Loan Agreement vs Promissory Note: Which One Should You Use?

When borrowing or lending money, it’s essential to have a written agreement outlining the terms of repayment. Two of the most common options are promissory notes and loan agreements. While they may seem similar, each serves a different purpose and fits different financial situations. Understanding the key loan agreement vs promissory note distinctions helps you choose the right document. It protects both parties, provides clarity, and prevents disputes.

In this article, we’ll break down the difference between loan agreement and promissory note. You’ll learn when to use each and what factors to consider before making your decision.

What is a Promissory Note?

A promissory note is a simple, legally binding document. In it, one party (the borrower) promises to repay a specific amount of money to another party (the lender) within a set timeframe. It typically outlines key details such as the principal amount, interest rate (if applicable), repayment schedule, and consequences for non-payment.

Unlike a loan agreement, a promissory note is more straightforward. It does not always require extensive legal terms or collateral. Lenders often use it for smaller, informal loans between individuals, businesses, or financial institutions. Understanding the difference between promissory note and loan agreement is crucial for determining when this type of document is appropriate.

When is the Best Time to Use a Promissory Note?

A promissory note is best for a straightforward, legally binding loan agreement. It avoids the complexity of a full loan contract. Here are the most common situations where a promissory note is the right choice:

- Small or Informal Loans – If you’re lending money to a friend, family member, or colleague, a promissory note provides a clear repayment agreement. It keeps things simple.

- Short-Term Loans – When the borrower must repay the loan in a short period, a promissory note helps establish repayment terms. It avoids the need for a detailed loan agreement.

- Unsecured Loans – If the loan lacks collateral, a promissory note still proves the borrower’s promise to repay. It also provides legal protection for the lender.

- Business Transactions – Startups and small businesses use promissory notes to secure funding from investors. They also help formalize debts between business partners.

- Installment or Lump-Sum Repayment Plans – Whether the borrower repays the loan in a lump sum or structured installments, a promissory note clearly outlines the terms.

If the loan is larger, requires collateral, or involves multiple parties with specific legal protections, a loan agreement may be a better choice…..

What is a Loan Agreement?

A loan agreement is a formal, legally binding contract between a lender and a borrower. It details the terms of a loan, including repayment conditions, interest rates, and legal protections for both parties. Unlike a promissory note, a loan agreement is more detailed. It often includes collateral requirements, co-signers, or other legal clauses to protect the lender’s interests.

Lenders and borrowers typically use loan agreements for larger, more complex loans when they need clear legal safeguards. They can tailor these agreements to fit specific financial arrangements, making them ideal for business loans, real estate financing, and structured personal loans. Knowing the difference between loan agreement and promissory note ensures you select the right document based on your needs.

When is the Best Time to Use a Loan Agreement?

A loan agreement is best used when a loan involves larger sums, longer repayment terms, or requires legal protections for both the lender and borrower. Here are the most common situations where a loan agreement is the right choice:

- Large or Complex Loans – When significant amounts of money are involved, a loan agreement ensures both parties have clear, legally enforceable terms.

- Loans with Collateral – If the lender requires security (such as real estate, vehicles, or business assets), a loan agreement formally outlines the collateral terms.

- Business or Commercial Loans – Companies and entrepreneurs often use loan agreements when borrowing funds from banks, investors, or financial institutions.

- Long-Term Repayment Plans – For loans that will be repaid over months or years, a loan agreement provides a structured repayment schedule and protects against disputes.

- Multiple Parties or Co-Signers – When there are guarantors, co-signers, or multiple lenders, a loan agreement ensures that all parties’ responsibilities and liabilities are clearly defined.

As you can see, there’s no straightforward answer to which form is “better,” but understanding your promissory note vs loan agreement options will help you determine which one fits your situation best.

Takeaway: Which Form Should You Use?

Choosing between a promissory note and a loan agreement depends on the size, complexity, and legal requirements of the loan.

— If you’re lending a small amount in an informal setting or need a simple, no-fuss repayment agreement, a promissory note is likely the best choice.

— However, for larger loans, long-term repayment plans, or transactions that require collateral and legal protections, a loan agreement provides greater security for both parties.

No matter which form you need, having a clear, legally binding agreement is essential to protect your interests. FormPros makes it easy to generate a professional loan agreement and promissory note online in just a few minutes. Get started today and ensure your loan terms are properly documented!

