How to File Taxes as a 1099 Worker: What You Need to Know

Filing taxes as a 1099 worker can be tricky, but this guide breaks down the steps, from understanding Form 1099-NEC to managing self-employment taxes.

Filing taxes as a 1099 worker can be tricky, but this guide breaks down the steps, from understanding Form 1099-NEC to managing self-employment taxes.

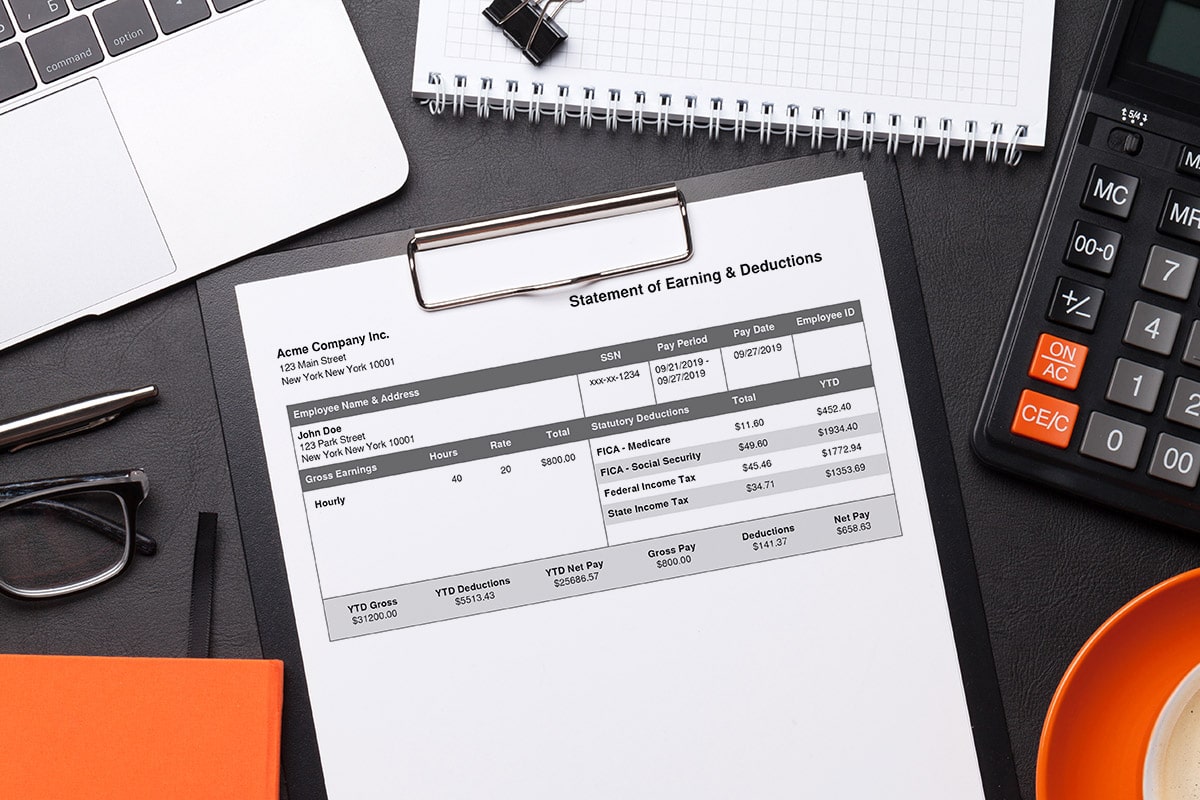

Discover how to create a paystub and break down each part of wage calculation—from gross pay to taxes and net pay—with clear examples and tips.

Learn what essential information you need before creating a paystub. Simplify your financial documentation and stay prepared with tips for accurate, professional records.

Misclassifying workers can cost your business big. Learn how to avoid misclassification with contractor agreements that align with real-world practices.

Unsure whether to use a promissory note or loan agreement? This guide breaks down the key differences to help you choose the right document for your loan.

Your pay stub breaks down your earnings, deductions, and taxes, including FICA. Learn how to read it correctly and ensure your payroll records are accurate.

Learn how to fill out Form 1099-MISC with this step-by-step guide. Get clear instructions, examples, and tips to ensure accuracy and compliance.

Learn how to fill out a W-2 form correctly to ensure your tax filings are accurate.