Articles of Incorporation vs Operating Agreement

Discover the key differences between an Operating Agreement and Articles of Incorporation, and learn how each supports your business structure and success.

Discover the key differences between an Operating Agreement and Articles of Incorporation, and learn how each supports your business structure and success.

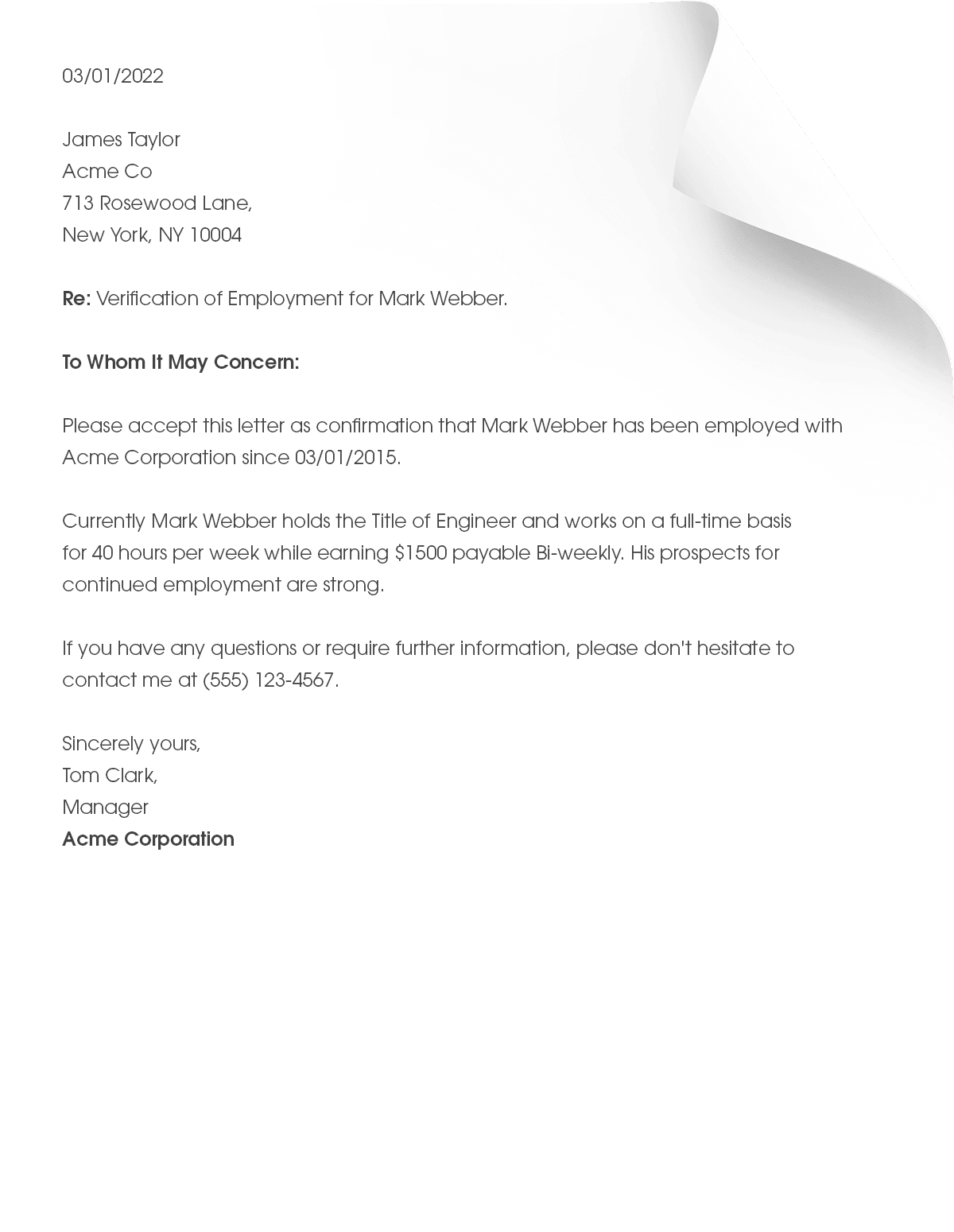

Need to verify your employment? Learn how to request an Employment Verification Letter the right way, avoid delays, and ensure a smooth verification process.

Many business owners miss out on valuable tax deductions—or misuse them entirely. This guide breaks down the most misunderstood write-offs to help you file with confidence.

Struggling to keep your business finances in check? Discover five common accounting mistakes business owners make—and how to avoid them for good.

Self-employed individuals need paystubs to verify income for loans, rentals, and taxes. Learn how to create accurate, professional paystubs with ease.

Freelancers and contractors must navigate unique tax obligations. This guide covers essential freelance tax forms, how to file taxes as a freelancer, and key deadlines.

Master how to keep books for a small business with this essential guide on bookkeeping and accounting. Learn key strategies to stay organized and manage finances effectively.

Discover why pay stubs offer more accuracy, security, and convenience compared to manually creating payroll records in Excel spreadsheets.

Learn the 4 most common mistakes people make when creating paystubs and how to avoid them for accurate and compliant payroll records.

Confused about payday, pay period, and pay cycle? Learn how they impact payroll, tax deductions, and your pay stub to stay on top of your earnings.