Understanding Paystub Frequencies: Weekly, Semi-Monthly & Monthly

Understanding paystub frequencies is essential for effective payroll management—whether you’re an employer setting up your system or an employee managing your budget. At FormPros, we make it easy to grasp the basics. Paystub frequency refers to how often employees receive paychecks and pay stubs, which affects everything from financial planning to bill alignment. Employers use it to schedule payments, while workers rely on it to track earnings and manage cash flow. From weekly to monthly schedules, each pay frequency has its own pros and cons. Below is a snapshot table of the most commonly used paystub frequencies, along with clear explanations to help you decide which one works best for your needs.

Paystub frequency—also known as pay frequency or pay cycle—defines how often employers pay their workers. By extension, it also determines how often they receive their pay stubs. The frequency dictates the number of pay periods in the span of a year.

The standard payroll frequencies are as follows:

– Weekly –

In a pay week, the workers receive their pay once weekly, and there are 52 pay periods in a year.

Pros:

- More Frequent Access to Wages: Workers get their wages more often, with faster access to their funds. It is especially helpful for handling short-term needs or unexpected crises. This reduces the stress of waiting for money or relying on short-term loans.

- Regular Paydays: Regular payment usually means employers pay workers on the same day each week, like every Friday. This can simplify budgeting and help individuals plan for weekly expenses more consistently.

- Sense of Instant Gratification: Getting paychecks more often can provide a psychological boost. It creates a sense of continuous reward for the work completed. This is especially helpful when starting a new job. It reduces the feeling of working for free while waiting for the first paycheck.

- Simpler Mental Accounting (for some): For some individuals, weekly pay simplifies the mental process of tracking finances. It eliminates the need for complicated arithmetic or budgeting tricks.

- Time Value of Money: Getting money sooner offers financial advantages. It allows people to save, invest, or use funds to pay off interest-bearing debt earlier—maximizing the time value of money.

Cons:

- Greater Possibility of Overspending: For some people, regular cash flow makes it easier to overspend or buy impulsively. They may justify the spending by saying, “I’ll get my next paycheck next week anyway.” It could be harder to form good budgeting habits this way.

- Challenge of Managing Money: Certain individuals find it difficult to keep up with managing money on a bi-weekly pay schedule. They might find it hard to remember whose paycheck is for which week.

- Greater Administrative Cost to Employers: Processing payroll more frequently, such as weekly, can be more time-consuming and expensive for employers. Less frequent paystub frequencies like semi-monthly or monthly involve fewer payroll runs each year. This could cause some employers to favor alternative pay frequencies.

– Bi-Weekly –

For bi-weekly (or fortnightly) frequency, workers get paid every other week, resulting in 26 pay periods in a year. Among various paystub frequencies, bi-weekly is one of the most popular. For salaried workers, their annual salary is typically divided by 26.

Pros:

- “Extra” Paychecks: Bi-weekly employees receive three paychecks every other month, rather than the usual two. It is like “extra money” that people will use on savings or hobbies. In some cases, benefits deductions are only taken from two paychecks per month. As a result, the third bi-weekly paycheck may appear larger since those deductions aren’t applied.

- Predictability: Under biweekly pay, the payday will frequently be the same day of the week, i.e., every other Friday. This can be used to plan when funds are expected to be received.

- Consistent Pay Period Length: Bi-weekly pay periods always have a duration of 14 days. This can simplify tracking regular and overtime hours.

- Greater Access But: Bi-weekly pay is less immediate than weekly pay but still provides frequent access to earnings. It offers more flexibility than semi-monthly or monthly schedules, which some workers prefer.

Cons:

- “Floating Paydays”: A significant drawback is that bi-weekly paydays “float” relative to most monthly bills. Paychecks won’t always align with bill due dates. This requires more mental effort and careful juggling to maintain a positive cash flow. This desynchronization can occasionally result in late charges if a paycheck falls after a bill’s due date.

- Complexity for Salaried Employees (from employer’s perspective): For salaried employees, converting an annual salary to bi-weekly payments (by dividing by 26) isn’t as straightforward. It’s cleaner with semi-monthly pay, which divides the salary by 24. This could necessitate reconciliations or adjustments to ensure the correct annual salary payment.

- Confusion with Benefit Deductions: If an employer withholds benefit deductions only twice a month, the third bi-weekly paycheck will be larger. This is because those deductions aren’t taken from that paycheck. This will confuse employees who are not closely monitoring their pay stubs.

– Semi-Monthly –

Although it may sound similar to bi-weekly pay, semi-monthly is different. In this setup, workers are paid twice a month on fixed dates—typically the 15th and end of the month. This equates to 24 pay periods annually. This pay frequency can lead to fluctuations in pay period lengths based on the number of days in a month.

Pros:

- Regular Pay Dates: Semi-monthly pay is usually favored by employees due to the predictability it provides, in the sense that they tend to know the precise calendar dates they will be paid (i.e., the 15th and month’s end). The predictability may simplify the budgeting for monthly bills because most bills are monthly due.

