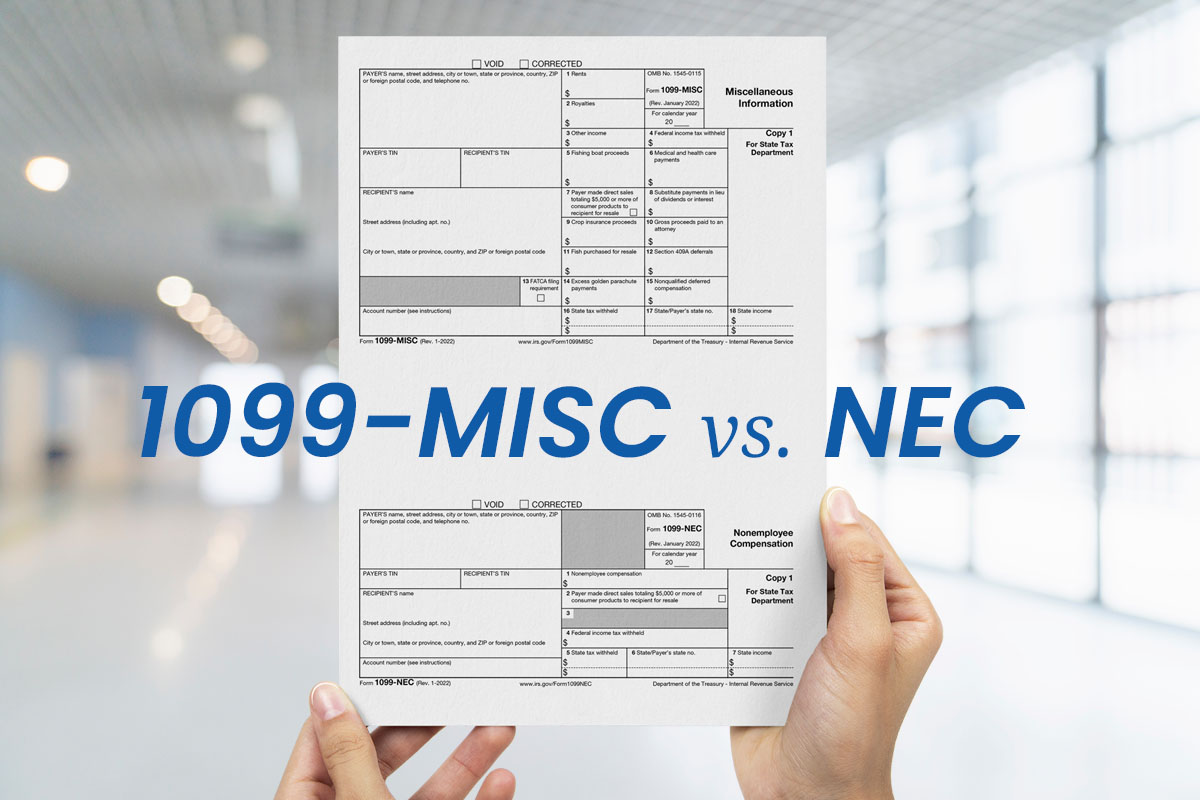

Confused about 1099-NEC vs. 1099-MISC? Learn the key differences, when to use each form, and how to stay compliant when reporting contractor payments and business expenses.

Confused about what YTD means on your pay stub? Learn how to calculate it, what it includes, and why it’s essential for tracking income and deductions.

Wondering how long you should keep pay stubs? This guide breaks down the best retention practices, legal requirements, and expert recommendations to help you stay organized and prepared for tax season, loans, and disputes.

Discover the key differences between Form W-4 and Form W-9, who needs to fill them out, and how they impact tax withholdings for employees and contractors.

Decode the mysteries of your paycheck stub with our definitive guide! Learn how to understand common abbreviations, track your earnings, deductions, and YTD totals, and ensure your paychecks are accurate.

Get ahead of tax season with this complete guide to 2026 IRS filing deadlines. Learn key due dates, penalties, and how to avoid costly mistakes.