How to Easily Get a Copy of Your W-2

Need a copy of your W-2? Whether you lost it or need an old one, this guide covers the easiest ways to retrieve it through your employer, the IRS, and more.

Need a copy of your W-2? Whether you lost it or need an old one, this guide covers the easiest ways to retrieve it through your employer, the IRS, and more.

Wondering if your LLC needs an Operating Agreement? This guide breaks down the what, why, and how—so you can protect your business from day one.

A Loan Agreement letter protects both lenders and borrowers by outlining clear loan terms. Learn when to use one and how to create a legally binding agreement.

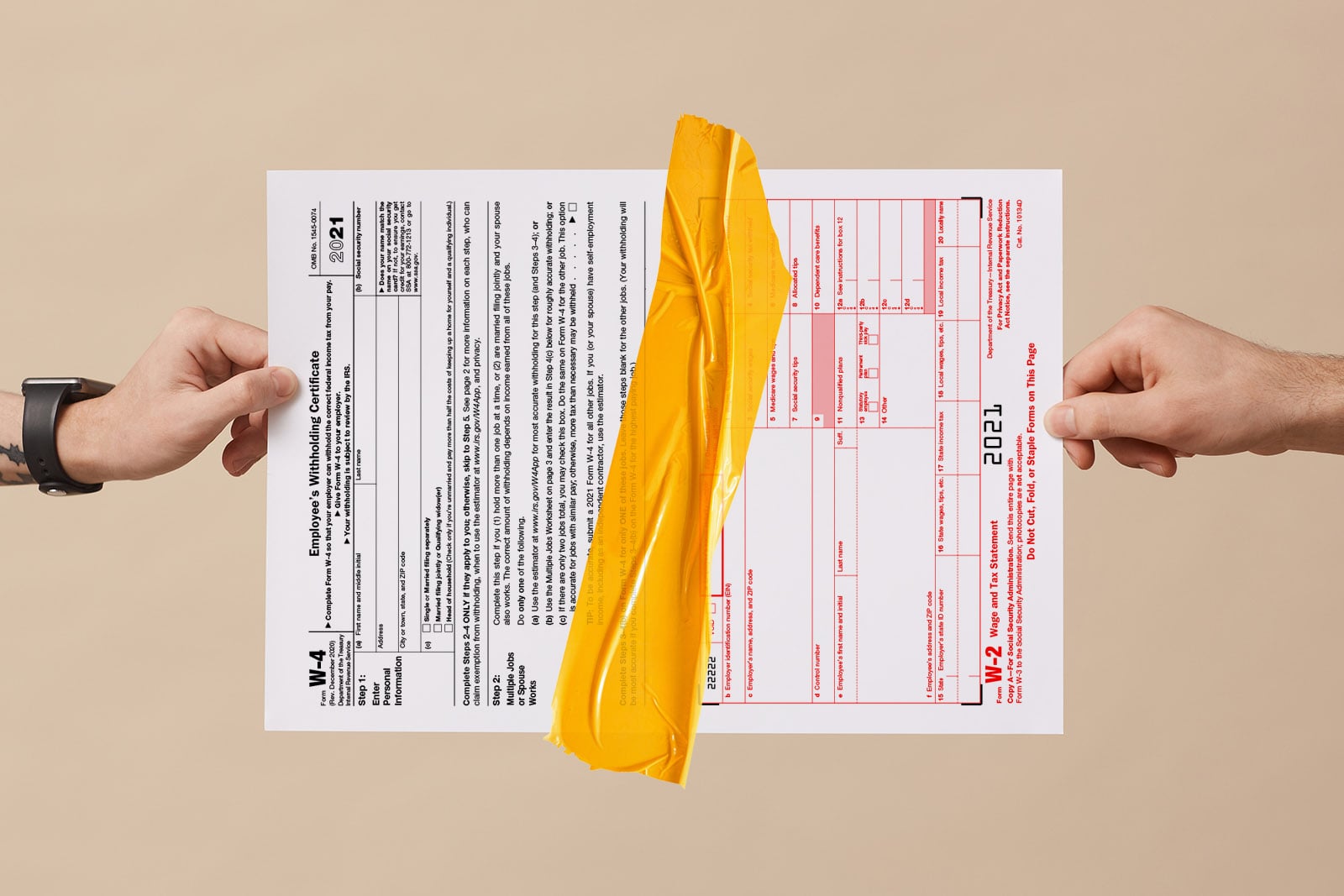

Understanding the difference between W-4 and W-2 is crucial for employers and employees. Learn how these forms impact tax withholdings and reporting.

Discover how to obtain pay stubs for a new apartment and explore alternative income verification methods to help you secure your rental application.

Avoiding payroll mistakes is key to keeping your business compliant and your employees happy. Learn what not to do when handling small business payroll.

Wondering how banks verify income for an auto loan? Learn what documents you need, how your credit score impacts verification, and tips to speed up approval.

Learn essential tax tips for yoga teachers, from reporting income and claiming deductions to filing the right forms. Stay compliant and maximize savings.

Uncover the essentials of a paystub with our detailed guide. Learn what a paystub includes, why it’s crucial for financial tracking, and how it impacts both employers and employees. Ideal for anyone seeking to understand their earnings and deductions clearly.

If you’re self-employed, understanding and planning for each estimated tax deadline is key to avoiding penalties. Here’s how to stay on track year-round.