FormPros Has You Covered

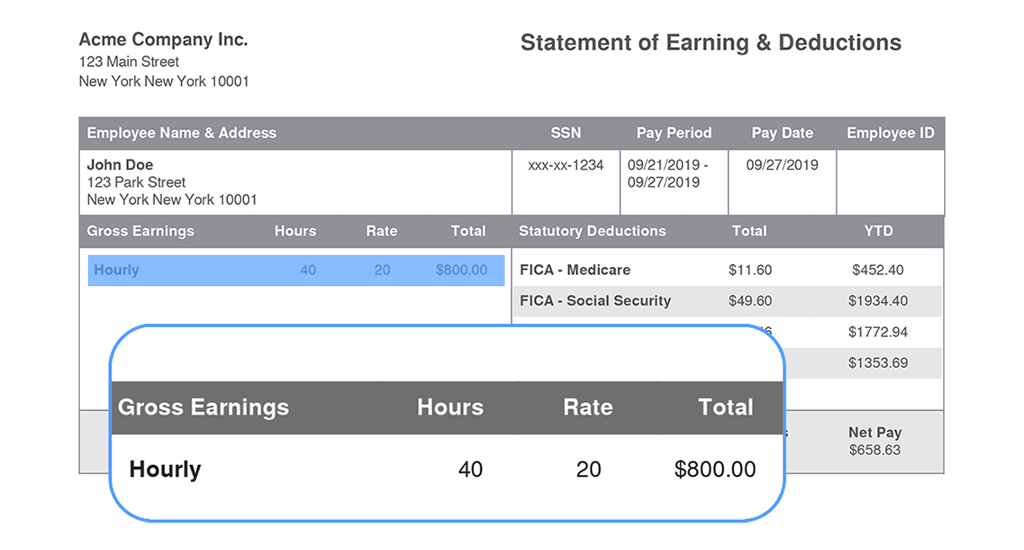

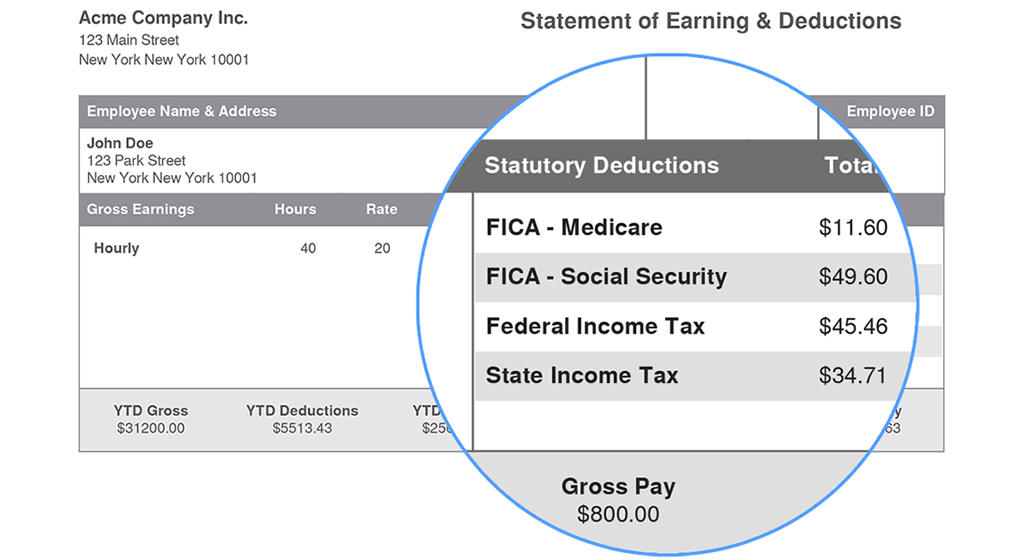

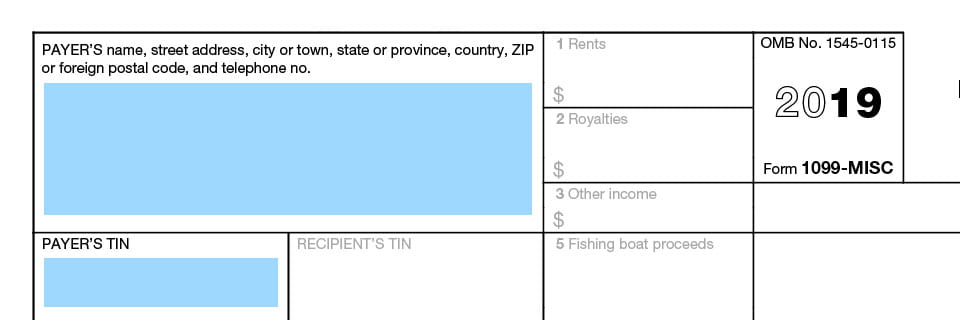

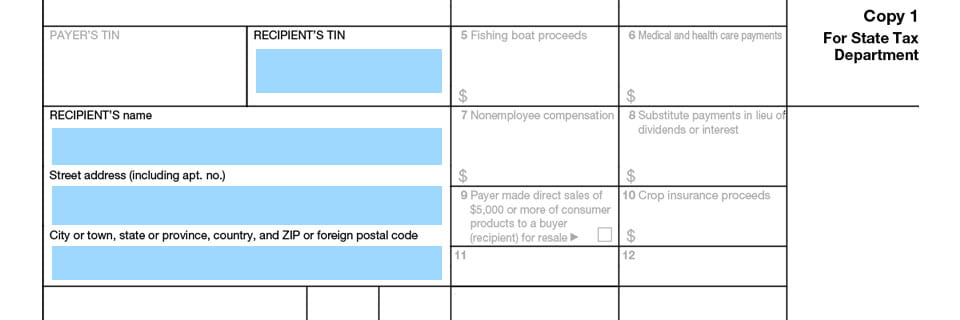

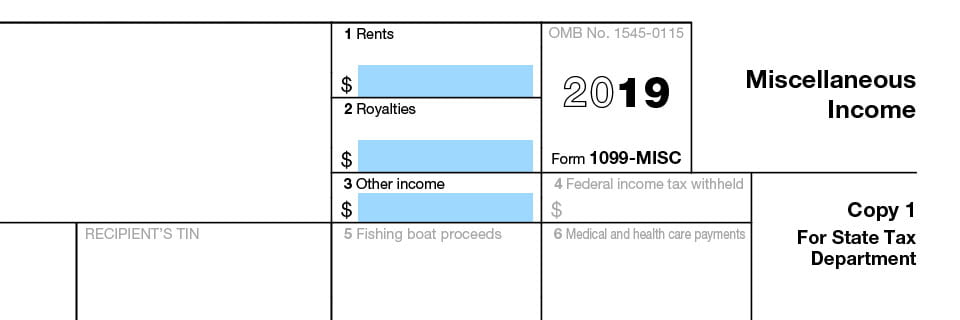

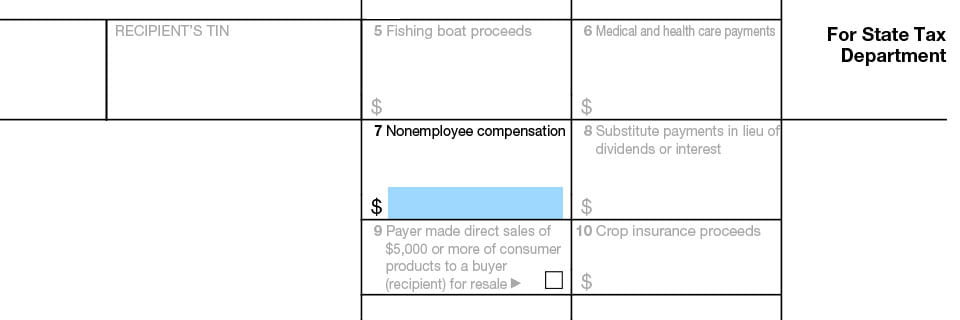

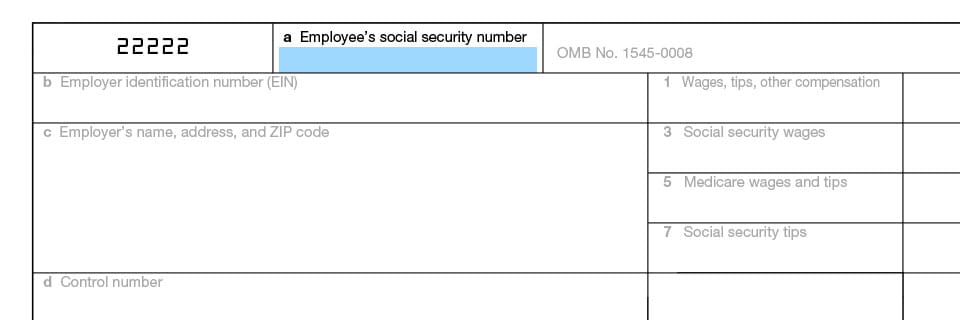

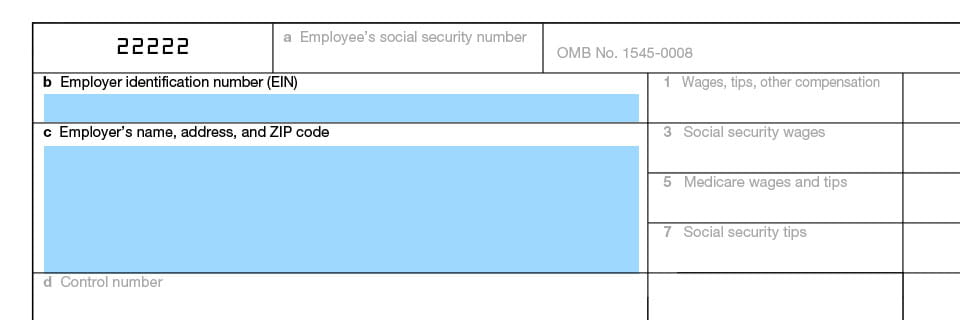