- Others like the regular pay date of semi-monthly compared to bi-weekly.

- Ease for Salaried Workers: For salaried workers, it is easy to divide their yearly salary by 24 (the number of pay periods in the year), which provides equal gross paychecks.

- Employer Advantages: From the employer’s perspective, semi-monthly payroll can simplify accounting, budgeting, forecasting, and payment of all types of taxes and insurance premiums (such as health, dental, vision, and worker’s compensation) due to their fixed schedule. It also makes month-end, quarter-end, and year-end accounting book closing easier compared to other payroll frequencies.

Cons:

- Variable Pay Period Length: In contrast to bi-weekly pay (14 days always), semi-monthly pay periods will always include a varying number of days (e.g., 13, 14, 15, or 16 days) since months always have a different number of days. Such variability has the potential to cause paycheck amount variability, particularly for hourly employees.

- Budgeting for Hourly Workers: While salaried workers get the same figures, hourly workers can find their paychecks differ as workdays within a period change, which makes budgeting difficult. Overtime that extends over two pay periods also creates a paycheck “short” since the hours are part of the following pay period.

- Complex Pay Dates (for certain corporations): Certain corporations may have “funky” or unusual bi-weekly payroll schedules, wherein the pay period concludes on the 1st and 15th, yet the payday actually falls on a different number of days later, irrespective of weekends and holidays. This can result in an uncertainty of payday among employees.

- Potential for Anxiety/Stretching Funds: Like monthly payment, this cycle can make one feel “drained of all funds” at the end of the pay period if not properly managed.

- Less Access to Funds: Semi-monthly is less frequent pay compared to bi-weekly or weekly, and longer waiting periods between paychecks, which some don’t like. It can feel as though money is “withheld” longer than wanted.

- Resistance to Change (employer side): Workers are opposed to altering frequency of payment because of the huge administrative burden of changing payroll systems, updating accounting procedures, and handling new compliance issues.

– Monthly –

Monthly payments involve employees being paid once every month, equivalent to 12 annual pay periods. This is the standard in certain nations. Monthly salaries can make budgeting easy because individuals can pay all the bills upfront at the start of the month and spend the remaining amount. But it can be anxiety-inducing if not strictly managed, particularly in months that have wide spaces between salaries and minimal cash left over at the end of the month.

Pros:

- Easier Budgeting for Monthly Payments: One of the best benefits is that monthly pay dates coincide with the regular billing cycles of most bills in a home, like rent, mortgages, and electricity bills, which usually fall due on a monthly basis. This can make it easier for people to budget and pay all their bills on the first of the month.

- Promotes Financial Discipline: The larger gap period between wages might promote greater attention to spending and more strict budgeting. It might even make it easier to save and invest money as soon as one gets a larger sum.

- Regular Pay for Salary Workers: Salary workers always receive the same amount of gross pay per paycheck because they simply divide their annual salary by 12.

Cons:

- Long Gaps Between Salaries: One of the main drawbacks is the long period between salaries. The staff may feel as if their account balance is “draining” throughout the month and can stress about running out of money towards the next payday.

- Risk of 5-Week Gaps: Compared to other paystub frequencies, a bi-weekly schedule occasionally results in five-week gaps between paychecks. For monthly pay schedules, even a four-week gap can be difficult without a solid financial buffer.

- Needs High Budgeting Discipline: Though it can instigate budgeting, a monthly salary system demands high financial planning. Unless strictly compliant with a budget, people will not be capable of managing their finances effectively, and this could result in overspending or credit card use prior to the next salary.

- First Paycheck Delay: New employees can experience a significant wait for the first paycheck when commencing new employment on a monthly payroll schedule, causing financial distress to the new hires.

– Semi-Weekly –

Though this is extremely uncommon, a semi-weekly payroll schedule would constitute twice a week pay to staff. Paydays would thus, for instance, occur each Wednesday and Saturday. Employees would thus get pay stubs semi-weekly as well, which would break down earnings, deductions, and net pay for every one of these two pay periods in a week. Some people wrongly assume that this term means “once every two weeks.” Others wrongly take the term “bi-weekly” to mean “twice a week.”

Pros:

- Very Frequent Pay Access: Employees gain access to their earnings more frequently than with any other common paystub frequency—even more so than weekly payroll. This can be helpful in managing sudden expenses or emergency needs.

- Immediate Reward: Continuous deposits can give a continuous feeling of immediate reward for work completed.

- Greater Time Value of Money: Earning money sooner implies saving money, investing money, or paying off debt sooner, benefiting from the time value of money.

Cons:

- Greater Danger of Overspending: The regular infusion of cash can make it even simpler for some to overspend or spend on impulse, which may discourage prudent budgeting.

- Greater Administrative Burden for Employers: Getting employees paid twice weekly would considerably boost employers’ administrative burden and expense compared to less frequent pay periods.