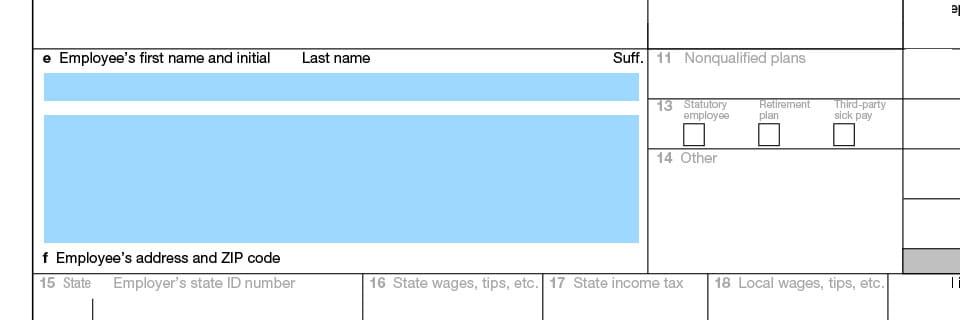

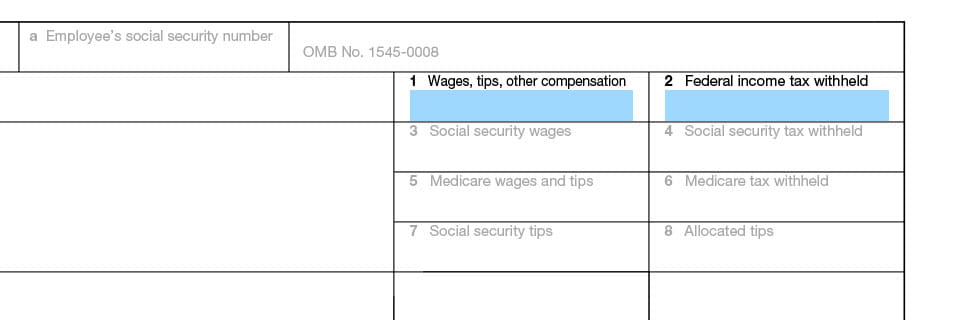

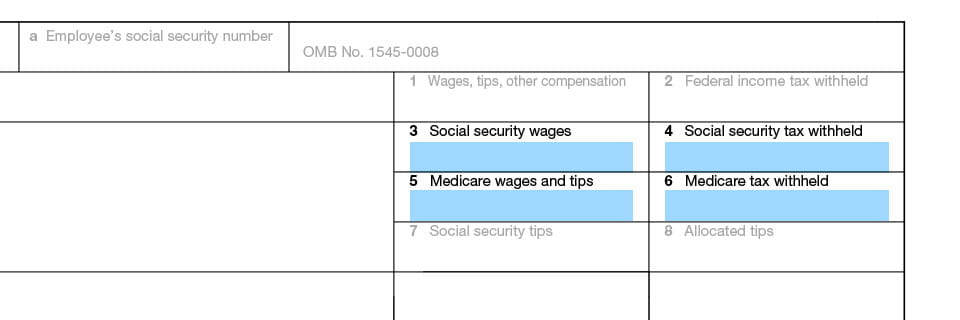

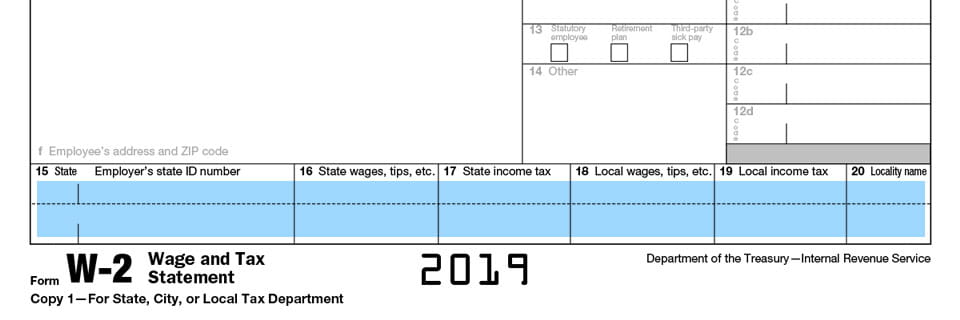

Simplify your paperwork with FormPros! From creating paystubs, W-2s, and 1099-NEC forms to generating LLC Operating Agreements and even voided checks, our easy-to-use platform has you covered. Save time, reduce errors, and handle your business documents with confidence. Start now and see how FormPros makes professional form generation fast, affordable, and hassle-free!

We Can Help You!

- Create A Promissory Note Instantly

- Saves time and headaches

- Preview and share easily

- Easy to follow steps