– Daily –

Less frequent for ongoing employment, certain jobs (especially those involving cash tips or daily payouts), might pay daily. Daily regular payments would have employees getting paid for every working day, which would be around 260 pay periods annually.

There are others who like to be paid on a daily basis, as this provides them with immediate access to their funds to invest or to avoid the impression that their employer is keeping their money.

Pros:

- Very High Frequency Access to Funds: Workers would get instant and ongoing access to their earned wages, possibly on the same day they perform work. Such timely access can be convenient for meeting immediate requirements or unforeseen costs, without financial stress or the necessity for short-term loans.

- Immediate Reward and Motivation: Payment at the end of a day’s work can be a powerful psychological motivator and source of immediate reward for effort.

- Time Value of Money: From a financial standpoint, faster payments enable quicker saving, investing, or debt repayment—maximizing the time value of money. Among all paystub frequencies, daily pay offers the quickest route to utilizing income.

Cons:

- Negative Financial Implication: It reflects that demanding payment on a daily basis is a sign of a lack of savings or investments. This might make employees unable to deal with larger, less frequent monthly bills such as rent or utilities.

- Unreasonable Administrative Burden on Business: Daily payroll processing would impose a much greater administrative cost and burden on employers than any other frequency of payroll, since it would involve daily computation, checking, and remittance.

- Potential for Confusion in Tracking: While some find frequent pay simpler, others might struggle to manage their finances effectively, leading to confusion about which day’s pay should cover which expenses.

FormPros Has You Covered

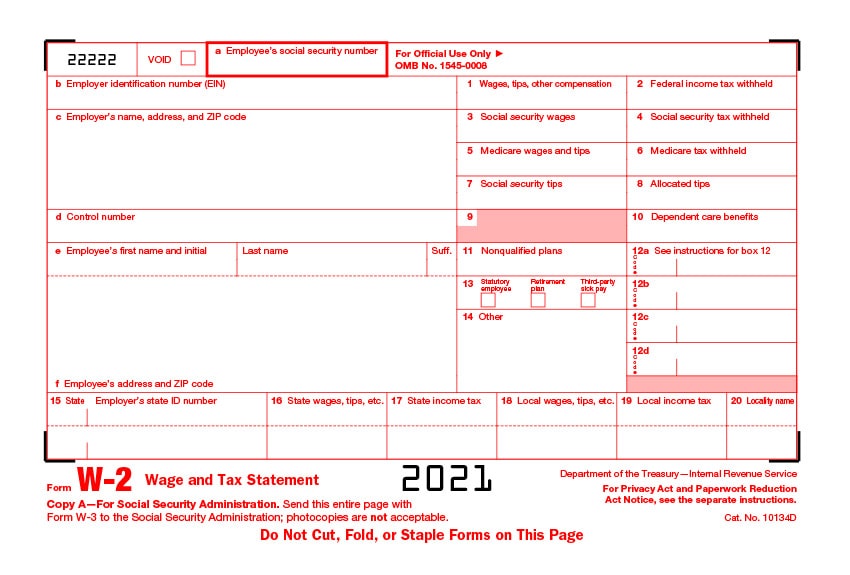

Simplify your paperwork with FormPros! Whether you need a paystub generator, want to make a W-2, or need to file a 1099-NEC, our easy-to-use platform has you covered. You can also learn what is a LLC Operating Agreement and generate one in minutes, or even create a voided check with just a few clicks. Save time, reduce errors, and manage your business documents with confidence. Get started today and see how FormPros makes professional form generation fast, affordable, and hassle-free!

Understanding Paystub Frequencies: Weekly, Semi-Monthly & Monthly FAQs

-

What is the most common pay frequency in the U.S.?

Among all paystub frequencies, bi-weekly pay is the most common in the U.S., especially for salaried workers. It strikes a balance between administrative ease for employers and frequent access to funds for employees, making it a popular choice across industries.

-

Do different states have laws about how often employees must be paid?

Yes, state labor laws can dictate minimum pay frequency. Some states require weekly or bi-weekly payments, especially for hourly workers. Employers must comply with the stricter rule—either federal or state—whichever offers greater protection to employees.

-

How do gig workers or freelancers usually get paid?

Gig workers and freelancers often negotiate their own pay schedules, which can range from project-based to milestone-based or even daily. These workers typically invoice clients and may experience irregular pay depending on when invoices are processed.

-

Can employees choose their own pay frequency?

Typically, no. Employers set the pay frequency based on administrative capacity and compliance with labor laws. However, some companies offer flexible pay solutions or earned wage access tools that let workers get paid more frequently.

-

How does pay frequency affect tax withholdings or deductions?

Pay frequency doesn’t change the total amount of taxes owed annually, but it does impact how those taxes are withheld. For example, more frequent paychecks mean smaller amounts withheld per check, but year-end totals stay the same.